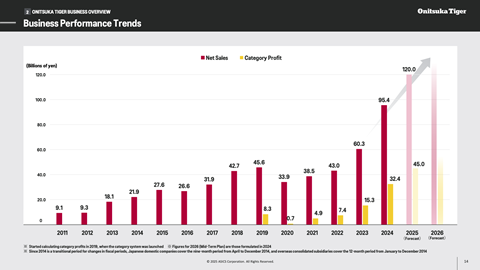

Onitsuka Tiger has been on a tear over the past two years, posting a year-on-year gain in revenue of 40 percent to 60.3 billion Japanese yen (€352m) in FY23 and a 58 percent gain to ¥95.4 billion (€557m) in FY24. For the current year, parent company Asics is projecting for the brand a further gain of 26 percent of ¥120.0 billion (€700m). That would be a near doubling in two years.

The projection for the gross margin stands at 75.0 percent, or an increase of 1,600 basis points over the 59.0 percent of FY19, when Asics began reporting profit by segment. Category operating profit for FY25 could surge 442 percent to ¥45.0 billion (€263m), while results could increase by 39 percent from FY24’s ¥32.4 billion (€189m).

Back in 2011 the category split was 5 percent DTC against 95 percent wholesale, but by FY24 brand-controlled stores were generating 99 percent of sales – representing the sum of DTC (58%), e-commerce (27%) and partner mono-brand stores (14%). Other channels made up the 1 percent balance.

As of this past June Onitsuka Tiger had 192 stores worldwide – split between Europe (7), South Korea (32), Japan (48), Greater China (83), Southeast Asia (19) and Australia (3). Its partner mono-brand stores amounted to 194 – split between Greater China (149), Southeast Asia (34) and India (11). There are no stores in the western hemisphere or in Africa.

As Onitsuka Tiger’s presentation for its 12th Investment Day details, the own-stores fall into four categories of design: global flagships, flagships, Red Concept Stores and Yellow Concept Stores.

Strategy

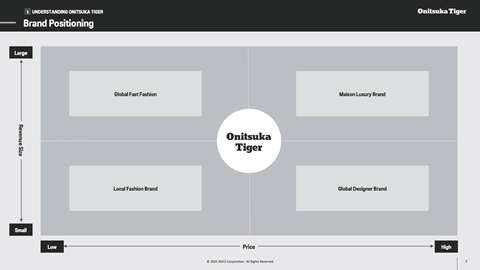

Onitsuka Tiger is positioning itself in the middle of a quadrant, whose two axes are low-to-high revenue and low-to-high price.

And it is making four changes in management, shifting:

- from wholesale to DTC

- from discounts to full price

- from regions (decentralization) to headquarters (centralization)

- from sports to luxury lifestyle

Geographically, it plans to expand in Europe, doubling its countries of from the current 15, and to enter the US market by mid-2027.

Our colleagues at the American edition of SGI have published a similar story on Onitsuka Tiger.