Strong growth in the lifestyle segment and a dominant position in the EMEA region propel Asics to the top in the second quarter of 2025. In addition to record margins, the group is focusing on premium products, direct sales and international sporting events – and the stock market is rewarding this strategy.

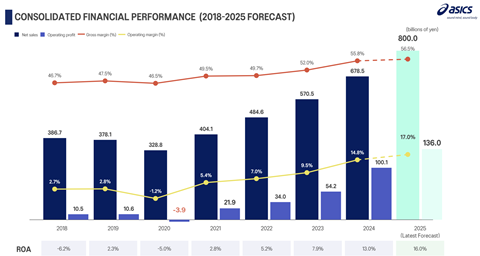

Things are going well for Asics: in H1 FY2025, the Japanese sports company has for the first time in its history exceeded the ¥400 billion (€2.36bn) sales mark. Driven by double-digit growth in all product categories – led by Sportstyle and Onitsuka Tiger – as well as sensational performance in the EMEA region, the brand has now raised its annual forecast by ¥20 billion (€118.0m) to ¥800 billion (€4.72bn).

Q2 and H1: Asics continues its strong run

Asics continued to sprint ahead in Q2 FY25. Sales rose by 15.7 percent to ¥194.4 billion (€1.15bn), or 18.9 percent on a currency-adjusted basis. Gross profit increased by 17.8 percent to ¥112.1 billion (€638.97m), with the margin remaining stable at 57.6 percent. Operating profit climbed by 45.8 percent to ¥36.6 billion (€208.6m), corresponding to an operating margin of 18.8 percent.

In H1 FY25, sales totaled ¥402.7 billion (€2.29bn) – an increase of 17.7 percent and the highest figure in the company’s history. Operating profit jumped 37.7 percent to ¥81.1 billion (€478.5m), while the operating margin rose 2.9 points to 20.1 percent. Given this momentum and the reduced uncertainty regarding the impact of US tariffs, management has raised its annual forecast by ¥20 billion (€118.0m) to ¥800 billion (€4.72bn) in sales. Asics now expects operating profit of ¥136 billion (€802.4m). This means that the target set out in the Mid-Term Plan 2026 is likely to be achieved a year earlier than planned. However, the percentage increase in gross profit is expected to be lower, mainly because of higher procurement costs caused by unfavorable exchange rates and rising material prices.

| Asics - Income | |||

|---|---|---|---|

| 2025 | 2024 | Change | |

| H1, ended in June (¥ billion) | |||

| Net sales | 402.7 | 342.1 | 17.7% |

| Gross profit | 228.4 | 190.0 | 20.2% |

| Gross margin | 56.7% | 55.5% | 1.2 pp |

| SG&A expenses | 147.3 | 131.1 | 12.4% |

| Operating profit | 81.1 | 58.9 | 37.7% |

| Operating margin | 20.1% | 17.2% | 2.9 pp |

| Ordinary profit | 78.6 | 57.8 | 36.0% |

| Extraordinary income | 2.1 | 0.2 | 950.0% |

| Q2, ended in June (¥ billion) | |||

| Net sales | 194.4 | 168.0 | 15.7% |

| Gross profit | 112.1 | 95.2 | 17.8% |

| Gross margin | 57.6% | 56.7% | 0.9 pp |

| SG&A expenses | 75.5 | 70.1 | 7.7% |

| Operating profit | 36.6 | 25.1 | 45.8% |

| Operating margin | 18.8% | 15.0% | 3.8 pp |

| Ordinary profit | 35.3 | 24.8 | 42.3% |

| Extraordinary income | 2.1 | 0.2 | 950.0% |

| Source: Asics | |||

Trendy lifestyle: Onitsuka Tiger on the rise

All Asics product categories recorded sales growth in the second quarter, with Sportstyle and Onitsuka Tiger standing out with growth of around 50 percent. In the Performance Running segment, the margin increased by 1.2 percentage points year-on-year to 25.2 percent, driven by a focus on higher-priced products and strong growth in Japan, Europe, and South and Southeast Asia. Sportstyle achieved a margin of 30.7 percent (+2.8 pp YoY), with double-digit growth in all regions – particularly in North America, Europe, Greater China, and South and Southeast Asia. Onitsuka Tiger increased its margin by 1.1 percentage points to 39.1 percent (YoY); business grew worldwide, especially in Europe and Japan, where it grew almost twice as fast, supported by high demand from international tourists.

EMEA once again strongest market for Asics

EMEA was already Asics’ strongest region in terms of sales in H1 FY24, just ahead of its home market of Japan. In 2025, Asics EMEA further extended this lead and was clearly in the lead in both the first and second quarters. In Q2 FY25, sales rose by 24.2 percent to ¥56.8 billion (€335.2m), or 27.3 percent on a currency-adjusted basis. The operating margin improved by 2.7 percentage points to 18.8 percent. The Sportstyle and Onitsuka Tiger segments performed particularly well, recording double-digit growth in all key markets in the region. Wholesale recorded growth of 36.8 percent year-on-year, with increases in Northwest Europe (58.4%) and Northeast Europe (36.6%), as well as on the Iberian Peninsula and in Italy (28.8%), compared with the previous year. In the region, Asics is focusing primarily on expanding its premium range, targeted marketing campaigns and the expansion of direct sales through its own stores and e-commerce channels.

| Asics - Revenues | ||||

|---|---|---|---|---|

| 2025 | 2024 | Change | ||

| H1, ended in June (¥ billion) | ||||

| Categories | ||||

| Performance Running | 184.9 | 170.9 | 8.2% | |

| Core Performance Sports | 44.1 | 42.0 | 5.0% | |

| Apparel & Equipment | 20.0 | 18.7 | 7.0% | |

| Sportstyle | 67.3 | 45.9 | 46.6% | |

| Onitsuka Tiger | 65.8 | 43.8 | 50.2% | |

| Regions | ||||

| Japan | 61.1 | 45.1 | 35.5% | |

| North America | 73.9 | 67.7 | 9.2% | |

| Europe | 113.7 | 91.5 | 24.3% | |

| Greater China | 62.0 | 53.0 | 17.0% | |

| Oceania | 21.4 | 20.6 | 3.9% | |

| Southeast and South Asia | 23.5 | 17.6 | 33.5% | |

| Other | 24.6 | 24.3 | 1.2% | |

| Channels | ||||

| Wholesale | 232.0 | 200.6 | 15.7% | |

| Retail | 88.6 | 68.6 | 29.2% | |

| EC | 75.8 | 67.1 | 13.0% | |

| Running Services | 6.3 | 5.8 | 8.6% | |

| Q2, ended in June (¥ billion) | ||||

| Categories | ||||

| Performance Running | 86.9 | 83.0 | 4.7% | |

| Core Performance Sports | 18.6 | 17.2 | 8.1% | |

| Apparel & Equipment | 9.6 | 9.3 | 3.2% | |

| Sportstyle | 32.1 | 22.4 | 43.3% | |

| Onitsuka Tiger | 37.5 | 25.8 | 45.3% | |

| Source: Asics | ||||

“This quarter’s exceptional results reflect the growing strength of our brand across Europe. We’ve seen strong momentum in every category and across every channel.” Carsten Unbehaun, Chief Executive Officer of Asics EMEA

Between the athletics stage and the trading floor

Riding the momentum of record results, Asics is stepping onto the next stage – in Tokyo. The company aims to strengthen its brand and boost sales by partnering with the 2025 World Athletics Championships. Product presentations, hospitality offers and fan activities are planned to increase visibility, customer proximity and innovation leadership in performance running.

Asics is already successfully performing on another stage: the stock market. Since the presentation of the Mid-Term Plan 2026 in November 2024, the share price has risen significantly and has been well above the issue price of the capital increase of ¥2,442.5 (€14.4) per share since summer 2024. The investor base has also been expanded to include long-term investors betting on further growth.