As AI assistants displace search engines in purchase decisions, a new benchmarking tool reveals which sporting goods brands are winning – and which are invisible – when shoppers ask ChatGPT what, how and where to buy.

In Germany’s sportswear and sporting goods market, Adidas and Puma are tied at the top of AI-generated shopping recommendations – both scoring 75 percent visibility on ChatGPT for the week of Feb. 9–15, 2026, according to newly published data from Parcel Perform’s AI Visibility Index. Nike, globally the largest sportswear brand by revenue, sits fourth in the same ranking with a 41.7 percent visibility score, a gap that raises questions about who is actually winning the AI recommendation channel.

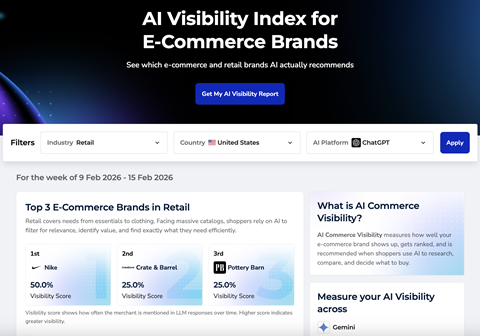

The index, launched Feb. 17, is the first publicly available benchmarking tool designed specifically to track how AI shopping assistants rank brands when consumers ask purchase-intent questions. It tracks real queries that shoppers submit to platforms including ChatGPT, Perplexity and Gemini – questions such as “best trail running shoes” or “where to buy fitness equipment” – and scores each brand across three metrics: Visibility, LLM (large language model) Ranking and Brand Trust.

What the German sportswear ranking reveals

The AI Visibility Index is freely accessible and can be filtered by country and category. We selected Germany and the Sportswear and Sporting Goods category for the week of 9–15 February.

The German snapshot – which can be filtered by AI tool (ChatGPT, Gemini, Perplexity) – shows a market in which German and European brands outperform their global weight in AI discoverability on ChatGPT. Jack Wolfskin ranks third with 50 percent visibility, ahead of Nike’s 41.7 percent and Vaude’s 33.4 percent in fifth. Under Armour, Bogner, Canyon, Falke and Jako complete the top 10, with visibility scores ranging from 25 percent down to Jako’s 16.7 percent.

Beyond visibility, the index tracks Brand Trust (–100% to +100%), which measures how positively or negatively AI assistants describe a brand when answering questions. A third metric is LLM Ranking (1–10), which captures where the brand appears in AI assistant recommendations, with week-over-week position changes tracked.

How AI searches treat sporting goods differently from fashion

The index’s category methodology is directly relevant to sporting goods executives. Parcel Perform categorizes Sportswear & Sporting Goods separately from general Apparel & Fashion because performance fit influences purchase decisions in specific ways.

Shoppers in this category rely on AI to analyze training needs, compare product specifications and match gear to activity level – making the prompts and recommendations materially different from those in adjacent fashion categories.

The rankings draw from Parcel Perform’s database of actual consumer queries submitted to AI platforms, covering questions from early research through to purchase readiness: “where to buy,” “what are the best features” and “what’s the return policy.” The company publishes sample prompt libraries for each tracked category, allowing brands to assess which purchase-intent questions are driving their scores.

A new channel brands cannot yet measure themselves

The broader competitive issue is structural rather than brand-specific. Sporting goods companies have spent years building search engine optimization (SEO) capabilities to rank highly on Google - an established, well-understood discipline with a mature ecosystem of tools and agencies.

The equivalent infrastructure for AI recommendation optimization does not yet exist at scale. A brand with strong organic search performance may simultaneously be absent from the recommendations that ChatGPT or Perplexity generate, and until now there was no public mechanism to verify that gap.

“You could be invisible to AI assistants while competitors capture the sale,” said Dr. Arne Jeroschewski, CEO of Parcel Perform, in a statement accompanying the launch. The index is positioned as an observational tool – it tracks AI recommendations without attempting to influence them. “We’re not paying for placement or trying to manipulate LLM outputs,” said Dr. Jeroschewski. “We’re showing e-commerce brands objective data on how they currently rank so they can make informed decisions. Think of it as the Nielsen ratings for AI Commerce.”

The public index covers the top 10 brands per category across eight industries and refreshes weekly. A more detailed AI Commerce Visibility report with category-level breakdowns and specific prompt analysis is available on request for brands seeking to understand their full competitive positioning in the AI channel. The Feb. 17 launch spans the US, the UK and Germany, with additional markets to be added weekly.

About Parcel Perform

Parcel Perform is a Singapore- and Berlin-based AI-powered delivery experience platform. Its data infrastructure processes billions of shipment events across more than 1,100 carriers globally, covering the entire e-commerce journey from checkout and post-purchase to returns management and logistics operations.

The AI Visibility Index is an expansion of the company’s AI Commerce Visibility product line. This suite of tools is designed to help e-commerce brands track, analyze, and optimize their performance in AI-assisted shopping environments, bridging the gap between real-world operational excellence and digital discoverability in the age of generative search.

The AI Visibility Index for E-Commerce is accessible here.