Since its founding in 2015, the sneaker-trading and resale platform StockX has seen a rapid rise. In its most recent annual Culture Current Index, StockX cited record revenue, 1.5 million lifetime sellers, 12 million lifetime buyers, and 40 million lifetime trades in 2022. International sellers accounted for nearly 50 percent of all StockX trades, up about 25 percent since 2021. The hashtag #gotitonstockx has 12.6 million views on TikTok.

So what makes StockX so successful, and how has it taken the market share from other resale platforms such as eBay? One reason is its unique sales model, which builds on the approach of its competitors. In this case study, we look at the unique StockX model, the ideas that inspired it, and how ensuring authenticity sets StockX apart.

- StockX pioneered a unique sales model by building on the approach of its competitors

- StockX established legitimacy through authentication, which has been key to winning over users

The rapid rise of StockX

StockX went live in 2015 with just 6 employees. The Detroit-based footwear-trading platform now has over 1,500 employees and 13 authentication centers.

StockX first topped gross merchandise value (GMV) of $1 billion in 2019, just four years into business. In 2021, StockX was valued at $3.8 billion, a 35 percent increase over the $2.8 billion appraisal given to the company in December 2020.

CEO Scott Cutler said at the time: “Fundamental shifts in both consumer buying and investing behavior provide an immense growth opportunity for StockX […] We are just scratching the surface of what StockX can deliver.”

While the long-term health of the company has been put in question with recent rounds of layoffs and a rumored IPO that never materialized, StockX’s rapid rise shows the value of learning from competitors to devise pioneering sales models.

The unique StockX model - How does it work?

Founded by Josh Luber, Dan Gilbert, Greg Schwartz and Chris Kaufman, the stock market-like platform works as a marketplace for first and second-hand collectible sneakers – as well as streetwear, handbags and watches – with a model that allows buyers and sellers to determine the prices of the products.

Previously, anyone trying to purchase a pair of new limited edition sneakers had to buy them directly from the retailer by queuing up, or even camping, outside stores, or scouring eBay for rare purchases. Sneaker consignment stores like Flight Club in America (which was bought by the GOAT trading platform in 2018, although the two operate separately) offered a chance to buy resales, but again under a traditional model. StockX aimed to plug that gap with a “stock market-like” variable pricing framework deploying a double auction strategy.

Sellers can choose from either an “Ask,” by which sellers select the price they would like to achieve, or a “Sell Now,” which will sell an item on the spot to the highest bidder. Buyers also have two options. Either a “Bid,” where the buyer gives their maximum price or a “Buy Now,” to secure the item at a given price immediately. Buyers see the lowest selling price, first locally and then from around the world, and sellers see the highest bidding price. In the bidding format, a transaction is executed if the buyer’s bid is at least as high as the seller’s ask.

Once items have been sold, they must be shipped to StockX within two business days for verification, upon which sellers are paid, and the items are shipped to the buyer.

As an added bonus, unlike other marketplaces such as eBay, Etsy and Amazon, because each sneaker model has its own StockX-managed page, there is no need for sellers to take photographs, write descriptions, or engage with buyers.

StockX builds on its competitors’ best ideas

The StockX model was largely built on the rule of the stock market. “The logic that this model should work for resell […] was so sound. The stock market is the perfect form of commerce,” Co-Founder and then-CEO Luber told NSS Magazine in 2019.

More recently, the platform has even adopted the concept of IPOs – initial public offerings – as a way of releasing new products onto the market. Said Luber: “What’s cool about that is that we didn’t make this up. All we’ve done is copy how the stock market works.”

An IPO release on StockX functions the same way as a traditional IPO. Pre-bidding opens in a blind auction on StockX at a minimum bid price; on the date of the IPO, products are sold to the highest bidders based on quantity (if twenty pairs of size 9 are available, the top 20 bidders receive a pair). After the IPO, products are shipped to buyers and can, of course, be resold on StockX.

The first IPO was the Ben Baller Did The Chain sliders, which received over 10,000 Bids for 800 pairs. The black slides sold at an average clearing price of $181 and the red at $260. Said StockX: “By letting the market decide the value of these slides from the jump, we essentially streamlined the entire process from release to resell […] we think this a fundamentally better way to release and price hyped products. We don’t set the price; you do. That’s how the resale market works, and we think this is how the retail market should work as well.”

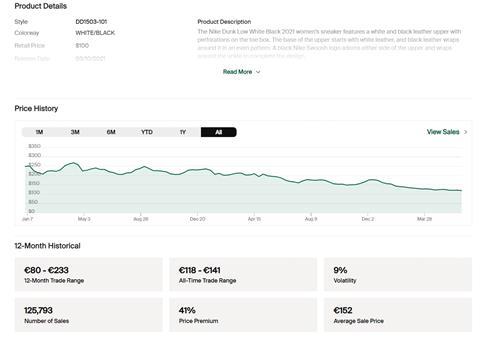

For StockX’s founders, eBay provided further inspiration. A decade ago, it was difficult for buyers and sellers to determine the price of a shoe, with popular sneakers gaining value over time. In a forerunner to StockX, Luber launched Campless in 2012: A system that scraped data from eBay for over 13 million transactions to create a constantly updated secondary market pricing guide.

The platform offered in-depth numbers on the secondary sneaker market, giving a more realistic price of the worth of a sneaker, which became one of its biggest draws. It was the idea of leveling the playing field that helped the platform draw users away from the likes of eBay.

Ensuring authenticity sets StockX apart

StockX’s abiding mission is to bring credibility to the sneaker resale market by being “a trusted global platform for consuming and trading current culture.”

Creating a team of 100-plus authenticators, who scrutinize sneakers sold on the platform according to tens of parameters, including a smell test, has been key to establishing legitimacy. StockX now has 13 authentication centers, including five in the Americas, as well as European centers in Berlin, Eindhoven, and London, three in Asia, and centers in Australia and Mexico.

In a bid to keep up with the sneaker resale market, eBay launched an Authenticity Guarantee service for all new and pre-owned collectible sneakers sold for over $100 in the U.S., acquiring Sneaker Con’s authentication business in late 2021. This year, the Authenticity Guarantee scheme was extended to new and pre-owned kids’ sneakers sold in the U.K. for £100 or more.

Even so, there remains the risk of counterfeits appearing on both platforms.

In 2022, Nike sued StockX in connection with its Vault NFTs, which connect physical products with digital assets. Customers can purchase items on StockX, which are stored in a StockX location, but a purchase also gives the buyer an NFT which can be flipped (repeatedly) on StockX without the object ever having to be shipped. Nike’s primary objection concerned the unauthorized use of its logo and the effect that such use may have on the minds of the buying public.

StockX responded with a robust defense, citing its authentication record.

The future of StockX

For now, the future of StockX seems secure. However, with a market estimated to be worth $28.8 billion, set to increase to $100 billion by 2026, other players are stepping up.

In May 2023, French-based sneaker reselling platform WeTheNew – which topped the €100 million turnover mark in 2022 – announced a €20 million capital funding round. The company’s objectives include achieving 40 percent of its turnover outside of France by 2026.

The Korean Meta[Z] platform, which trades sneakers in the form of NFTs, also announced a $1 million Series A Investment. Like StockX’s Vault, the platform’s Custody service receives and stores sneakers in exchange for NFTs, thereby keeping the condition and value as high as possible during trades.

StockX has shown itself as a company keen to evolve. It also appreciates the importance of tailoring a customer experience to local markets. But will brands seek to carve out the resale market for themselves, eliminating authentication problems?

Speaking to Medium in 2021, Cutler said: “One of the values we hold high is Hungry for What’s Next. This value represents our commitment to learning, growing and disrupting – and always pushing against the status quo.”

Two years later and this commitment remains. Schwartz, co-founder and COO, said in January 2023: “We’re always working to up our game, and investing in facilities, people, technology, and processes that serve our community will help us build a strong foundation for growth.”