A cooling boom, aging consumers, and widening regional divides. The latest World Consumer Outlook (WCO#7) outlines a pivotal moment in global consumption where growth persists, but the paths to capture it are becoming narrower and more complex.

Growth continues, but momentum fades

World Data Lab projects global GDP to reach $113 trillion in 2025, with $60.3 trillion of that tied to spending from the global “consumer class”—defined as middle- to high-income individuals engaged in the formal economy. This figure indicates a 3.4% increase compared to 2024; however, it also reflects a significant slowdown from the 4.3% growth recorded the previous year. The global middle class, which has historically been the driving force of upward mobility and market expansion, is losing momentum. In 2025, only 106 million people are expected to enter this demographic, a decrease from 116 million in 2024. Additionally, the forecast for total consumer spending has been revised downward by $1 trillion, dropping from $3 trillion to $2 trillion. This reduction is primarily attributed to a stronger U.S. dollar, slower inflation, and regional instability.

The mechanics behind the revision

Three macroeconomic forces shaped the $1 trillion downward adjustment:

- Currency effects subtracted $1.6 trillion.

- Real economic growth added $1.4 trillion.

- Inflation contributed $2.2 trillion—but this effect is weakening.

The strengthening U.S. dollar has had a disproportionate impact on emerging markets and export-driven economies, effectively reducing their nominal purchasing power. At the same time, easing inflation has diminished the nominal lift it once gave to spending figures. The result: companies can no longer rely on pricing to drive top-line growth.

Regional outlook: One story, many trajectories

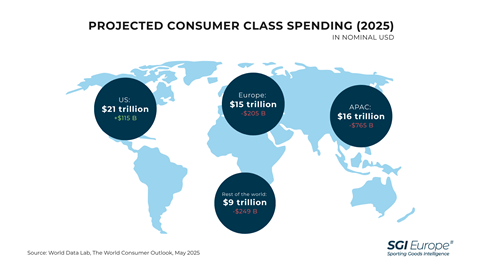

Despite an expanding global consumer class which is now 4.5 billion strong, growth is increasingly uneven. Regional forecasts have shifted notably since the initial January projection:

- The United States remains the world’s largest consumer market at $21 trillion, and the only region to see a revision upward (+$115 billion), buoyed by persistent inflation and dollar strength.

- APAC accounts for $16 trillion in spending but is facing substantial downgrades, especially in China (-$301 billion), Japan (-$109 billion), and India (-$82 billion).

- Europe stands at $15 trillion. It shows a fragmented picture, with the UK and Poland gaining modest upgrades, whereas Germany (-$88 billion) and France (-$41 billion) experience notable declines.

- The remaining global marketsm including Brazil, Canada, and Mexico, collectively contribute another $9 trillion.

The U.S. makes up nearly 46% of global consumption growth in 2025. For brands, this means increased exposure to U.S. monetary policy and heightened urgency to localize strategies in non-dollar markets. Asia’s long-standing growth narrative is changing, and Europe’s role hangs in the balance as it is heavily dependent on long-overdue structural reforms.

Who’s spending—and who isn’t

Beneath the topline figures lies a demographic shift with far-reaching implications:

- 63% of new spending will come from consumers aged 45 and older.

- 57% will be generated by high-income households.

With more spending power sitting in the hands of older, high-income consumers, the pool of potential buyers is becoming more concentrated. For the sporting goods sector, this shift creates both pressure and potential as brands now face the task of appealing to an aging, affluent audience while still finding meaningful ways to connect with younger consumers who may have less to spend.

Strategic implications of global reform scenarios

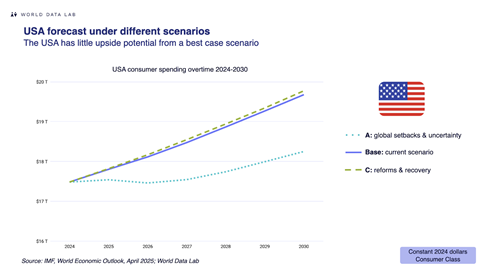

World Data Lab outlined three critical scenarios for global consumption through 2025:

- Scenario A: Trade tensions and fiscal tightening stifle growth. Wealthy Western households and China’s middle class suffer from falling asset values and shrinking discretionary spending.

- Scenario B: The baseline project moderate, uneven growth with persistent structural imbalances and ongoing policy uncertainty.

- Scenario C: Coordinated reforms and public investment benefit high-income Western consumers and China’s middle class. However, the U.S. middle class could face new tax burdens as a tradeoff.

These scenarios represent critical planning tools. Success in a fragmented economic landscape demands strategic foresight and agility, particularly geographic diversification.

What the experts say: A deeper lens on macro dynamics

The Chief Economist Roundtable after the presentation provided additional clarity. Here’s how four leading voices interpreted the shifting landscape:

Indermit Gill, Chief Economist at the World Bank, warned that the era of high global growth is over. Emerging markets’ growth rates dropped dramatically, he said, from 6% in the 2000s to around 3.5% now. He stressed that without productivity gains and structural reforms—particularly in Europe—the next five years could be marked by economic stagnation and missed opportunity. Gill also flagged persistent global imbalances: the U.S. continues to overspend, China under-consumes.

Anu Madgavkar, a Partner at the McKinsey Global Institute, drew attention to the demographic divide affecting consumer spending: While older consumers are sustaining demand, often through public transfers, this raises concerns about fiscal sustainability. In contrast, younger consumers are increasingly spending less. Madgavkar pointed out that around four billion individuals, primarily in Africa and Asia, remain economically marginalized, and their future will depend on accelerated growth to enable them to participate in the global consumer economy.

Alex Boersch from Deloitte Europe identified Europe’s puzzling contradiction; solid economic fundamentals but weak consumer spending. Despite low unemployment and rising real wages, consumer sentiment and expenditure remain low. He cited political uncertainty and lack of regulatory reform as the primary culprits. Aging and tourism, he added, may become Europe’s most reliable growth drivers in the years ahead.

Homi Kharas, Co-founder of World Data Lab, shifted the spotlight to Africa and services. With the continent set to house the majority of the world’s youth by 2050, he stressed the urgency of investing in education and healthcare to avoid a generational crisis. In his view, services—less exposed to trade tensions and now dominant in GDP—represent the next big growth frontier on a global level. Kharas urged greater focus on integrating service markets, especially in Europe and Asia.

Strategic takeaways for the sporting goods industry

The implications for the sporting goods sector are multifaceted:

- In Asia, brands must regionalize—what works in India won’t work in China. Cooling growth in China and divergent regional outlooks demand tailored strategies.

- In Europe, structural reforms and policy shifts will determine whether growth potential is unlocked—or left dormant.

- In Africa, long-term investments in service-led, youth-driven consumption models may yield high returns, especially in mobile-first sports, wellness, and training segments.

Across all markets, agility is paramount. Brands that can segment wisely, respond locally, and plan across multiple scenarios will be best positioned to thrive in a fragmented future.

Or, as Homi Kharas put it:

“The question is no longer if consumption will grow—but where, and who captures it.”

Prepared by SGI Europe based on World Data Lab’s WCO#7, May 2025.

About the Data:

This article is based on projections from the World Consumer Outlook 2025 (WCO#7), developed by World Data Lab. The forecast includes real and nominal consumption trends, regional spending revisions, and scenario-based modeling for global consumer growth. Data reflects revisions between January and May 2025.

About World Data Lab:

World Data Lab is a global data analytics company specializing in forecasting and modeling consumer, demographic, and income trends. The WCO#7 is part of its flagship research portfolio and includes insights from leading economists and policymakers.