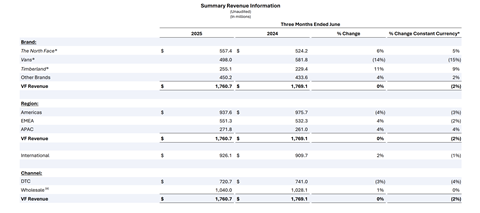

VF Corp. shares rose nearly 2.6 percent yesterday after the parent of Vans, The North Face, Timberland and others reported a narrower-than-forecast loss and total Q1/26 sales that exceeded projections. Total group revenues were down 2 percent on a constant currency basis to $1.76 billion as the operating loss came in at $86.6 million against a loss of $123.0 million, better than the guidance of a $110 - $125 million loss. The adjusted operating loss was $56 million.

In the second year of a turnaround under CEO Bracken Darrell, group senior management said that the European Union is closer to complete improvement than the Americas’ region. EMEA sales rose by 4 percent on a reported basis (down by 2% in C$) to $551.3 million in Q1. The larger Americas region suffered a 4 percent drop (-3% in C$) in revenues to $937.6 million. APAC sales grew by 4 percent year-over-year to $271.8 million. By channel, direct sales declined 3 percent on a reported basis to $720.7 million, while wholesale revenues increased 1 percent to $1.04 billion.

“We performed ahead of our expectations and guidance in Q1’26, improving our top-line trend versus last year to flat (-2% C$) while delivering a much stronger bottom line. The North Face and Timberland sustained their positive momentum while Altra grew strongly. Vans was impacted by channel rationalization actions, as we strengthen the business to return to healthy, sustainable growth.” (CEO Bracken Darrell

The North Face and Timberland had solid sales expansion in the period ending June 30. The North Face revenues increased by 6 percent on a reported basis (5% in C$) to $557.4 million, and Timberland sales, fueled by global momentum in its six-inch boot and a growing boat shoe business, realized an 11 percent reported sales (9% in C$) gain to $255.1 million.

Darrell told analysts that the company’s growth objective with The North Face is to bring the brand’s sales to high-single to double digits before eventually doubling the brand’s revenues. Product drivers in Q1, when the brand’s DTC sales jumped 7 percent and were aided by new door expansion, included technical trail running shoes, new lifestyle apparel, bags, and packs such as the Base Camp Voyager.

Ongoing channel rationalization accounted for about 40% of Vans’ 14% revenue decline to $498.0 million, in line with guidance. Backing out channel cleanup, the brand is running down high single digits. DTC experienced lower traffic across regions following the closure of non-strategic stores. However, wholesale reported a bright spot in the Americas’ sell-through, particularly in non-value wholesale doors. A compelling new product is coming from Sun Choe and her team, building on early success from skate variations like the Super Lowpro, Curren Caples, and OTW Pinnacle offerings.

Altra reported over 20% growth vs. last year, driven by recent launches of key franchise styles. Further share gains were achieved in road running and a leading position in trail running was reinforced in the US.

VF Corp. changed segment reporting

Based on current public information, VF Corp. is estimating an incremental annualized tariff impact on its business of $100-$120 million to bring this FY’s total tariff impact of $250-$270 million. Approximately half of the total will flow into FY26 results. The group intends to mitigate tariff impact through sourcing savings and price increases later this year. And while there is likely to be a $60-$70 million negative impact on FY26 gross profit, all current anticipated tariffs should be fully mitigated in FY27.

In another development, VF changed its segment reporting in Q1 by placing The North Face and Timberland (Tree and Pro) in the Outdoor unit and grouping Vans and pack brands Kipling, Eastpak, and Jansport in the Active group.