Skechers’ long-term borrowings are expected to rise from $82 million to over $6.2 billion.

On June 17 Skechers submitted a Form 8-K to the US Securities and Exchange Commission (SEC) to disclose material developments in its acquisition by 3G.

According to the document, Skechers will survive as a corporation and brand but merge with Beach Acquisition Merger Sub Inc. (Merger Sub), an entity established on April 28. Merger Sub will in turn be a subsidiary of Beach Acquisition Co Parent LLC (Parent), formed and controlled by 3G Fund VI LP.

In the filing, Parent is explicitly mentioned with the incorporation date April 28. Merger Sub is a subsidiary of Parent, but its incorporation date is not explicitly stated.

Following the merger, Skechers will become a wholly owned subsidiary of Parent and will no longer be publicly traded, effectively transitioning from a public to a private company.

To fund the acquisition Parent has secured debt commitments from JP Morgan Chase and others:

- $2.1 billion first lien term loan facility

- $1.6 billion first lien revolving facility

- $1.9 billion senior secured bridge facility

- $2.5 billion junior debt facility

In addition, Parent “intends to seek alternative financing options” and “currently expects to borrow approximately $165.0 million less first lien debt than the committed amount of first lien term loans and bridge loans.”

The estimated funding for the transaction totals about $10.4 billion, consisting of:

- $9.5 billion in cash

- $742 million in rollover equity

- $130 million in debt repayment of Skechers’ existing liabilities

This leveraged-buyout structure will significantly increase the company’s debt load. According to pro forma financial statements filed with the SEC, long-term borrowings are expected to rise from $82 million to over $6.2 billion, reflecting the substantial debt financing used to fund the acquisition.

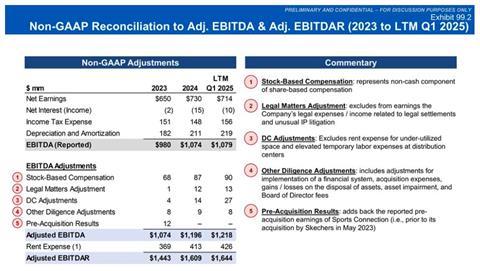

For a lender presentation, Skechers has further disclosed in its SEC submission its reckoning of adjusted Ebitda and adjusted Ebitdar (both non-US GAAP) covering the last 12 months (LTM) up to March 31 (see chart). The figures are intended to support lender decision-making by illustrating the company’s underlying earnings potential.

As we have reported, there is a lawsuit pending in US Federal Court against Skechers USA over the acquisition.