Eight consecutive years of growth—approaching the Tiger Woods-era peak—signals that golf’s commercial expansion has become structural. Diversifying demographics and off-course format adoption further contribute to extending the player community.

On-course golf participation in the US reached 29.1 million in 2025, marking the eighth consecutive year of growth and signaling sustained commercial opportunity for sporting goods brands beyond the pandemic surge, according to the National Golf Foundation (NGF).

The figure approaches the all-time record of 30.6 million set in 2003 during the Tiger Woods era. Over the past eight years, on-course participation has risen by more than 5 million, representing a net increase of roughly one million golfers year-over-year in 2025 alone.

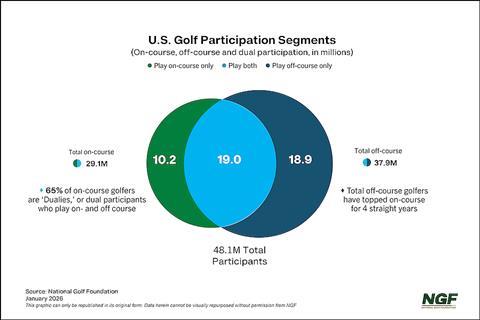

Total golf participation – combining on-course play with technology-enabled ranges, simulators and entertainment venues – reached an all-time high of 48.1 million, up 50 percent over the past decade. Off-course formats now account for 37.9 million participants, with 19 million playing both on-course and off-course.

Sustained demand supports golf equipment market

The data, published in NGF’s annual Graffis Report, shows the participation surge that began before the pandemic has stabilized at an elevated baseline rather than reverting to pre-2017 levels. This trajectory supports continued demand for golf equipment, footwear and apparel as participation gains convert into purchasing behaviour.

Rounds played reached another all-time record in 2025—the fourth time in five years—according to Golf Datatech. This was achieved despite operating with roughly 2,000 fewer facilities than existed during the 2003 participation peak.

Demographics reshape the US landscape

Women and girls now account for 8 million on-course participants—the highest figure on record and a 46 per cent jump since 2019. Female golfers made up 28 percent of all on-course players, while people of color comprised 26 percent, both record shares.

The shifting demographic profile has opened new product categories as manufacturers roll out women-specific equipment lines, apparel cut for a broader range of body types, and entry-level gear aimed at the estimated two-thirds of newcomers who first encounter the sport at driving ranges or entertainment venues rather than traditional courses.

Course operators have benefited from the uptick. Nearly 70 per cent reported their financial health as good or excellent, enabling increased capital spending on facilities, equipment and upkeep. Green fees for an 18-hole round have risen roughly 29 per cent since 2019—tracking closely with overall US inflation over the period.

The country now counts roughly 15,900 golf courses spread across nearly 14,000 facilities, maintaining its status as the world’s largest market even as the total course count has declined since the early 2000s.

About the National Golf Foundation (NGF)

Founded in 1936, the National Golf Foundation is the most trusted source of market intelligence and insights for the global golf industry. As a non-profit membership organization, it is supported by thousands of businesses across every sector of the game—from equipment manufacturers and golf course operators to media and financial institutions.

The NGF leverages a proprietary database of 3 million golfers and maintains the industry’s most comprehensive facility database, tracking every golf course in the United States and thousands more globally. Through its annual Graffis Report, the NGF provides the definitive “state of the industry” on participation, supply, and consumer engagement.