CEO Freddy Sobin, in office since May 2023, began the presentation of XXL ASA’s Q3 financial report by saying, “We are neither proud nor satisfied with the results.” The retail company’s sales fell 10.2 percent in the third quarter. At the same time, there was a loss on the earnings side.

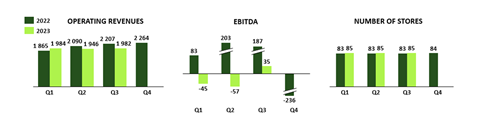

Total sales in the third quarter of 2023 were 1.98 billion Norwegian kroner (€167.7m) compared to NOK 2.21 billion in the same period last year, a decline of 10.2 percent. XXL’s markets continued to be characterized by low consumer confidence and lower demand for sports and outdoor products in general.

The negative trend from the spring and summer seasons continued in the third quarter. September, in particular, proved to be a difficult month with low sales effects for seasonal fall products. XXL continues to see improved sales of consumer products such as apparel and footwear, while the more capital-intensive products in the hardware categories continue to be a challenge.

E-commerce decreased 14.6 percent from Q3 2022 to Q3 2023, representing 18.0 percent of the group’s total sales (same period last year: 18.9 percent). Online sales have been more difficult during the pandemic after years of strong growth, which was also influenced by the general market trend of less efficient online marketing. Overall, XXL reported a negative like-for-like growth of 12.8 percent in the quarter.

The sports and outdoor retail market continued to be challenging and was impacted by lower demand, heavy discounting and high inventory levels in the value chain. Under these conditions, XXL prioritized liquidity and inventory control, resulting in continued high campaign activity and lower gross margin. As a result, Ebitda was NOK 35 million (€2.96m) compared to NOK 187 million in the same period last year. Inventories have now returned to normalized levels, offering the potential for a higher gross margin over time. During the quarter, XXL received a settlement of its oversubscribed rights issue of NOK 500 million gross (€42.3m), which strengthened its liquidity position accordingly. Total liquidity reserve was NOK 782 million (€66.2m) in the quarter compared to NOK 817 million in the year-ago period, and net interest-bearing debt was NOK 862 million (€73.01m; previous year NOK 983m).

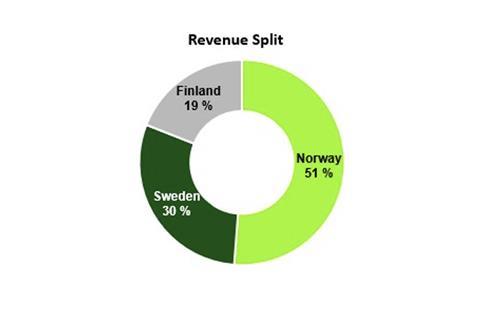

The group’s reporting structure comprises three operational segments based on XXL’s operations in Norway, Sweden and Finland, in addition to the HQ and Logistics segment.

Sobin explains the declines by saying that the market for sports and outdoor articles remains difficult. XXL is also suffering from excessively high inventory levels and is being forced into increasingly lower-margin sales.

New “Reset & Rethink” strategy

XXL is currently working on several short-term actions and a longer-term strategic plan called Reset & Rethink. Five “must-win battles” are expected to deliver an Ebitda increase of NOK 500 to 750 million (€42-64m) in the next 12 to 24 months. Development is on track, and most initiatives are expected to make a positive financial contribution from 2024 and beyond. During the quarter, XXL successfully launched an updated version of its customer loyalty program, XXL Reward, which allows customers to earn bonus points and subsequently receive bonus checks every time they shop at XXL. The strategy to increase the share of sales from private labels is already showing promising results, especially through the partnership with Stormberg, which is off to a solid start with good sales figures, an increase in gross profit margin and a high inventory turnover.

Going forward, the sporting goods giant plans to open two to three new stores per year, including relocations. At the same time, XXL intends to reduce the space in its existing stores. In the short term, however, further store closures are also expected.

In addition, exit agreements for the remaining three locations in Austria were signed in the reporting quarter. As a result, XXL will have no material activities or obligations in Austria after year-end 2023.