Bjørn Gulden presented mixed figures at Adidas’ main press conference – and the first loss in 30 years – yet he also managed to present the company’s “transition year” as an important step forward. The CEO singled out several growth drivers that he said would yield “double-digit growth again” in 2026.

Adidas posted a loss of €58 million in 2023. However, the operating result, at €268 million, was significantly better than expected. A year ago, Gulden was predicting a loss of €700 million for 2023. Given the difficult economic situation and the additional trouble surrounding Ye, this is very satisfactory.

At the very least, Gulden and CFO Harm Ohlmeyer showed confidence and optimism. 2024, the year of sport, they said, should lead to single-digit growth and a “healthy company,” with double-digit growth by 2026.

The levers Gulden sees for this are localization, speed, a cultural shift, innovation, brand evolution and a shift in the retail/wholesale balance.

From the global to the local

Gulden believes local markets to be valuable in many respects. Local sourcing can increase speed-to-market. Local marketing strategies can improve the approach to the customer. Local pricing, with only conditional suggestions from headquarters in Herzogenaurach, can zero in on the most lucrative prices. And local athletes and influencers can drive sales.

“The times of global heroes and collections are over,” Gulden often says when talking about the Adidas strategy. The European and US markets, for example, are further apart than people think. This is why the design office is located in Los Angeles and works closely with US retailers. In China, all products can be produced locally and thereby adapted to local requirements: “We have to give the consumer what he or she wants,” says the CEO. Local needs are the focus.

Standing for speed

Speed is another component that should help Adidas achieve more sales in the long term, and that is in many areas.

One is local production – not only in China but also in India. The latter is “the fastest-growing market,” Gulden says, estimating its growth potential at 20 to 25 percent. At the same time, Gulden is focusing on fast market launches. Rather than subject running shoes to intensive machine tests, he’d prefer to have 30 Kenyan athletes test-run them. “If it works, put it on the market” – that is his philosophy because “you can’t measure taste or feeling.”

At both headquarters and regional offices, business units are being given more autonomy to act and decide. At the same time, they are striving not only to recognize trends but also to scale them.

For example, the demand for shoe models in social networks is one of the most important indicators for scaling. In 2023/24, the focus will be on the Campus, Samba, Gazelle and Spezial models. For 2024/25, Adidas is focusing on the Superstar (“the most successful shoe Adidas has ever had”) and SL 72. The company also wants to benefit from the upcoming Lo Profile trend. But speed also goes hand in hand with a cultural shift, a genuine turning point.

A confident culture of “yes”

“There was a lot of ‘no’ in the value chain,” said Gulden, speaking of his first impressions of Adidas. Employees, when asked, will joke about the spontaneous showroom tour given to journalists after this year’s press conference – something that would never have happened in the past. “I don’t like concealment as a tactic” was Gulden’s terse summation. But the cultural change goes much deeper: it is a return to the old Adidas DNA.

“The innovation was there. We had to make sure that we got it out onto the market,” explained Gulden. He would often get a “no” from employees in response to his ideas. “Then I’d start asking questions. Why is it not possible? Why can’t we do it?” And just as often, a way would be found — faster scaling, shorter lead times — to get things done.

Product innovation

The new Adidas Predator for footballers, the Adizero Adios Pro Evo 1 running shoe, weighing just 138 g, and the Terrex Agravic Speed Ultra for trail-runners are just some of the innovations that Adidas believes has positioned it as an innovative, product-driven brand. As even CFO Ohlmeyer said, “We are a product company, not a digital company.” And Gulden, for his part, never tires of saying that the “best athletes in the world” wear Adidas products. Footballers Lionel Messi and Jude Bellingham, American footballer Patrick Mahomes, skier Mikaela Shiffrin and runner Tigist Assefa are at the top of the list.

However, in the running sector, as Gulden had to admit, brands such as Hoka and On have recently gained considerable market share in the amateur sector at Adidas’ expense. Adidas wants to make up for this with the Adinova and Adistar: “We’re a bit late, but these shoes have huge potential.”

Brand evolution

At the same time, the brand wants to become more visible – in part through further development of its look. In future, Adidas will dispense with the combination of word and image in its branding and rely on the performance and lifestyle logo, without lettering. It will use this in isolation. The three stripes will also be wider and more dominant.

Adidas wants to use a clear, positive, simple and emotional visual language, supported by a new slogan, “You got this,” which has already replaced “Impossible is nothing.”

“We felt the kids already have too much pressure,” said Gulden by way of explanation.

In addition, the visual language from the lifestyle sector is being used more and more in marketing for the performance lines. Adidas sees these two worlds merging. “When you see NBA athletes after a game,” said Gulden, “it’s like a catwalk.”

Adidas also seeks to raise its profile through advertising and during major sporting events.

Valuing wholesale again

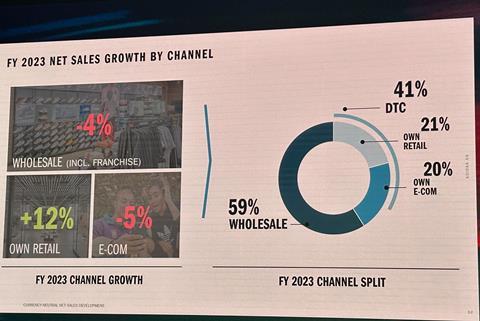

Adidas makes 50 to 60 percent of its sales through retailers. It is therefore seeking to strengthen that connection again. Many retailers have already visited Adidas in recent weeks, and another 150 will be coming to the campus for several days in the coming weeks. Gulden has announced that there will be more dialog with retailers in the US as well.

There is a sense of optimism at Adidas headquarters. People are looking forward to the year of sport. The next sales figures will show whether 2024 will also be an Adidas year – and whether Gulden can continue to radiate so much optimism.

****

Curious about Adidas’ financial figures 2023? Read on here.