Topgolf Callaway Brands raised its adjusted Ebitda guidance to $430 to $490 million for FY2025, after the sale of Jack Wolfskin to Anta Sports for $290 million, which closed on May 31. The divestment boosted liquidity by 48 percent year-over-year to over $1.1 billion. Full-year revenue guidance was lowered to $3.80 to $3.92 billion, down by about $200 million, in reflection of the portfolio change.

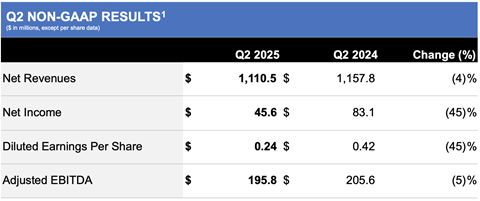

In Q2, group revenues fell by 4 percent to $1,110.5 million, with net profit dropping to $20.3 million from $62.1 million. Adjusted Ebitda stood at $195.8 million (-5%). US sales were down 3 percent to $862.2 million; Europe declined 8 percent (-13% CC) to $105.3 million; Asia slipped 9 percent (-12% CC) to $99.8 million.

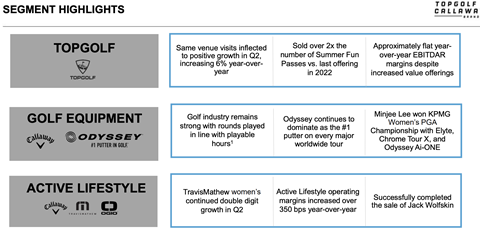

Topgolf revenues dipped 2 percent to $485.3 million, with same-venue sales down 6 percent. Traffic improved in venues offering new value initiatives like the Summer Fun Pass. Corporate events declined 12 percent, while operating income edged down 1 percent to $55.4 million.

Active lifestyle segment fell 14%

Golf equipment sales dropped less than 1 percent to $411.6 million. Club sales rose 1 percent to $312.7 million, while ball sales declined 5 percent to $98.9 million. Segment profits were slightly down at $76.3 million, impacted by tariffs.

The active lifestyle segment, now without Jack Wolfskin, fell 14 percent to $213.6 million. Apparel sales dropped 15 percent and accessories by 14 percent. Operating income rose 40 percent to $20.5 million, aided by the portfolio shift.

Topgolf guidance for FY2025 is $1.71 to $1.77 billion, with comps down 6 to 9 percent. The segment is expected to contribute $265 to $295 million to total Ebitda. CEO Artie Starrs will step down at the end of Q3; a spin-off of Topgolf is now expected in 2026.