Wolverine Worldwide shares rose more than 15 percent after the Saucony, Merrell and Sweaty Betty parent reported strong Q2 2025 results with gains in revenue, gross margin and operating income.

“A new brand-building playbook has proven effective, and we’ve been able to sequentially improve our year-over-year revenue trends for five consecutive quarters now, this past quarter posting our best year-over-year comparison in nearly three years,” Chris Hufnagel, President and CEO, told analysts in describing the results.

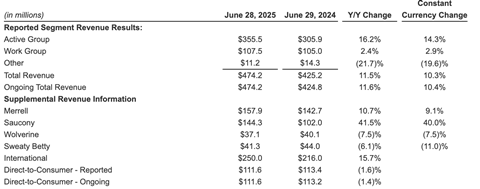

Operating profit rose by 40 percent to $40.7 million from $29.1 million in Q2 ended June 30, with net income soaring by 86 percent year-over-year to $29.0 million from $15.6 million. Total revenues jumped by 11.5 percent to $474.2 million, with sales gains at Saucony and Merrell fueling the growth. Gross margin improved by 410 basis points to 47.2 percent due to a healthier sales mix, lower promotional activity and benefits from supply chain cost initiatives. Period-end inventory decreased 6.4 percent year-over-year to $316 million.

Saucony with the best Q2 result

On a brand basis, Saucony was the largest quarterly sales gainer, with a 40.0 percent constant-currency increase to $144.3 million. Hufnagel believes the brand, positioned at “the intersection of authentic performance and lifestyle running,” will have a “pivotal year” in 2025 after its “ambitious strategic reset” over the last two years. With its core franchises Ride, Guide, Triumph and Hurricane increasing sales at a double-digit pace in the US, Saucony continues to expand its reach into the lifestyle, athletic specialty segment. The brand will add approximately 400 doors in the channel in H2.

Sweatty Betty saw a growth of 11 percent in Y-o-Y comparison.

At Merrell, Q2 revenues grew by 9.1 percent on a constant-currency basis to $157.9 million with increases in most regions and channels, as its year-over-year gross margin expanded by nearly 600 basis points. With its focus on “modernizing the trail,” Merrell continues to see its lighter, more athletic products fueling momentum and share gains in the hiking category.

The brand is said to be in the early stages of rationalizing its distribution through the development of stronger go-to-market plans with its key strategic outdoor specialty and sporting goods partners and the establishment of a footprint in the lifestyle market. Already, Merrell has launched a key city strategy in Asia-Pacific with store openings in Japan, increased its market share leadership in outdoor footwear in France and delivered strong growth in the broader EMEA region, the company said.