When it comes to rentals, even circular business pioneer and CEO of Houdini, Eva Karlsson, admits: “A rental or subscription model needs more infrastructure, a new business system, and software, so these models are slower in development.” Circular business models include repair, remaking, resale and, as we will discuss here, rental. When thinking about rental models, the Ellen MacArthur Foundation also highlights implementation strategies such as servitization – the connecting and adding of a service to a product – as a way to move towards circular business. Rental can also increase margins and is an extra source of revenue. Sounds good in theory. But what does this mean in practice? Where do brands start, and what help is out there? We explain.

- Product based companies vs. service based companies - what’s the difference?

- PaaS, rentals, and the Circular Economy - how rentals can reduce environmental impact and benefit brands

- How third-party solutions are enabling brands to enter the rental market

- The numbers behind rental models

- The challenges to PaaS and rental for brands

Product based companies vs. service based companies

Traditionally, businesses in the sporting goods industry – and to a large extent, outdoor industry retailers – are product based companies: Companies that produce products, with a high market value, which are improved on/upgraded to become new offerings on the market. Such a model often typifies the “take-make-waste,” linear way of doing business.

In a service based company, on the other hand, the primary business model is providing a service. Whilst the term may often be associated with IT companies – with cloud-based software subscriptions such as Adobe Creative Cloud replacing a one-time payment which secured the consumer ownership of software – there is plenty of middle ground between a product based company and a service based company, and it is here that the opportunities for circular business are found.

Servitization is one example. Jean leasing service Mud Jeans offers free repairs for leasers of its jeans.

For more on circular business models, see our Circular Business Special

PaaS, rentals, and the Circular Economy

Providing service support, maintenance, and the various rental models are all part of the transition towards a service based company. They can also be big steps in a company’s move towards circular business. Collectively, they are examples of product as a service business models (PaaS).

Some PaaS models may be familiar, others are starting to become more prevalent in industries where they have not been seen before, including the sporting goods industry. PaaS models in sporting retail include:

- Short-term rentals

- Leasing

- Pay-per-use

- Product service systems (PSS) or subscription models, where consumers subscribe to use a product for a fixed duration, with monthly or weekly fees.

- Rent to buy

According to Circular Economy: “In the PaaS model, ownership of, and responsibility over the product remains with the service provider or the manufacturer, who therefore holds the ability to…prolong the lifetime of the product. In the best case scenario, this could lead to offering high-quality, durable products that can be easily upgraded, repaired, refurbished or taken back at the end of their useful life.”1

In order to be truly circular, the PaaS model must provide an incentive to optimize the long-time use of a product and stimulate circular design through renewable and reusable materials.

There are a number of benefits for brands who adopt a PaaS rental model:

- Subscription models can help to reach new consumer segments.

- Subscription models generate continuous cash flow, which increases revenue forecast accuracy.

- Rented products can retain resale value, and hence a total lifecycle value which is higher than a product that is sold once.

- Renting gives brands an opportunity to test products prior to official launch, and for consumers to test the product before committing to buy.

- Renting offers consumers more convenience and a simpler way of living.

But it can be challenging to change an existing business model to a PaaS model:

- Rental is an asset heavy business model which can create challenges with upfront product costs, and profits realized at a later stage.

- Rental models require specific software to manage the rentals, subscriptions, and product tracking.

- There are few insights into precisely what products consumers are most likely to rent.

- Product life value is impacted by maintenance costs such as repair, washing, and reproofing. These require either internal skills and possible new personnel, or new partnerships.

So do solutions exist to help brands move towards a PaaS, rental based model?

Third-party solutions are enabling brands to enter the rental market

Because rental has a lot of front- and backend workflows that need to be created and connected, for brands with little to no experience, the answer is often to utilize the services of a third party.

When it comes to choosing a solution for setting up product rentals, brands should look for a complete offering which allows them to:

- Customize the front-end

- Follow their stock in real time

- Manage returns and refurbishing

- Handle logistics processes and carriers

One option is Lizee, a Paris-based start-up and a native circular SaaS (software as a service) solution that is logistics ready. Lizee’s B2B SaaS allows brands to launch, manage, and industrialize at scale rental and resale in two months. Decathlon, Adidas and VF have all used their service to start their circularity journey in Europe.

The US-based CaaStle is another B2B technology and services company that enables apparel retailers and brands to offer their own rental experience directly to customers, and has recently began expanding into the european market. Its logistics systems and infrastructure are available as an end-to-end solution known as CaaS (“Clothing as a Service”). Like Lizee, CaaStle allows brands to own the relationship with customers, while managing all rental operations, technology, and logistics on their behalf. Its subscription-based rental service clients in the U.S. include Banana Republic and Moss Bros.

In 2021, CaaStle introduced a “borrow” button that can be fully integrated into an e-commerce website. The borrow program – debuted on the Rebecca Minkoff website – allows customers to wear items as many times as they like during the rental period with the option to buy at any time.

![]()

The numbers behind rental models

To see how rental models using SaaS support can be a source of additional or alternative revenue stream, let’s look at the example of the partnership between Lizee and Decathlon.

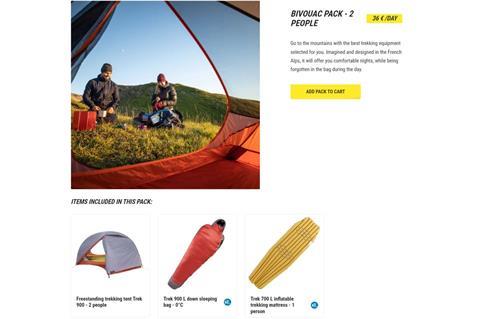

Camping equipment such as tents are ideal for rental models. For most of its life, a tent is not in use. By renting, customers can access a high quality item conveniently, affordably, and flexibly i.e. renting a smaller or larger tent, based on needs.

But more importantly for brands, providing rental camping equipment replaces a one-time purchase with a new revenue stream. Although the amounts may be smaller, over a camping season, the numbers add up. If the product was used 10 times, and the rental price was 20-35 percent of the sale price, you would have sold 3-4 times the original price of the goods. Lizee has found that a brand needs to rent out a product six times before they start to make profit.

As for maintenance and stock replacement? A tent at Decathlon can be rented out twenty times within a three year period before it needs to be taken out of rotation. Childrenswear brand Kaibi found they average about six rotations before a product needs to be taken out of rotation, however the products are kept for longer periods than, say, camping equipment, when rented through a subscription service. On average Lizee found that the average number of rotations (times an item can be rented) for most products is twelve, the same as Rent the Runway in the U.S.

By providing outdoor gear rental, Decathlon was able to increase its margins 2.4 times after one season only.3 On average, rental can have a gross margin between 15-60 percent within 2 years, including the resale of the product (see below). When done well, rentals can generate up to 3 times gross profit.

This is in addition to the environmental savings. Reporting on the Decathlon tent example, The Ellen MacArthur Institute quotes a 50% drop in emissions of CO2 and a 10 times reduction in use of water.4

“Try and buy” is also an option supported by Lizee and CaaStle. Lizee advises setting the rental price at 10-20 percent of the retail price, with the option to purchase. If a consumer rents a product for 20 Euro, and then decides to keep it, they buy it for 80 percent of the retail price. With the CaaStle borrow button, customers can either return items or continue with a daily fee to extend their rental. These are applied as a discount to the buy price. If paid daily fees equal the buy price, the consumer then owns the item.

Challenges to PaaS and rental still remain

Even with the support of third-party organizations and a willing management team, challenges for incorporating rental into a brand’s ecosystem still remain. One of the biggest hurdles is that retailers and brands are only renting a small portion of their offering, about 20 percent of their catalog. This has an issue for ROI just like returns for eCommerce.

Putting product back on the shelf is also a challenge and again requires a 3rd party certified partner. For example:

- A white label recommerce (reuse platform) that handles subscription rental, day-to-day rental, on-demand rental, and purchase options like try & buy.

- Refurbishment management

- Recommerce WMS (Warehouse Management System)

- Outsourced Logistics

Having a partner that works with multiple clients to search out friction and to test the model is crucial.

Lizee reports that most brands decide to work with them for 1-2 years before they launch their own in-house service to scale.

Our conclusion then, is that collaborating with solution providers remains the best way to gain entry into circular economy rental businesses.

Amy Rauen is a sustainable fashion and circular design strategist who partners with lifestyle brands to help them incorporate innovative technologies, sustainability, and circularity into their organizations. As founder of Circular Intention - a consultancy that is reimagining how we make products - along with being a Circular Economy Pioneer through the Ellen MacArthur Foundation, she advises brands looking to effectively increase their brand equity whilst driving responsible business profits all while focusing on reducing overconsumption and overproduction.

1 Circle Economy, EEB, FTAO (2020). Avoiding Blind Spots: Promoting Circular and Fair Business Models. Retrieved from: CE website

2 Circle Economy (2020). PaaS question KIT. Retrieved from: CE website

3, 4 Decathlon internal analysis