Monitor Deloitte and Playtomic have released their second annual Global Pádel Report, available online, and the results are rosy.

Some predictions

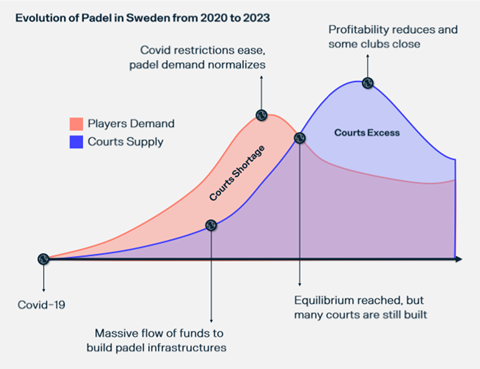

The report considers that the post-Covid boom is over and that the “surge” in club and court constriction has continued. From this, it infers that investment, too, has continued.

Pádel is spreading worldwide, although the spread is uneven. The sport should grow most over the next few years where it is newest: the UK, Germany, France, the US, the Middle East and Asia.

The report identifies three “new relevant regions”: the U.S., Big3 Europe (the UK, France, Germany), the Middle East (Saudi Arabia, Bahrein, Kuwait, Qatar, UAE) and Asia (India, China).

The current number of courts worldwide, about 40,000, will more than double by 2026 to 85,000.

The non-play market

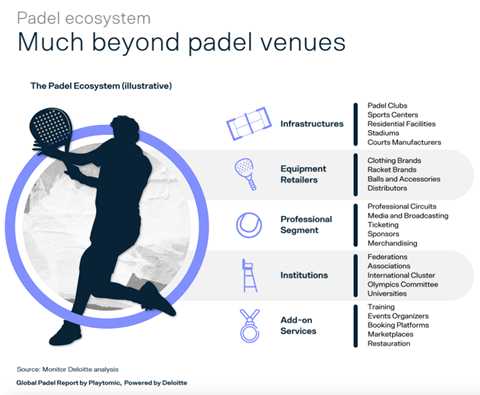

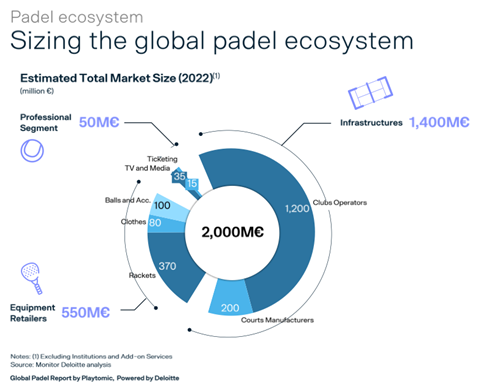

The market surrounding pádel, unrelated to the on-court action, is worth about €2 billion now and will increase in value, especially as pádel becomes more professional. The report calls this surrounding market the pádel ecosystem.

At present, pádel’s professional segment amounts to 1/40th of the ecosystem’s value: that is, €50 million out of the total €2 billion. Infrastructures account for the bulk, at €1.4 billion, and equipment retailers account for the balance at €550 million.

Pádel’s professional segment (€50m), incidentally, is tiny by comparison with that of tennis (€7.0bn), let alone that of baseball (€20.0m), basketball (€21.5bn) or especially football (€45.0bn).

Why pádel?

Part of pádel’s appeal derives from its relative ease of play. People of varying athleticism can play and have fun.

Another part is its function as a “social catalyst” and “means of exercise.” A pádel club, then, serves as a club in the social sense. You go not just to play but to meet. And many players, says the report, appreciate the “opportunity to play with a variety of partners.”

Pádel players tend to be “nomadic,” playing at more than one venue, so its players tend to form dense networks (denser, we at SGI Europe infer, than the networks of players of more demanding and therefore less nomadic sports, like tennis).

Pádel players have a “strong desire” to “spend more time on the court” – more than the supply of courts can afford. This analysis, it seems to us at SGI Europe, suggests that once supply catches up to demand, the hunger for pádel will abate. Indeed, the report’s analysis of Sweden shows similar thinking:

In fact, Monitor Deloitte speaks of its “market saturation metric,” based on a region’s population, tennis penetration (players per capita), number of tennis courts and pádel players per court. By this measure, says the report, Sweden’s point of saturation is about 3,700 courts.

On the net

According to the report, Google searches for pádel were relatively flat from 2016 to 2019 before a precipitous drop in early 2020. This led to a steep climb around the end of 2020’s first quarter, and pádel searches have been climbing ever since, with some irregularity.

At present, the top 15 countries for pádel searches are, in decreasing order: Spain, Denmark, Sweden, Portugal, Finland, Chile, Belgium, Italy, Paraguay, Norway, the Netherlands, Argentina, Kuwait, the UAE and Qatar.

Per court

As of January 2023, Spain remains the only country with a number of pádel courts in the ten-thousands (15,300). Italy (6,470) and Sweden (4,200) follow, and we see a drop with France (1,506), the Netherlands (1,445), Belgium (1,395) and Portugal (1,010). We see a drop into the hundreds with Denmark (766) and Finland (750), and there’s a further drop with Norway (350), Germany (250) and the UK (250).

In the report’s view, the pádel market has reached maturity in only two countries: Spain and Sweden. It places the world’s other countries in one of three other stages: boom, interest or beginning.

The report’s top “boom” country, Italy, has more courts than “mature” Sweden but also has almost six times the population (58.9m vs. 10.5m), and its number of courts per capita is, by SGI Europe’s reckoning, about four times lower.

Sporting goods

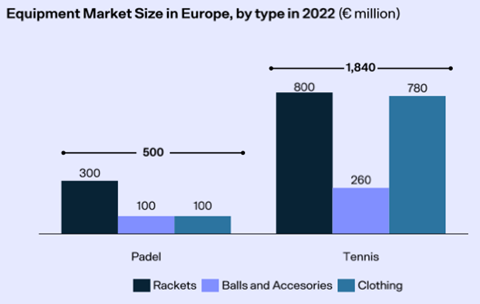

The overall equipment market in Europe in 2022 amounted to €500 million for pádel and €1.840 billion for tennis.

The report divides equipment sales into three segments:

- racquets

- balls and accessories

- clothing

In 2022, pádel players spent the most on racquets (€300m), whereas tennis players spent almost equal amounts on racquets and clothing (€800m, €780m).

Who are the players?

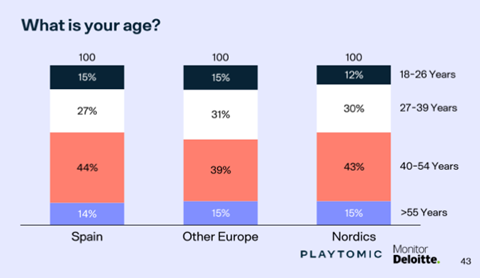

Many, many European pádel players fall between the prime of life and retirement (ages 27 to 54).

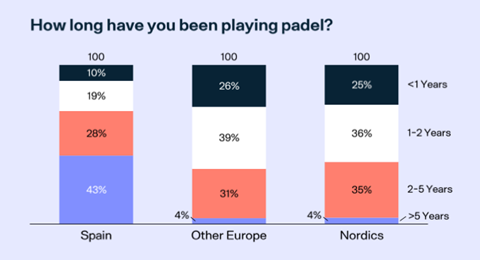

Even more, however, have taken up the sport in the past five years. How many? Outside of Spain, where 43 percent have been playing for longer, the figure is above 95 percent.

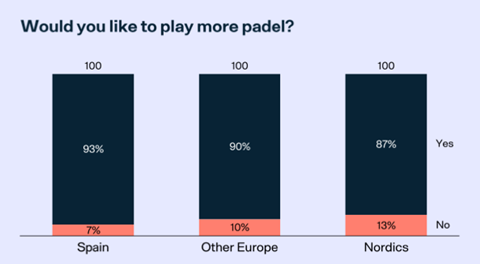

Another telling statistic is the desire for pádel. Almost all European pádel players, even in Spain, want to play more pádel.