In this contribution for SGI Europe, Fredrik Ekström, founder of Above The Clouds, explores how second-hand has shifted from a sustainability paradox to a mainstream business case. Drawing on fresh data from the NXT Consumer Germany report for 2025, he shows why resale is no longer just a niche choice but a growth engine for sporting goods and outdoor brands.

For years, second-hand was framed as a niche market – a choice driven by price sensitivity or environmental values. In Germany, that narrative no longer holds. The NXT Consumer Germany 2025 report shows that resale has gone mainstream, propelled by a mix of cultural shifts, economic pragmatism and a deeper sustainability paradox.

Nearly half of German consumers now shop, or plan to shop, with future resale value in mind. The result: second-hand is no longer just about doing good. It’s about making smart, safe and even status-enhancing choices.

The new consumer logic

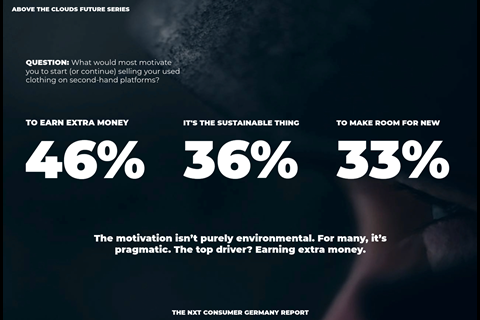

The motivations behind resale reveal its evolution:

- 46 percent sell clothing to earn extra money.

- 36 percent say it feels like the “sustainable” thing to do.

- 33 percent use it to make room for new clothes.

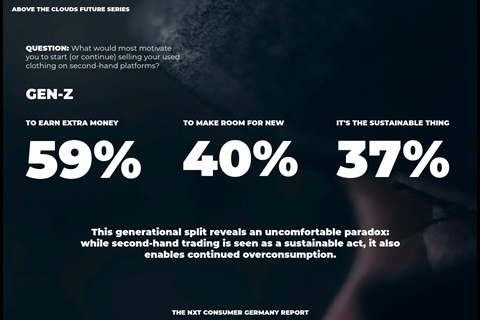

- 59 percent of Gen Z cite money as their top driver – followed closely by “space for new.”

This duality reflects the sustainability paradox. On the one hand, second-hand is an eco-friendly act that extends product life. On the other, it enables continued consumption, offering consumers a way to ease their conscience while refreshing their wardrobe.

Second-hand has become a safe, socially accepted shortcut through sustainability complexity: easy to understand, easy to explain and hard to get wrong.

From threat to growth engine

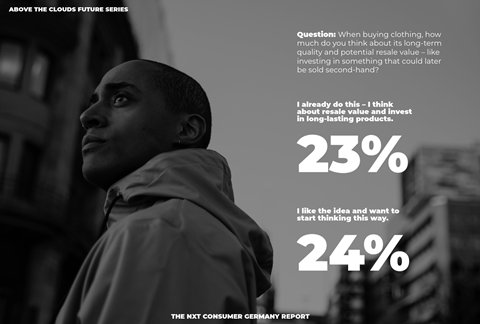

Outdoor and sporting goods brands often see resale as a challenge to margins and control. But the data show it is fast becoming a strategic business case:

- 23 percent of consumers already factor resale value into purchases.

- Another 24 percent say they want to start thinking that way.

- That’s nearly half the market adopting an investment mindset.

This reframes products not as costs but as assets. For brands, it justifies higher price points, not as “premium” but as “payback.”

The risk is letting peer-to-peer platforms like Vinted and eBay define the resale journey, diluting brand equity and consumer experience. The opportunity lies in owning the loop – integrating resale into product design, marketing and after-sales.

Owning the loop

Moving from peer-to-peer to peer-to-brand-to-peer models unlocks significant advantages:

- Control over product pricing and brand equity

- Direct consumer data from second-life products

- Storytelling around durability, quality and circularity

- Stronger brand loyalty through lifecycle engagement

Outdoor brands are particularly well positioned here. With technical products that carry intrinsic value, resale can reinforce credibility around durability and innovation. Platforms like Trove and Ninyes are already helping brands build these ecosystems, turning what was once leakage into loyalty.

The circular opportunity

The paradox at the heart of second-hand – sustainability meets overconsumption – should be seen not as a contradiction but as a cultural reality. Consumers are looking for shortcuts that make responsibility feel simple. Resale fits perfectly into this space, combining pragmatism with purpose.

For brands, the imperative is clear: don’t treat second-hand as a bolt-on. Treat it as a growth engine. Design for durability, publish resale values and integrate take-back programs directly into consumer touchpoints. For outdoor brands, owning the loop means owning loyalty, and brands need to build business strategies rooted in consumer behavior and cultural foresight. Because in 2025, controlling the loop is no longer optional. It’s the price of staying relevant.

Five signals of resale’s rise in Germany

- 46 percent resell clothing to earn extra money.

- 36 percent say resale feels like the “sustainable” thing to do.

- 33 percent use it to make room for new clothes.

- 23 percent already factor resale value into new purchases.

- 24 percent say they want to start doing so — nearly half of consumers are adopting an investment mindset.

Advantages and disadvantages: Peer-to-peer and peer-to-brand-to-peer resale

Peer-to-peer (P2P)

Platforms: Vinted, eBay, Depop

- Pros: Easy adoption, large user base, fast liquidity

- Cons: No brand control over pricing, quality or presentation. Fragmented consumer experience, diluted brand equity.

Peer-to-Brand-to-Peer (P2B2P)

Platforms: Trove, Ninyes, in-house resale platforms

- Pros: Brand retains control, integrates resale into product lifecycle, captures data, reinforces durability and quality story, strengthens loyalty.

- Cons: Requires upfront investment, operational complexity, higher responsibility for logistics and service.

Bottom line:

Peer-to-peer offers quickness but erodes control. Peer-to-brand-to-peer builds loyalty, equity and long-term growth. For outdoor brands, owning the loop transforms resale from a threat into a business engine.

Keep reading:

→ Future Fatigue: How brands can help consumers out of climate paralysis

→ From signal to substance: The new rules of consumer trust

About the Report

The NXT Consumer Germany 2025 report is part of the Future Series by Above The Clouds, created in collaboration with studio MM04. It combines five years of Nordic consumer tracking with fresh German insights, based on a survey of 1,306 respondents and a boosted Gen Z sample of 601. The report explores preferences, aspirations, status markers and anxieties around sustainability and consumption – translating raw data into actionable foresight. Think of it as a bridge: carrying the longitudinal strength of the Future Series while anchoring it firmly in Germany’s cultural and socio-economic context.