The Corporate Climate Responsibility Monitor analyzed climate targets and measures of 51 of the world’s largest companies. Within the fashion sector, the report closely scrutinized Adidas, Nike, Inditex, H&M and Fast Retailing.

The Corporate Climate Responsibility Monitor, by the NewClimate Institute, evaluates the transparency and integrity of companies’ climate pledges. The authors clarify that transparency refers to the extent to which a company publicly discloses the information necessary to understand the integrity of that company’s approach.

The Monitor observes that the bulk of emissions in the fashion sector originate from sourcing materials and production processes and that a potential way to reduce them would be for companies to adopt renewable electricity and electrify specific processes. The report notes an uptick in fashion retailers’ transparency and ambition in setting emissions targets.

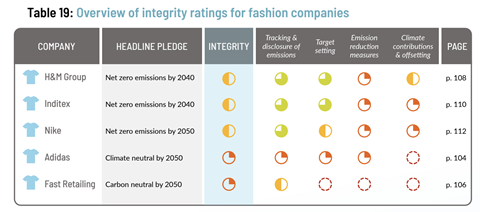

However, the likelihood that these targets will be hit depends heavily on the effectiveness of renewable energy strategies within the supply chain. Although companies are tending towards bioenergy and renewable certificates, the true impact on emissions reduction remains vague. While the five companies are aware of necessary decarbonization strategies, they often present their ambiguous plans. The report also highlights a lack of significant shifts towards sustainable business models, a critical step for the fashion industry’s long-term sustainability, which might conflict with the prevailing fast-fashion model. H&M gets the best “Integrity Rating,” followed by Inditex and Nike. Adidas lags behind, as the overview shows:

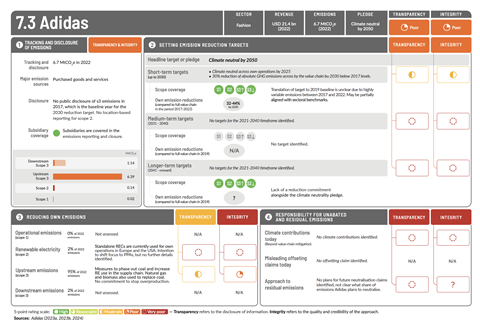

Adidas’ 2030 emissions reduction target falls short of the 1.5°C-compatible benchmarks

The Corporate Climate Responsibility Report’s scrutiny of Adidas AG’s approach to decarbonizing its supply chain has yielded mixed results. Although Adidas is one of the world’s largest sportswear brands, approximately 90 percent of its emissions are categorized under scope 3, which covers production, the processing of raw materials and the assembly of products. The company has implemented measures to phase out coal and increase renewable energy usage. However, its 2030 emissions reduction target falls short of the 1.5°C-compatible benchmarks, with a planned reduction of 32 to 44 percent across its value chain. The low end of this range is misaligned with the sector-specific benchmarks, which require at least a 41 percent reduction by 2030.

Adidas’s “Decarbonization Manifesto” mandates that tier 1 and tier 2 suppliers phase out coal by 2025, but NewClimate sees potential sustainability problems in the options to switch to natural gas or biomass, as they could lock in fossil-fuel use and contribute to biodiversity loss. While Adidas supports suppliers that seek power-purchase agreements (PPAs) for renewable energy, the details it provides are scant, and NewClimate finds its reliance on renewable energy certificates (RECs) less effective.

Furthermore, according to the report, Adidas’s commitment to making 90 percent of its articles sustainable by 2025 lacks substantiation and includes questionable environmental-benefit claims for the materials used. Despite efforts to audit its leather production and set targets for deforestation-free materials, the company’s actions toward a fully sustainable practice remain underdeveloped. NewClimate has significant concerns about the effectiveness of Adidas’s environmental standards and their actual reduction of greenhouse gas emissions.

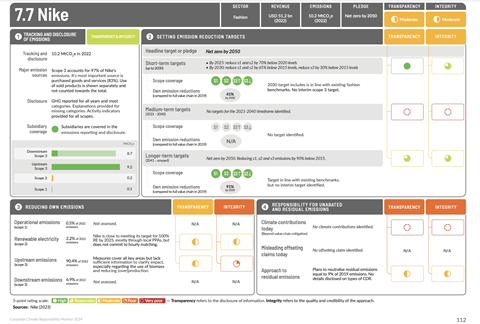

Nike’s strategy covers key decarbonization measures but lacks detail

With respect to Nike Inc.’s climate strategy, the “Corporate Climate Responsibility Report” highlights a 2030 target of 41 percent reduction in total value-chain emissions from 2019 levels, in minimum alignment with 1.5°C-compatible benchmarks. Nike has set a comprehensive goal, yet the report critiques the details and efficacy of the measures proposed. While the company has committed to eliminating coal in its value chain by 2030 and is exploring such sustainable solutions as the electrification of steam, it has not committed to non-combustible sources of renewable power, such as wind or solar.

Further, Nike’s approach is, in part, to engage with suppliers to increase energy efficiency and use on-site renewables. However, it relies heavily on renewable energy certificates (RECs) as an interim solution, with no clear commitment to transitioning to higher-quality renewable options. This lack of detailed commitment raises questions about its strategy’s actual reduction of greenhouse gas emissions.

Nike also emphasizes materials efficiency, setting a target to increase the use of “preferred materials” to 50 percent by 2025 for an expected savings of 0.5 MtCO2e, and aims to reduce waste in its manufacturing. Additionally, while Nike plans to make significant reductions in operational emissions by 2025 through the purchase of renewable electricity, the true effectiveness and additionality of its renewable energy procurement – and particularly the actual expansion of renewable capacity that power-purchase agreements (PPAs) will achieve – remain ambiguous. The report calls for more clarity and concrete actions towards a substantial decrease in emissions, in alignment with global efforts to mitigate climate change.

The Nike and Adidas assessments are based on their 2022 reports. “The Corporate Climate Responsibility Monitor” is published by the NewClimate Institute in collaboration with Carbon Market Watch. The first is a non-profit organization working in climate policy and global sustainability. The company is headquartered in Köln, Germany. The Monitor is published yearly. Learn more about the methodology here and read the initial Monitor.

Find out more about CSR & Sustainability in the sporting goods industry.