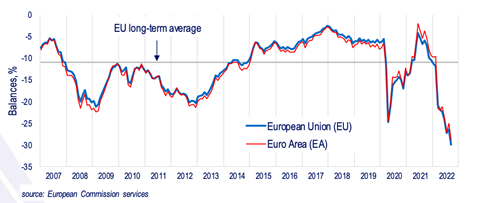

Consumer confidence has taken a dive in Europe. The European Commission’s Directorate-General for Economic and Financial Affairs (DG ECFIN) has produced a flash estimate for September, according to which the indicator has “resumed its steep downward trend, dropping by 3.5 points in the EU and 3.8 points in the euro area (EA).”

Worse, “at -29.9 (EU) and -28.8 (EA) points, consumer confidence hit the lowest level on record.”

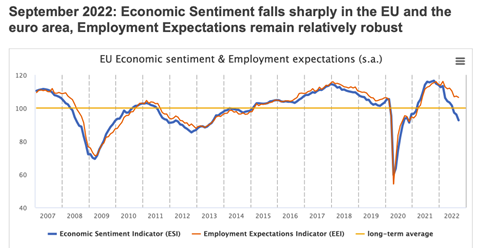

The same body reports similar results for economic sentiment, a weighted average of the balances of replies to selected questions addressed to firms in industry (weight 40%), services (30%), consumers (20%), retail (5%) and construction (5%).

For September, “the Economic Sentiment Indicator (ESI) continued its steep decline in both the EU (-3.5 points to 92.6) and the euro area (-3.6 points to 93.7). The Employment Expectations Indicator (EEI) decreased more moderately (-0.8 points to 106.4 in the EU and -1.2 points to 106.7 in the euro area), staying markedly above long-term average.”

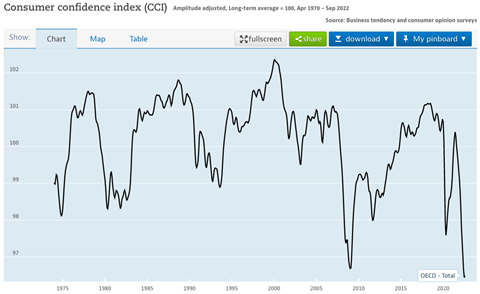

The OECD is reporting similar figures. Its version of the consumer confidence index has reached the lowest ebb since it began recording in 1975. By the OECD definition, “an indicator above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to spend money on major purchases in the next 12 months. Values below 100 indicate a pessimistic attitude towards future developments in the economy, possibly resulting in a tendency to save more and consume less.”

But what about Europe’s individual countries? Let’s look at the biggest economies.

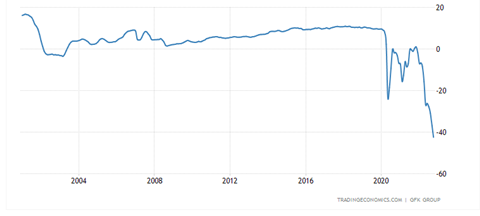

For Europe’s largest economy, Germany, the GfK Group reports that its Consumer Climate Indicator “fell to -42.5 heading into October of 2022 from a revised -36.8 in the prior month, hitting a new record low for the fourth straight month and worse than market forecasts of -39.” It ascribes the drop to “mounting concerns over surging inflation and high energy prices as well as persistent recession fears, with income expectations plummeting to a new record low of (down by 22.4 points to -67.7).”

As shown in GfK’s chart for Germany immediately below, the financial crisis of 2008 produced a blip in German consumer confidence by comparison with present circumstances. The only comparable drop has come with the pandemic.

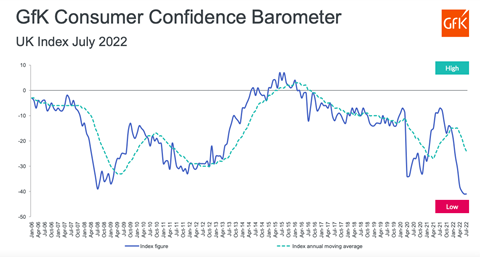

GfK’s most recent Consumer Confidence Barometer for the U.K., dating to July, shows a similar recent drop and record low but also a more turbulent history. U.K. consumers were pessimistic in 2008 and during the pandemic. There has also been a decline since the Brexit vote of 2016. The only period of positive consumer confidence in the U.K. since 2006 was brief and occurred in about 2015.

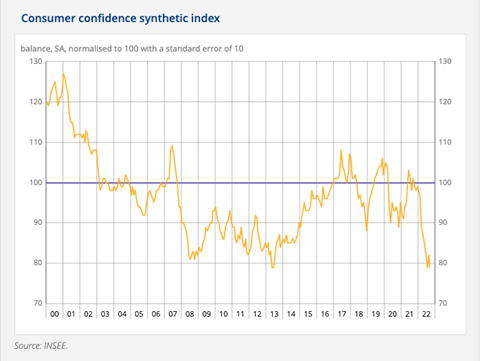

France’s statistical body, the INSEE, provides a view of French consumer confidence over the past 22 years. The overall trend is in decline. The worst single drop came during the financial crisis. The third-worst came in 2018 and was followed two years later by that of the pandemic. The current drop, the second-worst so far, has brought consumer confidence to its nadir over the past two decades.

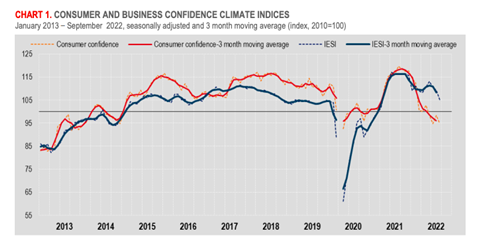

Italy is bucking the trend; or sort of. Things are not rosy from the consumer perspective, but neither are they as bad-seeming as they were in the recent past (during the pandemic). There has nevertheless been a decline over the past year. On the most recent figures, the country’s statistical body, Istat, writes: ”In September 2022, the consumer confidence index came in at 94.8 (compared to 98.3 in August). In a situation characterized by sharp deterioration of the economic climate (from 92.9 to 81.3), the breakdown of consumer confidence climate by components showed that also all the other indices decreased. More specifically, the future climate went down from 96.4 to 91.8, the current one from 99.7 to 96.9, and, finally, the personal one from 100.2 to 99.3.”

Spain’s statistical body, the INE, does not track consumer confidence, but Trading Economics has drawn data from Centro de Investigaciones Sociológicas – an independent body connected to Spain’s Ministry of the Presidency – to produce the chart below. Although down, consumer confidence in Spain is not at its lowest point in recent history, which came in 2012.

Accompanying the chart is this commentary: “Spain’s consumer confidence indicator dropped by 10.3 points from the previous month to 55.5 in July of 2022, marking a 36.4 point decrease from the corresponding period of the previous year. It was the lowest reading since March. The gauge measuring the current situation dropped 6.4 points to 53.1, dragged by deteriorated sentiment regarding the economy, financial situation of households, and the labor market. The gauge measuring future expectations plunged 14.3 points to 58.9, also pressured by lower confidence regarding the economy and the labor market.”

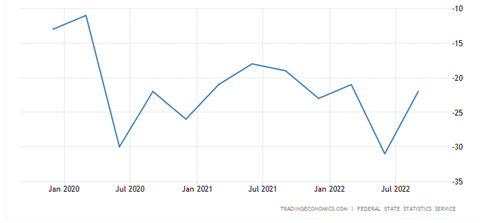

Of course, Europe’s other big economy, albeit outside the EU, is Russia, whose consumer confidence index looks like a mirror image of the EU’s. (Trading Economics has drawn its data from the Russian statistical body, the Federal State Statistics Service, whose website appears now to be blocked.) Rather than start steady and drop, it starts low (in about 1999, when Vladimir Putin first became president) and climbs to an unsteady hover around mild pessimism.

The most recent figures – which predate both the recent military reversals and the referendums in Ukraine – register an uptick: