There is hardly a company in the sports retail sector that is met with such mixed feelings as the French sporting goods manufacturer Decathlon. While many reject the vertically operating company’s aggressive pricing policy, which has made life difficult for traditional sports retailers for years, it is hard not to admire the company for the way it has risen to become a global player in a very short space of time and managed to integrate future-oriented topics such as digitalization and sustainability into its business model just as quickly. We give you an exclusive overview.

Ugly, but successful. This was the title of an article by Business Insider Germany about Decathlon in 2018. It criticized “the very pragmatic design” of the stores in the “ambience of an Aldi branch” and the “unusual-sounding names” of Decathlon’s many own brands. The author’s conclusion at the time was that the sports retailer had nothing to fear. The fact that Decathlon had not yet played a significant role in Germany seemed to confirm this judgment. But, as we all know, the situation was about to change.

Decathlon: The largest sporting goods retailer in the world

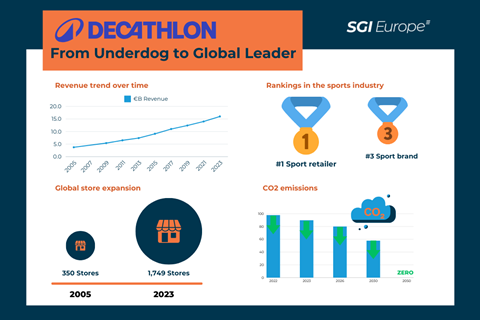

With a turnover of €15.6 billion in the 2023 financial year, a presence in 57 countries and 1,749 stores worldwide, Decathlon is now the largest sports retailer in the world. If you compare Decathlon with the major sports brands, Decathlon is not far from Adidas in second place with €21 billion turnover in 2023. Nevertheless, Decathlon is a privately managed, unlisted company. It was founded in 1976 by the French entrepreneurial family Mulliez, which is also behind other large retail chains such as Auchan and is still majority-owned today.

In addition to its size, the company’s image has also changed in recent years. Perhaps the best example of this is the Olympic Games in Paris, where around 45,000 volunteers were kitted out by Decathlon. Their outfits are now sold for large sums of money on online platforms. Decathlon is already considering launching a new version of the original uniforms, which are unavailable for sale, after the competitions.

Smart sponsorship deals have also helped to improve Decathlon’s credibility in the sport, which is a particular problem for multi-sport retailers. Decathlon has signed athletes and sports events from a variety of sports, including tennis, padel, cycling, volleyball, athletics and trail running. The company has even set its sights on football: As recently as July, Decathlon announced that it is looking to sign ball supply contracts in South American soccer, having already become the official match ball supplier for the Uefa Europa League and the Uefa Conference League. Additionally, there are rumours that Decathlon will sign the French world-class player Antoin Griezman. All these measures are creating an image transfer and are shaking up the decades-long dominance of major sports brands such as Nike, Adidas and Puma in professional sports.

Find more details in our exclusive infographic about Decathlon

Decathlon: Enormous growth, driven by international expansion

To give a few examples of figures: As recently as 2005, Decathlon recorded sales of €3.74 billion, with a growth of 9.4 percent. Most of the growth already took place outside France, where sales growth of almost a quarter (24.7%) was achieved in Spain, Italy and finally also in Germany – a country where the company had long struggled. In the same financial year, Decathlon reported a total of 350 points of sale, including 221 in France, 48 in Spain, 35 in Italy, 7 in Germany and Belgium, 6 in the UK and Portugal, 4 in Poland and the USA, 3 in Hungary and two in the Netherlands and Brazil.

In 2017, Decathlon broke the €10 billion sales barrier with a growth of 12 percent. At the same time, the company’s presence in international markets grew massively. In 2016, Decathlon opened its first stores in Mexico, the Ivory Coast, Singapore, Slovenia and Malaysia, with the total number of net openings rising from 140 in 2015 to 164 in 2016. 2017 saw market entries in Austria, Switzerland and Israel, and the total number of Decathlon stores grew to 1,228, 52 more than at the end of 2016, with many new locations in the pipeline.

The next record year followed in 2021 when global sales of what is now the world’s largest retailer with 1,747 locations in 60 countries rose by 21% to a record figure of €13.8 billion (the high growth was, of course, also a result of the lower template, as many stores were closed in the previous year due to the pandemic). Online sales were also impressive, rising by 30% to almost €3 billion (excluding taxes).

International markets: Germany catches up, Sweden and USA give up

France is Decathlon’s most important market. With sales of €4.75 billion (including VAT and other taxes) in 2023 as a whole, around a quarter of global sales are attributable to the home market alone.

However, Decathlon is now also doing well in the largest EU market, Germany: With record sales of €700 million and growth of 4.9 percent, the German branch also reported the most successful year in its 35-year history in 2021. 60 percent of sales were generated by brick-and-mortar retail and 40 percent by e-commerce (after returns), which corresponds to a 50 percent increase in online sales. Just one year later, in 2022, the €1 billion turnover mark was reached. Since the opening of the first German store in 1986, the store network had grown to 85 stores, two logistics centers and four campus locations for central services, with a total of 5,520 employees.

And the plans for Germany remained ambitious: In 2022, Decathlon Germany presented a business plan for the next five years, according to which Decathlon Germany wanted to double its turnover to €2.5 billion in gross merchandise value by 2026, compared to projected figures of around €950 million in 2021 and €1.3 billion in 2020. By the end of this period, almost 60 percent of total sales were to be generated via the digital channel, compared to 20 percent in 2020 and 40 percent in 2021. However, the company also saw the potential for further locations in brick-and-mortar stores. There was talk of an increase from the current 84 to 140 stores.

However, the Scandinavian and the huge US market are proving more difficult. In July 2024, after 13 years in the Swedish market, the last Decathlon store and the chain’s only store in Scandinavia closed. According to a Decathlon spokesperson, the chain had misjudged several factors. Firstly, Decathlon’s e-commerce was never a success in Sweden. Secondly, the chain misjudged which segments and products Swedish customers sought during the pandemic.

Two years earlier, in 2022, Decathlon closed its last two stores in the US. Instead of physical stores, Decathlon wanted to focus on e-commerce and cooperation with US retailers such as Walmart and Target in the US. Decathlon recently launched a new, “immersive” shopping app for the Vision Pro, Apple’s virtual reality (VR) headset, in the US. The sports chain was already represented in the US with several stores from 1999 to 2006 and tried again from 2017.

At the end of 2023, Decathlon acquired the German online retailer Bergfreunde from the US outdoor retailer Backcountry. This move enabled the company to penetrate the premium outdoor segment.

Decathlon acquires online players AllTricks and Bergfreunde and launches Decathlon Pulse

In addition to the expansion of the online business and the focus on multi-channel sales, further digitalization continued with the development of an international marketplace business in 2021, in which third-party brands can be docked onto the company’s own online shop. Following a successful test in Belgium, the Spanish, German and UK markets were connected first. Towards the end of the year, France, Italy, the Netherlands, Poland, Portugal and Hong Kong followed. All third-party products were selected to complement the company’s own range with a “local-first” approach, according to the company, to be relevant to the local community. In Germany alone, around 200 new brands were added in one fell swoop, including Adidas, Hummel and Reebok.

In Spain, Decathlon also launched its own marketplace for padel called D-padel.com, which offers products from its own Artengo and Kuikma brands and other suppliers.

Decathlon also joins online pure players. In 2019, Decathlon acquired a majority stake in Alltricks, a French multi-brand online retailer founded in 2008. It uses its own marketplace for partnerships and specializes in the cycling, running and outdoor segments. At the end of 2023, Decathlon acquired the German online retailer Bergfreunde, which specializes in mountain sports, climbing and outdoor equipment, from US outdoor e-tailer Backcountry. In both cases, the companies continued to operate independently, and the management remained in place. With the strategic takeover of both stores, Decathlon expanded its online expertise and its portfolio and reach in the premium cycling and outdoor segments.

But it will not stop there: In July 2024, Decathlon announced the founding of the wholly-owned subsidiary Decathlon Pulse. As an independent unit within the group, Decathlon Pulse aims to invest in “innovative people and companies.” Investments as a shareholder are to flow primarily into highly innovative companies and people that, according to the company, could change the sports ecosystem and accelerate the introduction of new sustainable business models.

Decathlon with new strategy and management team in 2024

In 2024, Decathlon finally put an end to many of its “unusual sounding” own brands and the “Aldi ambience” and presented a new brand direction, including a new brand identity. As part of the realignment, around 30 of the existing 49 own brands are to be dropped. This should make the company’s portfolio clearer for customers and, at the same time, strengthen the potential of the remaining brands. New specialized areas include, for example, the private brand Quechua for mountain sports, Tribord for water and wind sports, Rockrider for outdoor cycling, Domyos for fitness, Kuikma for racket sports, Kipsta as a team sports brand, Caperlan for outdoor sports, B’twin for urban mobility and Inesis for precision sports.

There is also a new logo, supplemented by a new symbol, the so-called “Orbit.” The new identity and the new look will be implemented in all Decathlon stores worldwide. This includes a facelift of the interior design to improve the aesthetics and make navigating the different sports easier. The physical stores will also be digitally upgraded with digital price tags and service points for product and range information.

The extensive changes are preceded by a CEO change: In March 2022, digital expert Barbara Martin Coppola took over. Following management roles at well-known companies such as Google, YouTube, Samsung and Texas Instruments in Europe, the US and Asia, she was most recently Chief Digital Officer for digital transformation and omnichannel strategy at Ikea. She replaced Michel Aballea, who had been the group leader since 2018.

The positive development of Decathlon Germany in general and the digital business in particular also paid off for Germany CEO André Weinert. In the summer of 2023, Weinert, who had been with the company for 20 years, took over the position of CEO for Central, Eastern and South Eastern Europe, which includes 17 countries.

Retailer with ambitious sustainability targets and alternative consumption models

Decathlon has set ambitious environmental targets and has committed to reducing its absolute GHG emissions according to Scope 1 and 2 by 42 percent by 2030, starting from the base year 2021. By 2050, the figure is to rise to 90 percent. The extraction of raw materials and manufacturing products account for 74.8 percent of the total carbon footprint, which is why the company is prioritizing these areas in particular for reduction.

Decathlon wants to increase the proportion of recycled materials in its products and align the supply chain with renewable energies. By 2026, all products are to be made from “environmentally friendly” materials. Another focus is on the development of durable, repairable and recyclable products that are suitable for rental and second life. Decathlon has pioneered work, particularly in selling and renting second-hand products. So, Decathlon has established a second-life service for used goods in many countries, enabling customers to resell their items directly in the store or online. In addition, a repair service has also been set up for many products, which customers can use online and offline. The rental of products is also already being tested, with the company cooperating with the Finnish start-up Rentle. According to Decathlon’s research, the cost of buying sports equipment is one of the biggest barriers to taking up a new hobby.

Decathlon is also a member of several initiatives to promote sustainable practices in the sports industry. As recently as May, Decathlon entered into a partnership with the French start-up Recyc’elit. Recyc’elit has introduced a technology for separating materials such as polyester, elastane and polyamide, which increases the potential of textile recycling.