The world-leading shoe producer posted mixed results in the first nine months of 2025. A stronger product mix and higher shipments could not offset mounting margin pressure. Rising labor costs and weak retail conditions further weighed on performance.

Yue Yuen Industrial presented a mixed picture for the first nine months of 2025. The world’s largest contract manufacturer of sports shoes, headquartered in Hong Kong, once again delivered more pairs of shoes and benefited from a higher-quality product mix. However, rising wage costs, production problems and a persistently difficult retail environment in China had a noticeable impact on profitability.

Consolidated sales declined slightly by 1 percent to $6.02 billion. While the core manufacturing business grew by 2.3 percent, the Pou Sheng trading division slipped significantly (-7.9%). Net profit also fell by 16 percent to $0.28 billion, not least because one-off income had boosted the previous year’s result.

Sales mix shows shifts within the group

With a share of 55 percent, the Athletic/Outdoor Shoes segment remained by far the largest revenue driver, followed by Pou Sheng, with 29.7 percent, while Casual Shoes & Sports Sandals contributed 10.8 percent and Soles, Components & Others 4.5 percent to total revenue.

The Casual Shoes & Sports Sandals segment performed particularly well, growing by 21.2 percent to $0.65 billion. The core business with Athletic/Outdoor shoes remained stable and increased by 1.8 percent to $3.31 billion. By contrast, the Soles, Components & Others segment declined significantly, falling by 21.9 percent to $0.28 billion. The Pou Sheng retail division remained under pressure, slipping 7.9 percent to $1.79 billion. The Chinese retail market remains a major challenge for Yue Yuen. Particularly weak customer traffic and increased discounting weighed on business, with the gross margin falling 0.5 percentage points to 33.5 percent.

Premium orders help – but margins still under pressure

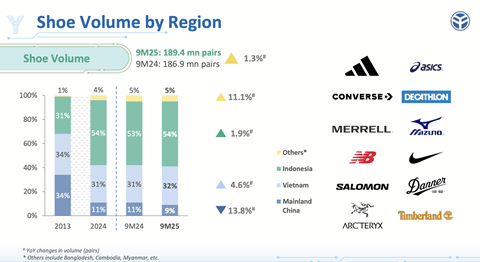

Deliveries rose to 189.4 million pairs (+1.3%). The average selling price also increased, reaching $20.88 per pair – an indication that customers are opting for higher-quality models.

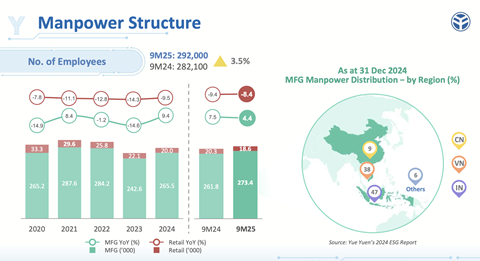

However, this was not enough to boost the manufacturing margin, which fell to 18.3 percent (–1.3 percentage points). The group cites several reasons for this, including underused plants, lines that fell short of efficiency targets and significantly higher labor costs in several production regions.

Slight easing in Q3, but environment remains difficult

Nevertheless, there is a ray of hope at the end of the summer quarter. Yue Yuen reports a slight improvement in margins, driven by stricter production discipline and efficiency gains that have been noticeable in several regions.

However, there is no cause for complacency. New US tariffs, geopolitical tensions and more cautious orders from brand partners continue to cause headwinds.

Looking ahead: Peak season with unanswered questions

The fourth quarter is traditionally the strongest period for the manufacturing business, and Yue Yuen expects higher delivery volumes. At the same time, the environment remains fragile: tariffs, inflation and fragile supply chains could slow the upturn at any time.

The group is therefore focusing on flexibility and cost discipline. In Indonesia – more precisely in Central Java – a new factory went into operation as planned in the third quarter. Yue Yuen is also expanding production in India. The goal is clear: to broaden its geographical footprint and further reduce its dependence on China. Additional manufacturing centers in Vietnam and Bangladesh should help achieve this.

Despite all the uncertainties, management is optimistic. The continuing robust “athleisure” trend, strong brand partners such as Nike, Adidas and Asics, and major sporting events – including the FIFA World Cup 2026, the Asian Games and the next Winter Olympics – are likely to support demand in the coming year.