At the ISPO Munich 2022 press kickoff on Sep. 6, Tobias Gröber, the head of ISPO Group at Messe München, informed the attending press representatives about the latest details and plans for the upcoming trade show from Nov. 28-30 and gave a quick outlook on the sports market in general.

The sports market to grow by an annual average of 6% until 2025

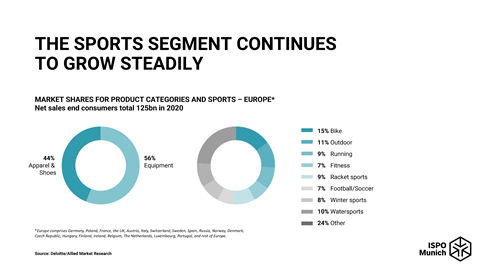

First, Gröber gave an outlook on the sports market after the Covid-19 pandemic, based on data from Deloitte and Allied Market Research. According to this data, the growth of the European market is unbroken. From sporting goods net sales to end consumers of €125 billion in 2020, an average annual increase of 6 percent is expected to reach net sales of €164 billion by 2025. The strongest segments are bike (15% share) and outdoor (11%), followed by water sports (10%), running and racket sports (9% each), winter sports (8%), and fitness and football (7% each). In terms of product categories, equipment accounted for 56 percent of sales and apparel & shoes for 44 percent.

The future of the fitness market is hybrid

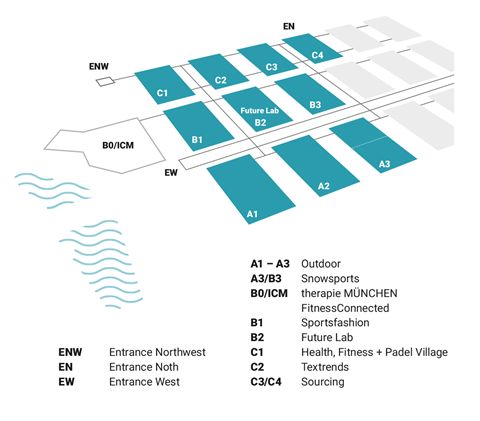

The pandemic has significantly changed consumer behavior, especially in the fitness segment. Although there has been a return to fitness studios after the lockdowns, more than half of all respondents (55%) intend to continue exercising at home or outdoors rather than in a gym, according to another Deloitte analysis. As a result, operators of individual (not chain) fitness centers in particular are facing a number of problems in this segment. The market of the future is seen to be “hybrid,” i.e. a mix of studio, (connected) home fitness and outdoor training. Thanks to the integration of the parallel events FitnessConnected and Therapie München, ISPO Munich will place a strong focus on the segment in November and supports suppliers and operators with seminars and in-depth information for both the commercial fitness sector (in ICM/Hall B0) and end consumer offerings (Hall C1).

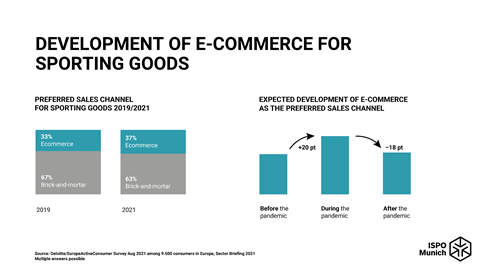

The sporting goods market is changing

E-commerce and direct-to-consumer haven’t just been on the rise since the Covid pandemic, during which digital shopping has naturally seen a significant boost due to the lockdowns. And it remains popular after brick-and-mortar stores reopened. As such, more and more sporting goods brands are pushing their omnichannel strategy on DTC business through their own e-commerce store and marketplaces, keeping brick-and-mortar stores under pressure. Nevertheless, consumer demand for service and convenience in shopping (from fitting to rental to click-and-collect) remains.

Also, operational costs for DTC brands are becoming more expensive due to increased demand and growing competition. Gröber also touched on the well-known supply chain issues that are changing the sports market profoundly. He cited as a striking example the delivery times for skis, which will be significantly delayed for the coming season due to supply shortages. However, delivery in Nov./Dec. instead of (as in former times) Aug./Sept. holds not only problems but also opportunities.

Not to forget the influence of geopolitical issues, including the war in Ukraine, rising energy costs or inflation. The changed overall situation requires a rethinking that is already taking place on a broad level, but needs to be pushed even further.

Rethinking is also taking place at consumer level. For example, topics such as sustainability and diversity/inclusion are becoming increasingly relevant alongside digitalization and a clear trend toward athleisure (in everyday life and sports). As a result, says Gröber, the sporting goods industry as a whole must develop new perspectives – regarding consumers, services, retail values and the business as a whole.

The trade show as the ideal place to talk

Gröber’s appeal to the industry: “Time to talk!” The “new” ISPO Munich in November offers traditional retailers as well as brands many opportunities to discuss and find solutions. The main focus here is on presenting and understanding new perspectives for the sporting goods industry and strong partnerships. According to Gröber, retailers, in particular, can benefit from ISPO Munich by discovering innovative and dependable alternatives to brands focusing on DTC. Finally, the new date in November is perfect to get in touch with new labels, see innovations, and network with other “insiders” at the start of the ordering season.

ISPO Munich on Nov. 28-30, therefore, has the task and the goal, according to Gröber, to show the new perspectives in sports and to communicate them through its participants and partners. How does the business work in a world in change? How can digitalization help to transform the industry for the better? Can we all win without nature losing? These are just some of the questions that need to be answered.

“Same but different”

In keeping with this motto, visitors of ISPO Munich 2022 can expect several other important cornerstones in addition to the new date. There will be five main product categories: Outdoor, Health & Fitness, Snowsports, Sports Fashion and Textrends & Sourcing. In addition, ISPO Munich offers new formats and a new focus on changed core topics. What remains unchanged after the forced break due to the pandemic is that ISPO Munich is the melting pot and trend showcase for the key players in the sporting goods business. Especially because the personal interaction is more valuable than ever before. In addition, according to Gröber, the physical trade show allows a maximum return of investment and strengthens the community feeling. Also important: To learn that “our” industry is bigger than just sporting goods. Therefore, other topics from the entire value chain, such as tourism, will also be addressed.

Size and internationality

One big change from the last ISPO Munich before the pandemic is the number of halls, which had to be reduced to 10 because of the “Heim+Handwerk” home improvement consumer show taking place at the same time. Therefore, the halls A4 to A6 as well as B4 to B6 are not available and the maximum stand size for ISPO Munich exhibitors was reduced to 200 sqm. “In doing so, we are appealing to ‘better vs. bigger’,” Gröber said.

As for the exhibitor list, project management is “still in the allocation process,” but it is already clear that more than 90 percent of the 1,500 confirmed exhibitors (2020: 2,800) will be of international origin. The top 6 nations are Italy, Germany, Taiwan, China, Turkey and France (number of exhibitors per country). In total, exhibitors from 55 countries have registered to date.

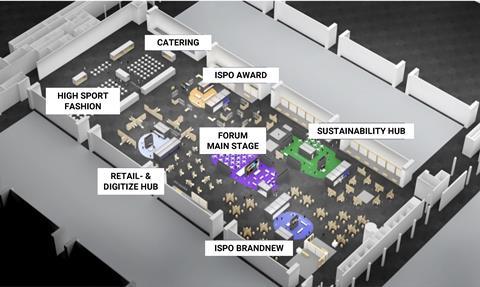

Central Future Lab

Centrally located in Hall B2 is the new “Future Lab”, which includes all of ISPO’s award and young talent programs (Brand New Hub), plus a Retail & Digitize Hub, a Sustainability Hub, and a catering & socializing area. ISPO’s educational programs and partner presentations will take place on several stages throughout the hall. All major focus topics such as inclusion, women associations, textile trends, digitalization in fashion as well as health and mindful living will also be covered here, and cross-industry experiences will be offered in dedicated “Innovation Labs.” The ISPO Cup, previously a closed VIP event, will also be awarded for the first time in the hall, which also hosts the ISPO parties. The hall design is being completely redeveloped and intended to underline its “Future” aspect.

Visitor forecasting and consumer activation

As for expected visitors, Gröber cited a figure of 55,000, compared to around 77,000 at the last pre-pandemic event. “Most of them will come from Europe,” but it remains to be seen what Covid-related travel regulations will be in November, he said.

According to Gröber, end consumer activation, as most recently planned in the form of a separate hall, is off the table for the time being, not least because of the lack of space. “We will bring a hand-picked number of opinion-leading end consumers to the show through our ISPO Collaborators Club,” he said. But this has nothing to do with an opening to the public, which was never planned anyway, as it was always only about a parallel “festival” for end consumers who would not have had access to the trade show halls. Gröber could not say what the approach to the topic will be in the future.

Ski and bike industry

Two segments will be represented at ISPO Munich only to a very limited extent. On the one hand, the majority of ski hardware manufacturers will be absent, since, according to industry representatives, the trade show date has no relevance; on the other hand, bike hardware will be missed, although it has never really been a key segment at ISPO in the past either. “We will be able to welcome a few exhibitors from the mobility segment at ISPO Munich,” says Gröber, but the bulk of this segment will again be found at the IAA Mobility in Munich in 2023, for which Gröber is also responsible. It remains to be seen whether both segments will return stronger at ISPO Munich in the future or whether they could partially shift to OutDoor by ISPO (ski touring and/or mountain biking in particular).

More information on ISPO Munich 2022 and all updates on exhibitors and the supporting program can be found at www.ispo.com.