Wolverine Worldwide reported better-than-expected first quarter results and said it was exploring options for its Sperry footwear and apparel brand as it works to reshape its business amid a deterioration in market trends since the start of the year, macroeconomic concerns and a cold spring selling season that has hit consumer demand.

The company has been reorganizing operations in response to consumers cutting back discretionary spending. In late March, Wolverine said it would axe UK staff in its Sweaty Betty brand and consolidate office space in London to save costs. The company also offloaded its Keds business late last year to focus on higher-growth brands such as Saucony and made Designer Brands the exclusive licensee for Hush Puppies across all channels in the U.S. as well as Canada.

Wolverine CEO Brendan Hoffmann: “We’re just starting this process”

“We need to focus our efforts and investments on our Active and Work Groups, specifically our growth brands – Merrell, Saucony and Sweaty Betty. The recent sale of Keds and pending licensing of Hush Puppies will enable this focus, and these transitions are well underway,” said chief executive Brendan Hoffman.

“We are now exploring strategic alternatives for Sperry while we continue the foundational work needed to position the brand for long-term success,” he added. “So it could be a sale, it could be a joint venture, could be a licensing. I mean, we’re just starting this process.”

Management has in the past admitted Sperry struggled to stay a step ahead of market trends over the last four years and Hoffman said: “It just became apparent to all of us that we should start this process and much like Keds look for a result that’s best for the company and also best for the brand.”

Wolverine’s latest key financial figures

First-quarter net income rose to $19 million from $9.7 million a year earlier, while revenue fell 2.5 percent to $599.4 million, but above consensus of $577.5 million. Operating profit rose to $45 million from $19.6 million.

Gross margin was 39.4 percent compared to 42.5 percent in the prior year reflecting the sale of higher-cost inventory due to transitory supply chain costs from 2022, the acceleration of end-of-life inventory liquidation, and increased promotions.

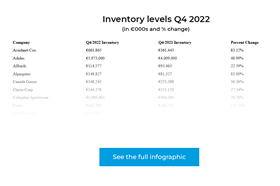

Inventory at the end of the quarter was $725.9 million which excludes $11.2 million for held-for-sale business. Inventory was also down approximately $19.0 compared with the fourth quarter of fiscal 2022.

Boost from new model but weather affecting sales

First-quarter revenue at Sperry declined 13 percent year on year to $63 million primarily due to lower sell-throughs of certain styles caused in part by the unfavorable weather during the spring season.

Merrell sales grew 17.6 percent to $180.3 million, with the brand taking the largest market share gains of all brands in the hike category, with specific strength driven by the company’s newly-launched MOAB 3 shoe – which it said was the top selling shoe in the US Hike market during the quarter.

“However, we expect Q2 revenues to decline mid-teens versus 2022 caused both by the difficult macroeconomic headwinds as well as year-over-year product flow shifts that I mentioned earlier. Revenue for the first half of 2023 is expected to be flat,” Hoffman told analysts.

Saucony was up 21.2 percent to $132.6 million with management targeting global expansion of its lifestyle Originals business as a key priority for the brand “which remains robust in Europe and has great potential elsewhere in the world, particularly in the U.S. as well as extending its reach beyond core everyday active and lifestyle consumers.”

Sweaty Betty fell 11.4 percent to $47.5 million as Wolverine continues to stabilize the brand in its UK and Ireland home market, while improving profitability through synergies from stronger integration within the rest of the portfolio. A low teens sales decline was forecast for the brand.

Wolverine brand sales were 12 percent lower at $51.7 million.

Outlook for 2023 reaffirmed

The active group – consisting of Merrell, Saucony, Sweaty Betty and Chaco – grew sales by 12 percent, although some of the increase was due to timing given last year’s recovery from the Vietnam shutdown that changed the order flow throughout the first half of the year. Benefits in the first quarter will turn to pressure in the second three months of the fiscal year, Hoffman said.

The group generated 74 percent of revenues from the wholesale channel and the remaining 26 percent from direct-to-consumer. Markets outside the U.S. were responsible for 42 percent of annual sales.

Wolverine reaffirmed its outlook for 2023 and expects revenue to be between $2.53–$2.58 billion, which would be a flat or 2 percent growth. It expects gross margin to be roughly 41.3 percent and for its inventory to improve by about $225 million by the end of this year.

Gross margin is expected to be around 41.3 percent and operating margin approximately 8.7 percent.

Cash from divestitures and tight expense control was expected to help generate operating free cash flow of at least $200 million, with year-end net debt forecast to be approximately $750 million.