The growth of in the consumption of sporting goods quickened to 7 percent in constant currencies in 2018 from 5 percent in the previous years, according to the Global Sports Market Estimate of the NPD Group. The market rose to a level of $471 billion including bicycles and accessories, which are included only in part in our own retail statistics.

The global growth was driven by the Chinese market and by a 9 percent increase for footwear worldwide, thanks to the ongoing sneaker boom and the product development and marketing efforts of the major brands. In line with our own estimates of the vendors sales, which we published earlier this year, sales of sports apparel and equipment grew at more moderate rates of 8 percent and 5 percent, respectively. The bike sector went up by 6 percent, with the growing popularity of e-bikes in Europe contributing to the positive trend.

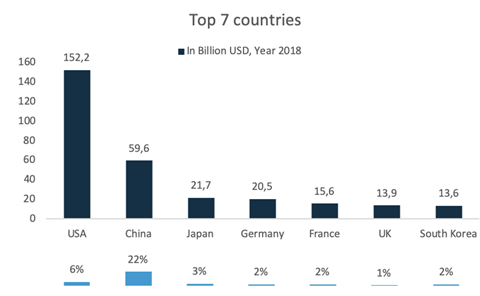

As a country, the U.S. remained by far the biggest market for sporting goods in the world, rising by 6 percent to an estimated $152.1 billion, but China continued to improve its position as the second-largest market with strong growth of 22 percent and a turnover of $59.6 billion. The other five major national markets in NPD’s 2018 ranking – Japan, Germany, France, the U.K. and South Korea – grew by only one to three percent (see the chart on this page).

All in all, the global sporting goods market is performing better than the personal luxury market, which rose by an estimated 6 percent to €260 billion last year, according to Bain & Co., after some ups and downs in the past few years. Bain expects that its growth will decline to 5 percent this year and in the next ones, with footwear doing better than clothing. More on this market in Shoe Intelligence.