Growing demand for its Classic shoes and double-digit sales growth rates in both Greater China and Latin America are projected to spark the overall results of Adidas this year, leading to double-digit sales growth in H2 and an annual operating profit of approximately €500 million. The North American market is projected to continue as a big laggard on the company’s business this year, with sales in the market expected to fall by a mid-single-digit rate. Meanwhile, currency-neutral sales in Europe, Emerging Markets, and Japan/South Korea are forecast to increase by a high-single-digit rate.

Read also our exclusive Adidas strategy analysis

Adidas’ shares rose by 3.8 percent in Europe on March 13 to close at €200.15 after the group reported its first annual loss in more than 30 years and Q4 and FY23 results that came in below the market consensus. Nonetheless, some industry analysts concurred with Adidas CEO Bjørn Gulden that it was again going in the right direction. “We still have a lot of work to do, but I feel very confident that we are on the right track,” Gulden said in a statement, later adding, “Although by far not good enough, 2023 ended better than what I had expected at the beginning of the year.”

At one point in early 2023, the group had anticipated an annual operating loss of €700 million. But that estimate was proven wrong when Adidas opted to sell off the balance of Yeezy styles from its former endorser Kanye West, which added about €750 million to the annual revenue total.

In Q4, the group’s operating loss improved by 48 percent to €377 million from a loss of €724 million as total revenues fell by 7.6 percent to €4,812 million from €5,205 million. Footwear sales increased by 8 percent, but apparel sales slipped by 13 percent. Gross margin, helped by less discounting, improved by 550 basis points to 44.6 percent. The net loss attributable to shareholders improved by 26 percent year-over-year to €379 million from €512 million. North America was the big regional laggard, with sales declining by 21 percent on a currency-neutral basis to €1.16 billion. Sales fell 7.0 percent in the EMEA to €1.86 billion and were essentially flat in Asia-Pacific at €570 million. Greater China sales rose nearly 37 percent year-over-year to €670 million and were 1.0 percent higher in Latin America at €479 million.

| Adidas - Income | |||

|---|---|---|---|

| 2023 | 2022 | Change | |

| Q4 (€ millions) | |||

| Net sales | 4,812 | 5,205 | -7.6% |

| Cost of sales | 2,664 | 3,170 | -16.0% |

| Gross profit | 2,147 | 2,035 | 5.5% |

| Royalty and commission income | 17 | 26 | -34.6% |

| Other operating income | 10 | 41 | -75.6% |

| Other operating expenses | 2,551 | 2,825 | -9.7% |

| Operating profit | -377 | -724 | 47.9% |

| Financial income | 25 | 30 | -16.7% |

| Financial expenses | 63 | 41 | 53.7% |

| Pre-tax | -415 | -734 | 43.5% |

| Tax | -14 | -252 | 94.4% |

| Net income from continuing operations | -401 | -482 | 16.8% |

| Gain from discontinued operations (net of tax) | 42 | -31 | – |

| Net income | -359 | -513 | 30.0% |

| Diluted EPS from continuing operations | -2.36 | -2.69 | 12.3% |

| Diluted EPS from continuing and discontinued operations | -2.13 | -2.87 | 25.8% |

| FY (€ millions) | |||

| Net sales | 21,427 | 22,511 | -4.8% |

| Cost of sales | 11,244 | 11,867 | -5.2% |

| Gross profit | 10,184 | 10,644 | -4.3% |

| Royalty and commission income | 83 | 112 | -25.9% |

| Other operating income | 71 | 173 | -59.0% |

| Other operating expenses | 10,070 | 10,260 | -1.9% |

| Operating profit | 268 | 669 | -59.9% |

| Financial income | 79 | 39 | 102.6% |

| Financial expenses | 282 | 320 | -11.9% |

| Pre-tax | 65 | 388 | -83.2% |

| Tax | 124 | 134 | -7.5% |

| Net income from continuing operations | -58 | 254 | – |

| Gain from discontinued operations (net of tax) | 44 | 384 | -88.5% |

| Net income | -14 | 638 | – |

| Diluted EPS from continuing operations | -0.67 | 1.25 | – |

| Diluted EPS from continuing and discontinued operations | -0.42 | 3.34 | – |

| Source: Adidas | |||

For the full year, operating profit declined by 60 percent to €268 million from €669 million, while total revenues fell by 4.8 percent to €21.4 billion from €22.5 billion. Gross margin inched up by 20 basis points to 47.5 percent. The annual net loss attributable to shareholders was $75 million against a net profit of $612 million. Adidas reduced its year-end inventory level by more than 24 percent to €4.53 billion.

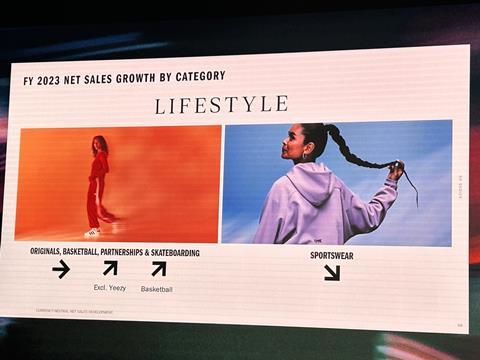

On a currency-neutral basis, EMEA revenues were essentially flat in FY23 at nearly €8.24 billion, up by 8.2 percent in Greater China to €3.19 billion; up by 7.0 percent in Asia-Pacific to €2.25 billion; increased by nearly 22 percent in Latin America to €2.29 billion; and tumbled by 16 percent in North America to €5.2 billion. Much like competitors in the athletic footwear and apparel business, the company was negatively impacted by lower consumer demand and high retail inventory levels in North America last year.

| Adidas - Sales | |||

|---|---|---|---|

| 2023 | 2022 | Change | |

| Q4 (€ millions) | |||

| EMEA | 1,863 | 2,073 | -10.1% |

| North America | 1,159 | 1,542 | -24.8% |

| Greater China | 670 | 520 | 28.8% |

| Asia-Pacific | 570 | 606 | -5.9% |

| Latin America | 479 | 542 | -11.6% |

| Other businesses | 35 | 39 | -10.3% |

| Total | 4,776 | 5,322 | -10.3% |

| Q4 (€ millions) | |||

| EMEA | 8,235 | 8,550 | -3.7% |

| North America | 5,219 | 6,404 | -18.5% |

| Greater China | 3,190 | 3,179 | 0.3% |

| Asia-Pacific | 2,254 | 2,241 | 0.6% |

| Latin America | 2,291 | 2,104 | 8.9% |

| Other businesses | 155 | 150 | 3.3% |

| Total | 21,344 | 22,628 | -5.7% |

| Source: Adidas | |||