After reporting slightly weaker third-quarter numbers earlier this month, Canada Goose, founded in 1957 in a small warehouse in Toronto, Canada, announced not only its five-year financial goals but also an update on its strategic priorities at its Investor Day on Feb. 7, 2023, at the company headquarters.

“Today, Canada Goose is recognized around the world as a performance luxury lifestyle brand, known as a global leader in warmth and protection. Our products are iconic, our style is enduring, and our brand has never been stronger. Looking ahead, we see incredible opportunity to continue the revenue growth trajectory we have experienced since the time of our IPO and deliver increasing rates of profitability,” said Dani Reiss, chairman and CEO. “As we grow, we will expand our categories, geographies and capabilities with a keen eye toward investing where we see a high return, protecting our brand and delivering high quality, profitable growth. As I look at the next five years, I am confident in our long-term financial plan, introduced today, to reach $3 billion in revenue and an adjusted Ebit margin of 30 percent through the execution of our three strategic growth pillars.”

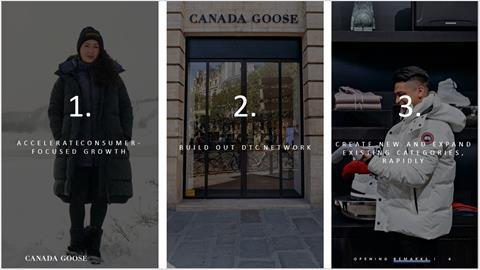

Three-pillar strategy

As part of its strategic plan, Canada Goose intends to execute on the following strategic growth pillars:

- Accelerate consumer-focused growth: in doing so, the company aims to increase the lifetime value of long-standing and new customers, with a focus on women and Generation Z.

- Expand the DTC network: The company expects to more than double its retail presence from its 51 permanent stores at the end of Q3 FY2023 while continuing to expand its digital presence both omnichannel and online. “We see opportunity in new markets around the world and expect to increase our DTC penetration within existing markets and will evolve our distribution structure in others.”

- Create new categories quickly and expand existing ones: The company aims to become relevant as a luxury lifestyle brand year-round. “We expect continued growth in all categories, including in heavyweight and lightweight down and accelerated growth of newer categories such as rainwear, apparel and footwear as well as the addition of further categories including eyewear, luggage and home.”

Long-term financial outlook

Looking far ahead to fiscal 2028, the company expects:

- Revenues of $3 billion, representing a CAGR of approximately 20 percent, in line with historical performance for the CAGR of revenues from fiscal 2017, when the company completed its IPO, to expected revenues of between $1.175 billion and $1.195 billion in fiscal 2023. This growth is expected to be driven by the three growth pillars described above. Across all geographic regions, the company’s strategy is focused on continuing on the path of luxury growth, with regional sales as a percentage of total sales moving toward an even split between North America, EMEA and Asia Pacific.

- Adjusted Ebit margin of 30 percent: The targeted adjusted Ebit margin is expected to be achieved through disciplined execution of the strategy, actively balancing headwinds and tailwinds to maintain gross margin, which is expected to continue to benefit from a favorable channel mix, pricing and production overhead leverage. Selling, general and administrative expenses are expected to benefit from the company’s increasing scale and proactive approach to investing ahead of growth. The cost structure is also expected to benefit from actions taken to increase efficiencies and reduce the direct cost of goods, improve sourcing costs and leverage technology, among others. Overall, the company expects to save and avoid $150 million in operating costs by the end of fiscal 2028 while focusing increased spending on new category expansion and business initiatives.

Assumptions

Canada Goose said that the fiscal 2028 financial outlook and related long-term targets described above are based on its best estimate of the current macroeconomic environment (global supply chain, inflation, exchange rate volatility, the war in Ukraine, Covid-19 variants, other Covid-related disruptions, etc.). As part of its long-term outlook, the company expects the retail environment to recover to pre-pandemic levels, inflationary pressures to decline to normalized levels, and stability in other economic factors in the regions where it operates. Fundamentally, the overall outlook is based on the following key assumptions for the period from the end of fiscal 2023 to the end of fiscal 2028:

- Accomplishment of the aforementioned initiatives

- Ability to increase the number of permanent retail stores to between 130 and 150, with growth in the Asia Pacific, EMEA and North America regions

- Drive store productivity and e-commerce sales with year-round product assortments, pricing and an enhanced retail and digital experience

- Optimize wholesale and other distribution channels, including launching travel retail and buying back key distribution markets

- DTC revenue representing approximately 80 percent of total revenue in fiscal 2028

- Achieve and maintain DTC gross margin in the mid 70 percent range and Wholesale gross margin in the mid to high 40 percent range with heavyweight down, lightweight down and other product categories representing approximately 50 percent, 25 percent and 25 percent of revenue, respectively, in fiscal 2028

- SG&A costs decreasing to approximately 40 percent of revenue, with marketing costs increasing slightly faster than revenue as the company generates more efficiency from its overhead costs and improves store productivity

- Taxation rates consistent with historical levels

- No material fluctuations in foreign exchange rates relative to current levels