The Japanese corporation remains firmly on track for growth and confirms its annual targets. Buoyed by strong core businesses, a clear strategic focus, and rising profitability, the company is consolidating its position in the global marketplace.

In the first nine months of fiscal year 2025, Mizuno remained firmly on track for growth and continued its positive performance in the third quarter. Consolidated sales rose 6.8 percent year-on-year to ¥187.3 billion (€1.15bn), driven by stable demand in all core segments. Running, football, and workwear once again proved to be particular growth drivers. The gross margin improved to 42.1 percent, although higher personnel expenses and rising procurement costs weighed on the cost environment. Operating profit increased by 12.1 percent to ¥17.9 billion (€110m), while net income rose disproportionately by 18.0 percent to ¥14.9 billion (€92m). This means that the Osaka-based group achieved new record figures for sales and profitability on a nine-month basis – driven by a clear strategic focus on its four growth pillars.

Strategic pillars with increasing momentum

Once again, the workwear business, which has established itself as an independent growth pillar, delivered the best performance. Inspired by innovative sports technologies, the segment grew significantly faster than the group as a whole. Workwear thus proved to be a key factor in the positive development of sales and profitability in the first nine months.

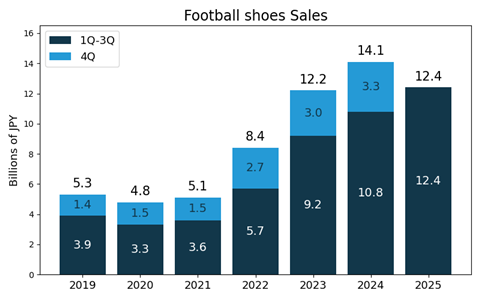

The Football Division also performed strongly in the first nine months, making it another key growth driver. Mizuno benefited not only from stable demand for performance footwear, but also from its presence in international club and team sports, particularly in Japan, Europe, and parts of Asia. The focus on technical performance features and a clearly positioned product portfolio supported both sales and revenues.

Solid growth continued in the running business, again driven by sustained robust demand for performance shoes. The category benefited from Mizuno’s technical expertise on the one hand and from broader international positioning on the other, particularly in Europe and Asia/Oceania. Running thus continued to make a reliable contribution to sales growth on a nine-month basis.

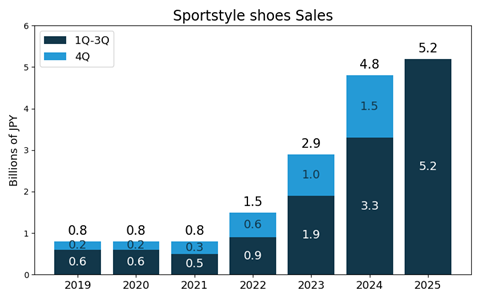

The sportstyle pillar continued to gain in importance and developed into an important addition to the core business. At Mizuno, this segment is designed as a strategic pillar across all divisions. The combination of functional sports technology and lifestyle-oriented design met with increasing demand, particularly in Japan, EMEA, and Asia. Sportstyle thus not only contributed to sales growth but also supported the product mix.

Core divisions stable: golf grows, baseball stabilizes

In addition to the four strategic growth pillars, the Group’s traditional core divisions also remain of central importance. Golf performed well in the first nine months and grew significantly, driven by strong demand in Europe and the Americas. Baseball, which remains one of the highest-revenue categories, lagged slightly behind the previous year but proved to be a stabilizing factor in the overall portfolio.

Revenue by segment (9M FY2025)

- Golf

¥28.6 billion (€176m), +9.4 percent - Baseball

¥28.6 billion (€176m), -1.2 percent - Sports Facilities

¥21.7 billion (€134m), -0.1 percent - Running

¥19.1 billion (€118m), +10.5 percent - Football

¥17.0 billion (€105m), +10.4 percent - Indoor (including for example volleyball, badminton, basketball)

¥16.0 billion (€99m), +10.4 percent - Work business

¥12.5 billion (€77m), +24.0 percent

Regions at a glance: Momentum in EMEA, stability in Japan

Business performance varied across regions but overall remained clearly on track for growth. In Japan, the most important single market, sales rose by 4.3 percent to ¥106.4 billion (€655m), while operating profit grew disproportionately – driven by football, indoor sports, and the rapidly growing workwear business. In the Americas, sales increased by 4.6 percent to ¥30.2 billion (€186m), with the golf business driving growth, while cost pressures weighed on profitability. Asia/Oceania recorded an increase of 9.4 percent to ¥27.1 billion (€167m), supported by running, football, and sportstyle, while golf enthusiasm declined in Korea. The EMEA region performed particularly well, with revenues climbing 19.9 percent to ¥23.7 billion (€146m), supported primarily by running, golf, and sportstyle.

Guidance raised: between multisport giants and specialists

Against the backdrop of strong nine-month results, the company confirmed its forecast for the full year. The group continues to expect sales of ¥260 billion (€1.60bn) and operating income of ¥22.5 billion (€139m). As a challenger with a strong performance DNA, the Japanese company continues to position itself between global multisport groups such as Nike and Adidas on the one hand and specialized growth brands such as On and Brooks on the other. Unlike the big volume players, Mizuno is more firmly anchored in performance-oriented running without limiting itself to a single segment. At the same time, the group is cautiously expanding its profile to include lifestyle-oriented approaches, following an industry trend in which technical credibility is increasingly merging with urban relevance.