At ISPO 2025, Hot Pot and the China Outdoor Association presented compelling insights into the Chinese market, offering data that defies stereotypes and reveals a nuanced picture of consumer habits and preferences – in both activewear and outdoor activities.

Chinese participation at the ISPO trade show has grown steadily year after year. Since ISPO China launched in 2005, the exchange between the two events has become constant and multifaceted – brands, manufacturers, startups, organizations, buyers and experts traveling between the one and the other.

Yet the market is huge and complex, and accessing reliable data requires the expertise of true insiders. This year, ISPO delivered its best with sessions featuring two of the finest sources for exploring the Chinese active lifestyle and outdoor sports market from the inside out.

Active lifestyle: The new luxury

Hot Pot, a partner of SGI Europe specializing in marketing and commercial strategies for premium lifestyle brands in China, delivered on Dec. 1 a crisp and insightful session about China’s activewear boom. The 2025 e-commerce data from Tmall, Douyin and JD are crystal clear: Chinese consumers are spending more on sportswear, outdoorwear and equipment – and the premium segment is driving growth. On Running made $2.7 million (€2.5m) with the Cloud X 4 Training ($165), while Descente earned $3.8 million (€3.6m) with its ski-style jacket ($550).

It may seem counterintuitive, but – as Adam Sandzer explained in conversation with our Claudia Klingelhöfer – while Western and European consumers often “trade down” during economic slowdowns, opting for more affordable alternatives, China’s active lifestyle segment defied this conventional wisdom in 2025.

Consumers chose premium products and invested in value: superior materials, cutting-edge technology, innovative design and brands that align with their aspirational, healthier lifestyles.

Main driver – Consumer reallocation of spending

As purchases of traditional luxury items – like high-end fashion – have declined, some of that budget has moved towards active lifestyle products. Even premium activewear costs significantly less than luxury fashion, making it an accessible form of “new luxury” that directly supports personal health and self-improvement. This reflects a deeper societal shift: wellness and self-care are becoming the ultimate status symbols.

China: An outdoor mecca and more

The other major shift that often surprises international observers is the Chinese passion for outdoor sports. With more free time than ever and the desire to spend it outside, Chinese consumers are investing time and money into activities that connect them with nature – whether running (58%), hiking, cycling, camping, fishing or trail running (12%).

Oliver Wang, general secretary of the China Outdoor Association, has for more than a decade been helping Chinese brands advance their product research and development while also supporting international brands in establishing themselves in China.

In this session we learned something counterintuitive: skiing and snowboarding – which we often associate with stunning images of facilities across the country – are actually a minimal part of the overall outdoor market. The market size itself is remarkable: RMB150 billion (€20bn) in 2024, with 23 percent year-over-year growth, five to seven times larger than five years ago (pre-Covid).

Top outdoor activities

The most popular outdoor activities in the past 12 months were:

| Activity | Popularity | |

|---|---|---|

| 1 | Running | 58% |

| 2 | Hiking | 52% |

| 3 | Cycling | 43% |

| 4 | Camping | 33% |

| 5 | Fishing | 16% |

| 6 | Trail Running | 12% |

| 7 | Marathon | 12% |

For three activities – cycling, trail running and marathon running – there’s a 15 percent gap between casual and performance users, Wang pointed out. This is higher than for other activities, indicating stronger loyalty and willingness to upgrade to performance-level participation.

The multichannel reality

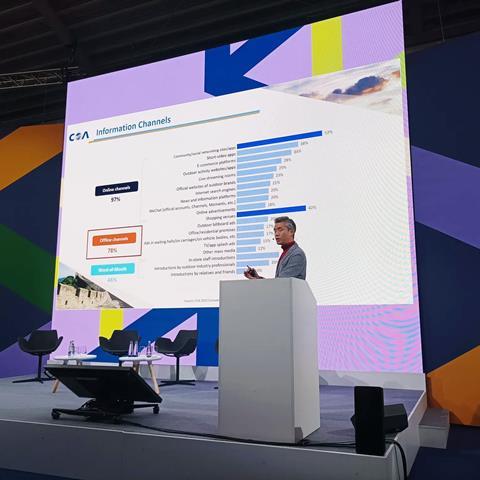

Another surprise: although China is highly digital, with its widespread e-commerce, the vast majority of consumers still gather product and brand information offline. Chinese consumers are multichannel, gathering information simultaneously from online and offline sources, with 46 percent relying on word of mouth.

This pattern extends to purchasing channels, where 98 percent buy online and 97 percent buy offline – virtually identical figures. This explains why more Chinese brands are shifting from online to offline, establishing physical retail channels or investing in offline presence.

Shopping behavior and channels

- Information gathering: 97% online, 78% offline, 46% word of mouth

- Purchase channels: 98% buy online, 97% buy offline – nearly equal usage

- Retail strategy shift: Brands moving from online to offline as e-commerce costs rise

- Purchasing priorities: Quality, design, brand awareness and sustainability (27% consider it a key factor)

The criteria informing buying decisions are far from trivial: 27 percent of consumers consider sustainability a key factor when purchasing. Quality, design and brand awareness matter, as expected, but a quarter of consumers actively seek sustainability. If you think Chinese consumers are less focused on sustainability than Europeans, think again. They expect committed brands, not empty promises, and do not forgive inconsistent behavior.

The next generation of outdoor and active lifestyle enthusiasts

As for future consumers, the growth of children’s outdoor events in China is impressive: in 2024, there were over 500 of them, compared with just 65 a decade ago. Children’s activities are hugely popular among young people in China and are attracting many newcomers. This presents a significant opportunity for international brands targeting young Chinese consumers.

About Hot Pot

Hot Pot is a strategic partner of SGI Europe’s, specializing in marketing and commercial strategies for premium lifestyle brands seeking success in the Chinese market. With a team split between Shanghai and London, Hot Pot acts as an extension of its clients’ marketing departments. The agency has assisted brands like Canada Goose, Noble Panacea and La Perla to enter and succeed in the Chinese market.

- SGI Europe and Hot Pot: How Chinese consumers shop for outdoor apparel online

- SGI Europe and Hot Pot: How chinese consumers shop for sports footwear online

About the China Outdoor Association

With nearly 20 years of experience in the Chinese outdoor and winter sports industry, Oliver Wang has been a driving force in the sector. Since 2024, he has served as secretary general of the China Outdoor Association – the only active national industry association for outdoor sports in China, with over 30 members. The association started in 2010, was legally registered in 2019 as the China Sporting Goods Industry Federation, and has 31 members representing about 40 brands from China and abroad.

- Linkedin: China Outdoor Association and Oliver Wang