It’s all a matter of defining the scope of the sporting goods market. The NPD Group’s annual Global Sport Market Estimate shows that it remained flat at €429 billion in the 2020 pandemic year, after continued increases since 2009. The NPD study points out that it would have fallen by 4 percent excluding bicycles and related accessories, whose sales grew by a whopping 27 percent last year. In terms of the U.S. dollars, the global market was estimated at $508 billion.

Consistently with our previously reported studies of the athletic footwear, apparel and equipment markets at the wholesale level, NPD’s report says that the consumption of sports shoes and clothing fell by 7 percent, while the consumption of other types of equipment rose by 3 percent.

Spurred by a desire to keep fit and to use an alternative to public transportation, the cycling boom led to an increase in the total German market of 15 percent to €24.1 billion ($28.5bn) in 2020, making it the third-largest in the world ahead of Japan, but it would have fallen by 2 percent excluding bikes.

In contrast with its strong development of the previous years, which actually slowed down in 2019, the Chinese market recorded a 2 percent decrease to €55.7 billion ($66.0bn) in 2020, because of the Covid-19 pandemic. It remained the second-largest market in the world after the U.S., whose 3 percent increase to €136.8 million ($162.0bn) contributed to 48 percent of the global market’s growth.

The market declined by 3 percent to €19.6 billion ($23.2bn) in Japan. France came next with a drop of 1 percent to €15.5 billion ($18.4bn). It was followed by the U.K., flat at €13.2 billion ($15.6bn), Canada with a turnover of €11.6 billion ($13.7bn), South Korea at €11.3 billion ($13.4bn), India at €10.9 billion ($12.9bn) and Italy at €9.2 billion ($10.9bn).

The Italian market declined by 8 percent overall, including a drop of 18 percent in footwear and apparel. Further down the rankings, Spain was flat, but the consumption of sports apparel and footwear went down by 12 percent. Sales of softgoods declined by 7 percent in France and by 9 percent in the U.K., according to NPD’s more detailed studies of the five major European markets.

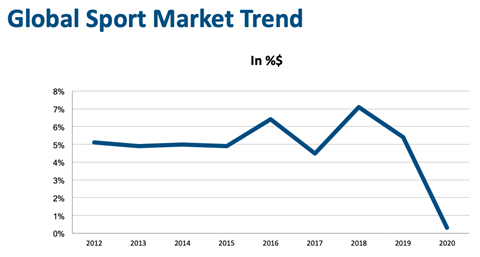

The over-proportional growth of the bike market actually started before the pandemic. In 2019, a 9 percent increase in global retail sales of bikes and accessories, partly driven by a shift to more expensive e-bikes, allowed the global sporting goods market to increase by 5 percent, according to NPD. While the consumption of athletic footwear went up by 6 percent, sales of apparel and equipment both rose by just 4 percent.

It’s hard to forecast what will happen at the global level in 2021. At this stage, judging from the dynamics at the wholesale level, it seems that retailers have been restocking in the expectation of a general recovery in the demand for many categories of sports products, but they were locked down in Germany, the U.K. and other important markets during the first part of the year. Furthermore, supply chain issues and the Delta variant of the coronavirus are causing shortages of certain items. According to NPD, the consumption of sports clothing and footwear fell in the first half of 2021 by 6 percent as compared to the same period of last year in the five major European markets.