Sport, according to Sports for People and Planet (January 2026), a report from the World Economic Forum (WEF), is now generating $2.3 trillion in annual revenue. This should rise to $3.7 trillion by 2030, at a compound growth of 10 percent. And by 2050 the figure should be $8.8 trillion.

But there are headwinds, in the form of “worsening physical activity, climate change and nature loss.” Should their present rate persist, these could lop 14 percent ($517bn) off the sport economy’s annual revenue by 2030 and 18 percent ($1.6tr) by 2050.

The definition of sport

For the WEF sport has 15 stakeholders, four industries, five connected industries and four drivers of growth. It also lies at the intersection of food, energy, infrastructure and fashion. The sport economy breaks down as follows:

Core industries (ca. $2.0 trillion):

- Sports tourism ($672bn)

- Sporting goods ($614bn)

- Participatory sport and physical activity ($560bn)

- Professional and elite sport ($140bn)

Connected industries (ca. $0.3 trillion, sports-related only):

- Broadcast and streaming

- Gaming

- Sport services

- Nutrition

- Wearables and tech software

Tertiary concerns:

- Government

- Local communities and indigenous people

- Philanthropy

- Advocacy and accountability

- Investors

- Academia and research

- Wide private sector

The size of sports economy ($2.3tr) is the sum of the first two tiers only.

The WEF ascribes the sports economy’s growth to four things:

- The rise of sports tourism

- Sport’s emergence as an asset class

- The rise of women’s sport

- “The rebalancing of sport growth with emerging economies”

Sports tourism

The largest single component of the sports economy, by the WEF’s measurement, is sports tourism, which accounts for about half the combined contribution of all the identified “connected industries.” Sporting goods comes in second place, trailing by about $60 billion. Professional sports, with all its glitz, comes in fourth and last – after the sporting and other physical activity of the public.

Sports tourism:

- already accounts for 10 percent of travel expenditures

- is the fastest-growing kind of tourism (CAGR of 28% since 2020, vs. 20% for all tourism)

- will account for 60 percent of sports revenue until 2030

Though already the biggest fish in this pond, sport tourism is in the WEF’s view undercapitalized. And so are participatory sport and sport media, the WEF adds.

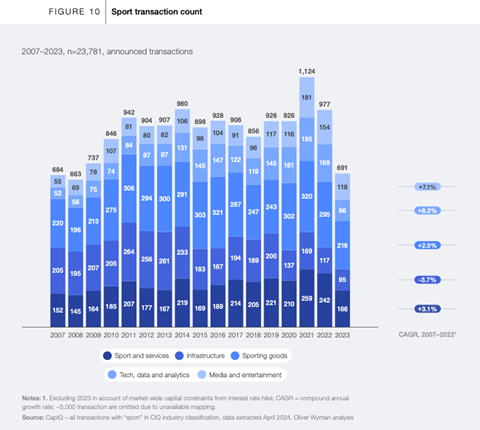

Sport as an asset class

The year 2021 alone saw more than a thousand deals involving sports assets close in the US. Why the surge? The WEF sees at least four reasons:

- The potential for asset appreciation

- New ownership models

- Modified financial regulations

- The convergence of sport with media, entertainment and tech

Thanks in part to those changing regulations, this asset class is attracting more than rich individuals. Institutional investors, sovereign wealth funds, venture capital, entertainment companies and athletes themselves are now investing.

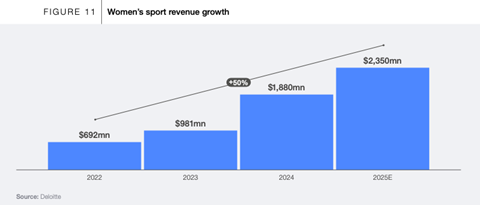

Women in sport

Four-fifths of the economy in women’s sport consists of basketball and association football. The whole has seen revenues triple in three years (2022-25). Pro sports aside, women make up 37 percent of players in the EU, 40 percent in the US and 45 percent in Canada.

And connected with this is an emergent phenomenon: women’s sport as an asset subclass. The WEF highlights the Monarch Collective, a private-equity firm established in 2023 and purchasing minority stakes in the teams and leagues of women’s sports (e.g., Angel City FC, San Diego Wave FC, BOS Nation FC, FC Viktoria Berlin). But there are other such firms.

The WEF way…

…is top-down, favoring “systems-based solutions.”

“[E]fforts across the sports economy remain fragmented, often limited to specific industries or geographies,” reads the report. But “the future of global prosperity hinges on stakeholders coming together to prioritize healthy societies and resilient natural ecosystems alongside financial returns and job creation.”

The WEF seeks “coordinated action among financial institutions, governments, industry leaders and solution providers to unlock the investment needed for system-wide transformation.” In its estimation, “companies that lead this transition will be better positioned to secure long-term economic advantage and build more resilient participation ecosystems.”

But first must be a “shift from transactional funding to impact-oriented, values-aligned investment,” which will in turn catalyze “purpose-driven capital flows.”

“Blended models” – combinations of concessional capital, public funds, private investment and philanthropy – can “de-risk” projects, make them bankable and attract capital.

The sports economy in particular…

…should use its “economic scale and cultural influence to drive positive cross-sectoral change” – for instance, by making urban green spaces and waterways into “high-performing assets that strengthen climate resilience, attract investment and increase property values.”

It should also use sporting events to “pilot and scale sustainable materials and responsible consumption models.” One way is to set up “fan engagement programmes,” whose incentives would shift “demand patterns” and effect “long-term cultural change.” Another is to install “collection hubs for used equipment.”

The WEF encourages reuse, repair, rental, refurbishment and recycling, as well as subscriptions, pay-per-use and “life-cycle tracking systems.”

It hopes through sport to encourage “sustainable urban design,” through infrastructure and “activemobility systems.”

Odds and ends

- Outdoor sport accounts for about 90 percent of media rights and 76 percent of sponsorship revenues.

- India’s sports economy should be worth $130 billion by 2030

- China aspires to expand its sports economy to $985 billion by 2030

- China plans to open “100 outdoor sport precincts” by 2030

- Asia-Pacific manufactures 80 percent of the world’s sporting goods

- One-third of adults and 80 percent of children fail to meet “recommended physical activity guidelines” (The Lancet Global Health)

- Less than 6 percent of health expenditure in G20 countries goes toward preventive health

- Cities generate 80 percent of the world’s GDP and should by 2050 account for 70 percent of the world’s population

- Two-thirds of the urban infrastructure “needed for 2050” in Africa has yet to be built

- The sponsorship market was projected to reach a value of $52 billion last year

- 81 percent of consumers see sport sponsorship as credible (Nielsen.com)

The report ”Sports for People and Planet” was developed by the World Economic Forum in collaboration with Oliver Wyman and released in January 2026. Visit weforum.org to download it.