Strong full-price selling across both flagship brands drove margin expansion and record earnings, prompting the company to raise full-year guidance for revenue, earnings, and capital returns as HOKA captures market share and UGG sustains momentum in lifestyle footwear.

Deckers Brands posted record third-quarter revenue of $1.96 billion (€1.8bn) for the period ended Dec. 31, 2025, driven by strong global demand for both HOKA and UGG brands across wholesale and direct-to-consumer channels.

The Goleta, California-based footwear and apparel company reported diluted earnings per share of $3.33 (€3.06), up 11 percent from $3.00 (€2.76) in the prior-year quarter, while raising full-year guidance for both flagship brands and share repurchases.

HOKA drives growth, UGG sustains momentum

HOKA brand sales increased 18.5 percent to $628.9 million (€578.6m), extending the performance running brand’s growth trajectory as it captures market share in the expanding athletic footwear segment. UGG brand revenue rose 4.9 percent to $1.31 billion (€1.21bn), reflecting continued strength in the lifestyle category despite difficult year-over-year comparisons from the brand’s peak selling season.

The company’s other brands segment declined 55.5 percent to $23.2 million (€21.3m), primarily reflecting the planned phase-out of Koolaburra brand standalone operations.

On a constant currency basis, consolidated net sales increased 6.8 percent, indicating minimal foreign exchange headwinds during the quarter.

Balanced channel growth

Wholesale revenue grew 6.0 percent to $864.6 million (€795.4m), while direct-to-consumer sales increased 8.1 percent to $1.09 billion (€1.00bn). Comparable DTC sales rose 7.3 percent, signaling healthy performance in company-owned stores and e-commerce platforms.

Stefano Caroti, President and Chief Executive Officer, attributed the results to strategic marketplace management that balanced growth across both channels. “UGG and HOKA each delivered high levels of full-price selling, resulting in strong gross margins,” Caroti said in a statement.

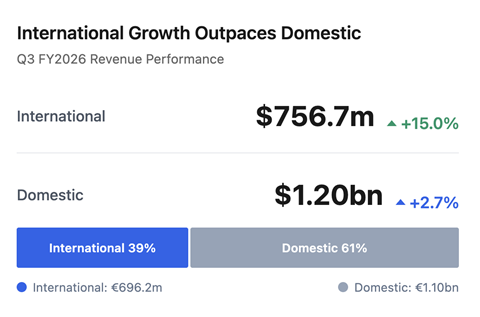

International momentum accelerates

International markets delivered 15.0 percent growth to $756.7 million (€696.2m), outpacing domestic revenue growth of 2.7 percent to $1.20 billion (€1.10bn). The divergence reflects accelerating demand in international territories and the lapping of strong prior-year domestic comparisons, alongside the impact of Koolaburra’s phase-out on US sales.

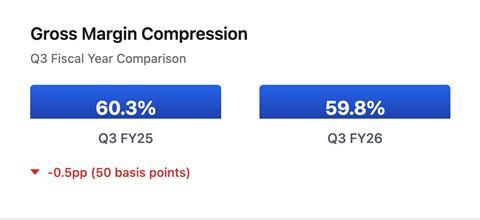

Gross margin compressed 50 basis points to 59.8 percent from 60.3 percent in the prior year, while operating income expanded to $614.4 million (€565.2m) from $567.3 million (€522.0m) as revenue growth offset higher selling, general and administrative expenses.

Capital deployment intensifies

Deckers repurchased 3.8 million shares during the quarter for $348.5 million (€320.6m) at a weighted average price of $92.36 (€85.0) per share. Through the first nine months of fiscal 2026, the company bought back approximately 8.0 million shares—representing more than 5 percent of shares outstanding at the fiscal year start—for a total of $813.5 million (€748.4m).

The company now expects full-year share repurchases to exceed $1.0 billion (€920m), with approximately $1.8 billion (€1.66bn) remaining under its stock repurchase authorization as of Dec. 31, 2025.

Raised guidance reflects momentum

Deckers increased its full fiscal year 2026 outlook, now projecting revenue of $5.40 billion to $5.425 billion (€4.97bn to €4.99bn). HOKA is expected to deliver mid-teens percentage growth versus fiscal 2025, while UGG is forecast to increase by a mid-single-digit percentage.

The company raised its diluted earnings per share guidance to a range of $6.80 to $6.85 (€6.26 to €6.30), incorporating the impact of expected fourth-quarter share repurchases. Operating margin is now expected to reach approximately 22.5 percent, while gross margin is projected at approximately 57 percent for the full year.

Selling, general and administrative expenses as a percentage of net sales remain expected at approximately 34.5 percent, with an effective tax rate of approximately 23 percent.

Balance sheet strength

Cash and cash equivalents totaled $2.09 billion (€1.92bn) as of Dec. 31, 2025, down from $2.24 billion (€2.06bn) a year earlier, primarily reflecting share repurchase activity. Inventories stood at $633.5 million (€582.8m), up from $576.7 million (€530.6m) in the prior year, with the increase including the impact of incremental tariffs. The company maintained zero outstanding borrowings.

The earnings guidance assumes no meaningful changes to business prospects or identified risks, including potential shifts in macroeconomic conditions, consumer confidence, discretionary spending, inflationary pressures, foreign currency fluctuations, global trade policy changes including tariffs and trade restrictions, geopolitical tensions, or supply chain disruptions.