Björn Borg’s third-quarter results showed net sales of SEK 299.8 million (€27.3m) for July-September 2025, up 5.2 percent year-on-year (7.2% currency-neutral). For the nine-month period, sales reached SEK 805.7 million (€69.8m), up 6.7 percent. Operating profit rose 5.7 percent to SEK 89.9 million (€7.8m).

Margin pressure and product mix concerns

Despite top-line growth, the gross profit margin fell to 51.1 percent – down from 52.4 percent in the same period of 2024. The Q3 gross margin improved slightly to 52.5 percent, but currency headwinds and a shift towards lower-margin new footwear distribution partly offset this gain. The stock price dropped significantly immediately after the Q3 2025 results were announced.

CEO Henrik Bunge commented: “Our sports apparel collection continued to drive growth, increasing by 24 percent in the quarter, which was undoubtedly the greatest success of the quarter.”

Product lines: Sports apparel surges, footwear stalls

Underwear

The underwear segment held steady in Q3, matching the previous year’s performance. Wholesale channels showed resilience with 7 percent growth, but this was offset by a 25 percent decline in own stores – a direct result of the company’s operating fewer physical locations – and a sharp 31 percent drop in external distributor sales, driven largely by reduced orders from Norway. Over the nine-month period, underwear edged down 1 percent overall, though the company’s own e-commerce channel managed to grow 5 percent.

Sports apparel

Sports apparel emerged as the quarter’s standout performer, surging 24 percent in Q3. The growth was powered by a 36 percent jump in wholesale and a 16 percent rise in own e-commerce. However, external distributors tumbled 49 percent, and own stores slipped 4 percent. For the first nine months, sports apparel climbed 26 percent, with own e-commerce up 29 percent and wholesale advancing 34 percent – a clear signal that this category is driving the brand’s momentum.

Footwear

Footwear stumbled in Q3, falling 5 percent as wholesale slipped 5 percent and own e-commerce declined 4 percent. Own stores provided a rare bright spot, rising 10 percent. Over the nine-month period, footwear managed only 3 percent growth – a concerning lag with respect to other product lines and a sign that distribution challenges and product-market fit may need attention.

Bags

The bags category posted modest but steady growth of 3 percent in Q3, led by a 3 percent increase in wholesale, 8 percent growth in own e-commerce, and a strong 30 percent rise in own stores. For the nine months, bags grew 8 percent, with direct-to-consumer channels – particularly own stores and e-commerce – leading the charge.

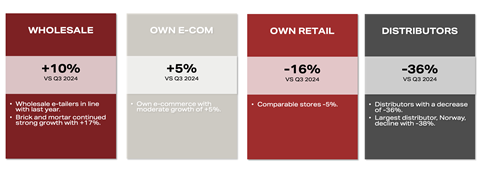

Channels mixed, too

Björn Borg’s channel performance in Q3 2025 presented a mixed picture, with wholesale operations – the company’s largest channel – growing 10 percent in the quarter. Within wholesale, physical stores increased by 17 percent, while e-tailers matched the previous year’s performance.

Own stores fell 16 percent in the quarter, largely because there were fewer locations than last year. Own e-commerce continued to grow, up 5 percent in the quarter, driven primarily by sports apparel and bags.

However, external distributor sales dropped by a sharp 36 percent, with the Norwegian distributor showing particularly weak performance. For the first nine months of the year, wholesale operations grew 10 percent and own e-commerce rose 18 percent, while own stores fell 16 percent.

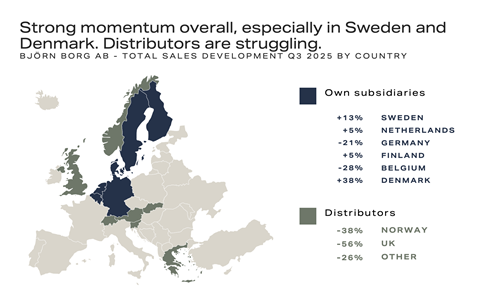

Countries: Nordics shine, Germany and UK struggle in Q3

Nordic markets generally performed well in Q3, with Denmark (+38%) and Sweden (+13%) showing strong growth. However, significant challenges were evident in Germany (-21%) and Belgium (-28%), while the distributor markets Norway (-38%) and the UK (-56%) faced even steeper declines.

Strong equity, but rising debt amid growth push

The company’s net debt stood at SEK135.6 million (€11.7m) at Sept. 30, with a strong equity ratio of 51.1 percent (vs. 46.7% last year). The long-term financial objectives remain: minimum annual sales growth of 10 percent and a 10 percent operating margin.

Brand foundations look strong

Consideration among women in Germany jumped to 18 percent (+37% vs. Q3 2024), aided awareness among men in Germany climbed to 55.7 percent (+10%), and unaided awareness among women in Sweden rose to 5.6 percent (+22%).

Notably, Björn Borg ranks third in brand consideration among leading global sports brands for Jan.-Sept. 2025, at 53 percent, behind Nike (89%) and Adidas (81%) but ahead of Puma (51%) and others.

The bottom line

Björn Borg delivered respectable growth in 2025 and strengthened its apparel business, but margin decline and footwear underperformance highlight vulnerabilities that put markets on alert. The company must address execution challenges in low-growth areas and market-specific weaknesses if it is to meet its 10 percent growth and margin goals.