“We are a brand with a great opportunity and we are focused on the brand,” said Puma CEO Arne Freundt at the annual press conference. Read about his next steps for Puma, a brand that lacks investor confidence.

Half a day before the start of its annual press conference, Puma had to issue a profit warning. Last year, the company had simply overstated its promises to investors.

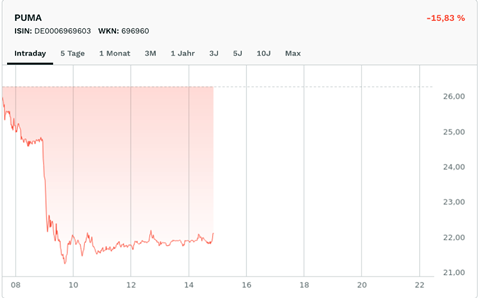

The 4.4 percent increase in currency-adjusted sales and the operating result of €622 million (Ebit margin 7.1%) were not signals to delight investors, and the share price fell by 15 percent within a few hours.

Generally, the stock market’s confidence in Puma does not seem to recover. Over the past three years, the share price has lost around two-thirds of its value (from over €70 to €22) and is now trading at its lowest level in eight years. CEO Arne Freundt is under pressure.

To put the company in a better position, Freundt has announced corporate reforms and is focusing on a long-term strategy to build the brand.

An efficiency program called “nextlevel” with a one-off cost of €75 million will ensure, among other things, that purchasing is based on global framework agreements, IT systems are standardized and inventory management systems are modernized. Growth in recent years has increased complexity,” said Freundt, “and now we need to work on our efficiency and reduce costs in the back office. He continued: “We have a strong decentralized organisation with strong local entrepreneurs, but we need to be as cost efficient as possible without affecting the consumer.”

“Nextlevel” also includes the elimination of 500 jobs worldwide and the closure of unprofitable Puma stores.

In addition to these cost-cutting measures, Freundt is driving forward the long-term strategy he has been developing for the past two years. This has three pillars:

1. Brand elevation

A purified brand DNA will ensure greater unaided brand awareness globally. The associated campaign (launching March 20, 2025) builds on the 2024 campaign and focuses on the individual, authentic athlete. Its tagline: “Be true to yourself.” In 2025, the aim is to increase media spend and invest to expand points of sale.

2. Innovation as driver for the performance category

Puma wants to gain market share and visibility in the performance category. The focus is On Running, football, basketball and fitness.

“Innovation is the key to winning in performance,” especially in the running category, said Freundt. The company focuses on the Puma Nitro Foam, which is expected to propel Puma into the top five running brands. In 2021, the first running shoe with Nitro technology was launched, in 2023, the company “moved into the top ten running brands and in 2024, we were number nine. We want to go much higher.”

Marathonhandbook sees the Puma Deviate Nitro Elite 3 as the 11th “most successful” shoe of the 2024 season. The ranking is based on podium finishes in the season’s major marathons. Adidas, like Puma, which is based in the small German town of Herzogenaurach, has three models in the top ten. In addition to working with top runners, the company also plans to work closely with grassroots running communities and gain more shelf space in specialty stores, says Freundt.

In the fitness segment, the partnership with Hyrox should bring increased visibility.

3. Elevate sportstyle prime

Freundt’s goal is to attract more shoppers in the middle segment – for example, at sports retailers such as JD, Snipes and Foot Locker. “Puma is always strong in the core segment [e.g. Deichmann, ABC Mart, Shoe Carnival, etc.], but we believe we will return to growth in core and prime in 2025. The Speedcat lifestyle model in particular is intended to achieve this. The latest version was given away last summer by celebrities such as Rosé and sold in the top price segment at Kith, Atmos, End and Naked. The shoe sold very well there, says Freund, and now it’s only a matter of time before the style catches on in the mid-range segment: “It will continue to gain traction in spring and summer. Even if it takes a bit more time than we originally thought.”

Time is one of the most important components for the “Forever. Faster” company. But CEO Freundt and CFO Markus Neubrand are convinced that the strategy and efficiency programs will have an impact this year.

Read more here: Puma’s financial reporting