Amazon’s chief of operations in India, Manish Tiwary, is resigning. A spokesman for the company tells MoneyControl that Tiwary seeks “to pursue an opportunity outside of the company” but will be continuing to serve until October. Amazon has not named a successor, but “Amit Agarwal, SVP India and Emerging Markets, will remain closely involved with the Amazon.in team,” the spokesman continued.

Tiwary has been with Amazon for eight years and became India’s Country Manager in late 2020. The company has described him as a “self-confessed Globetrotter, running enthusiast, and ‘work-life harmony’ hacker.” His keynote address last year on Amazon’s business in India was filmed.

A glance at the Indian scene

Forbes India published a recapitulation of Amazon’s business in September 2023. According to this, Amazon had raised its planned investment in the country to $15 billion by 2030, which would make for a total investment of $26 billion. Amazon Web Services (AWS) was for its part planning to invest $12.7 billion over the same period, and expecting thereby to add $23.3 billion to India’s GDP. In addition, Amazon hoped to digitize 10 million small businesses, with 6.2 million already digitized. Amazon’s Next Gen Store was boasting more than a million fashion items from some 200 domestic and global brands.

According to a report in TechCrunch, Amazon’s focus on e-commerce, up 11 to 12 percent in 2023, has overlooked quick-commerce, still small as a market but up 125 percent for the year. Unlike standard e-commerce, quick-commerce promises delivery within about an hour. It typically deals in groceries, household and kitchen items and electronics.

In ChannelSight’s analysis, quick-commerce has a few advantages. First, at least according to Deloitte, back in the lockdown days about half of e-commerce customers were willing to pay extra for faster delivery. Second, the richer the customers, the more likely they are to pay for convenience. Third, the logistics of quick-commerce require a small selection, which can focus on the most profitable products.

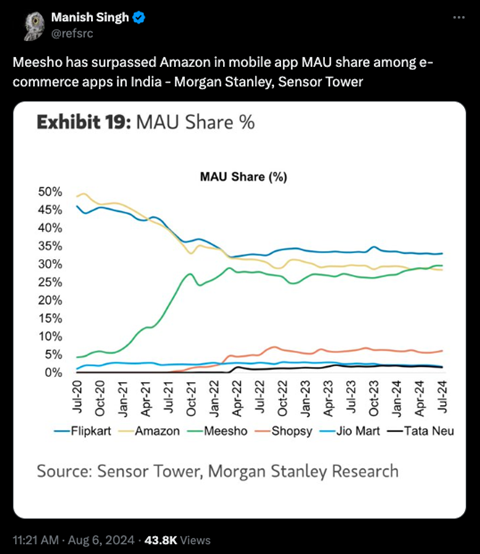

Amazon’s chief rival in India is Walmart’s Flipkart, which has just introduced its own quick-commerce service: Flipkart Minutes. According to Morgan Stanley’s research firm Sensor Tower, Flipkart has been India’s top mobile app for shopping since 2022, when it established a lasting lead over Amazon. Both, however, have been flat or on a slight decline ever since, whereas Meesho has been on the rise. In fact, it has just taken the number-two slot from Amazon.