In a year marked by economic uncertainty and shifting consumer behavior, Moncler managed to keep revenues steady at €1.84 billion through September 2025. The Italian luxury group leaned on its direct-to-consumer strength and Asia-Pacific resilience to make the best of European softness.

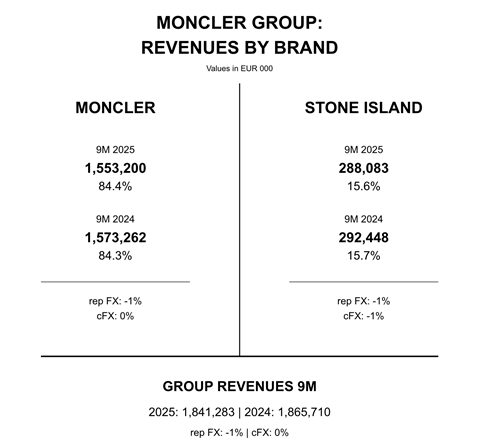

Moncler Group closed the first nine months of 2025 with consolidated revenues of €1.84 billion – flat when adjusted for currency fluctuations. The flagship Moncler brand delivered the lion’s share of group revenues, at €1.55 billion, while Stone Island contributed €288 million, edging down 1 percent year-on-year. The third quarter alone brought in €615.6 million, a marginal 1 percent decline that reflected the broader challenges facing luxury retail – from cautious consumer sentiment in Europe to wholesale channel headwinds.

Behind the stable headline figure lies a strategic recalibration. Moncler is doubling down on brand experience and direct relationships with customers, through owned retail, rather than chasing volume through wholesale. That shift is starting to pay off, particularly in its owned stores.

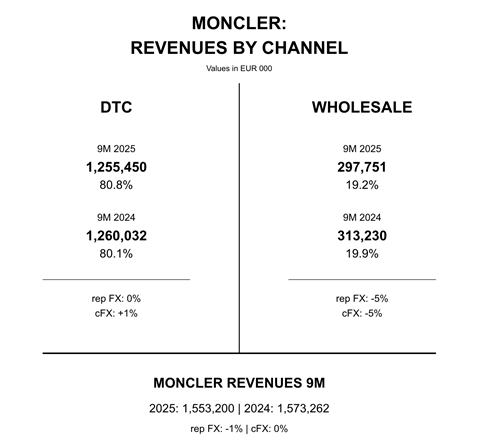

Moncler’s direct-to-consumer channel edged up 1 percent year-on-year, while wholesale slipped 5 percent. Stone Island’s DTC jumped 9 percent, though wholesale dipped 9 percent – largely because of timing shifts in deliveries rather than demand weakness.

Regional contrasts were stark: China and the Americas stood out. Moncler’s Americas business grew 2 percent, while China led a 3 percent rise across Asia. Europe lagged, down 4 percent year-on-year, weighed down by weak tourist flows and cautious local spending.

“As we close the first nine months of the year, we remain focused on executing our strategy with discipline, agility, and a strong sense of direction,” said CEO Remo Ruffini. “Our recently-launched Warmer Together campaign celebrates the values that have defined Moncler for over 70 years – love, connection, and a shared sense of warmth.”

Expanding the footprint of both Moncler and Stone Island

Moncler operated 294 directly owned stores by end-September, with new locations in Austin and Beijing among the additions. Stone Island reached 92 stores, including a relocated flagship in New York