“I’m just happy,” CEO Kevin Plank said early on at the investor meeting that Under Armour (UA) held on Dec. 12. It was the first such meeting in about six years, and meant to provide, as he said, a “holistic, qualitative overview” of the business.

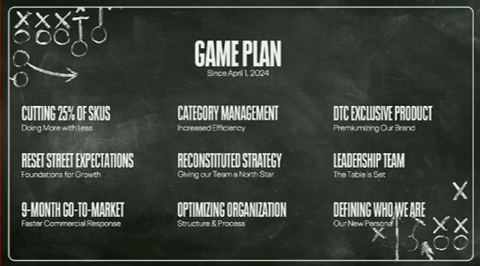

Like Steve Jobs before him, Plank has been brought back to the company he founded, in hopes of a renaissance. He spent about five years in the wilderness, founding companies in real estate and spirits, both called Sagamore. The return to UA was announced last March and took place on April 1, so it has been nine and a half months.

Plank’s focus is on “building a brand,” because brands are “so much more valuable than companies.” And that brand’s proper place, he said, is to be among the world’s four sports houses, patterned after Europe’s fashion houses. (The other three are Nike, Adidas and Puma.)

In Plank’s view, UA has of late gotten caught up in behavior antithetical to its sports-house status. It’s been behaving like a company, selling on price. Well, no more.

UA has cut back on promotions, generating a payoff, Plank said, in its swelling gross margin. In Q2 2025 (the most recent period reported), ended Sept. 30, UA increased gross margin by 200 basis points to 49.8 percent, through what its press release calls “lower product and freight costs, reduced discounting levels in the direct-to-consumer business, and a favorable channel mix,” and forecast a further increase of 125 to 150 basis points. (Q1 saw an increase of 110 basis points to 47.5 percent.)

The DTC channel, incidentally, now serves as an outlet for products that UA believes in but that wholesalers refuse to buy. In the past, said Plank, the company would scrap plans for such products.

Plank had also had the staff apply the Pareto distribution to the 325 fabrics UA uses. It turned out that 30 accounted for 80 percent of production, so Plank had UA cut out half. UA has likewise reduced its SKUs by a quarter.

At one point Plank produced from his pocket a wad of fabric that, when he relaxed his grip, flounced into its proper shape. This was the StealthForm baseball cap, which is seamless, sweat-wicking and, as he’d demonstrated, uncrushable. With this novelty UA intends to blow up the market for caps, and Plank predicts that within two years every other sportswear company will be producing its own version – especially as it will be raising the price point from $16–$25 to $45. “Taking price points up is what we do.”

Product

Yassine Saidi, Chief Product Officer for the past ten months, spoke of blending design into UA’s usual technical innovation and of effecting a shift in category management. UA has had a division-driven split between apparel, footwear and accessories, which felt like three separate companies, according to Saidi. The new split is a consumer-driven one between five new categories: Train, Team Sports, Basketball, Run and Sportswear.

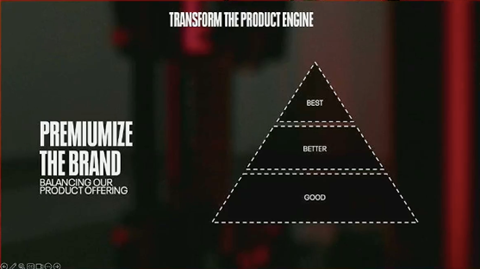

Saidi seeks to “premiumize” the brand. This echoed Plank’s talk of taking price points up. In fact, Saidi used the same pyramid diagram, with “good” at the base, “better” in the middle and “best” on top. UA has been chasing revenue – that is, making the pyramid’s base too big. The plan now is to shrink “good” and expand “better” and “best.”

Cases in point: two new sneakers. The Echo will be making its debut with Steph Curry at the next NBA All-Star Game, in February. More important for the brand philosophy, though, is the Aura, which is supposed to redefine UA’s design language for shoes, with a literal integration of the UA logo. Plank had already emphasized the logo’s top-down and left-right symmetry and how it would henceforth be placed in the center of UA’s products, to suggest the company’s ethos of equilibrium.

The Aura will also add to the “better” and “best” categories, with the Rogue version at $90 and the Runner at $140.

“We have not yet made our defining product,” Saidi concluded, saying that UA expected to do this for itself in the coming months and for the industry in the coming years.

Kyle Blakely, Senior Vice President of Innovation, Testing and Development, and a 17-year UA veteran, spoke of UA’s five foundational innovations:

- Low-shed synthetic fabrics

- Cold-gear infrared, which uses ceramic particles to trap body heat

- SpeedForm, the running-shoe line that takes inspired from the brassiere

- Clone, a fabric that expands as it stretches and involves 40 patents

- ARMR Grid, a jersey fabric that doesn’t stretch and thus helps ball carriers elude tackles in American football

He also announced two new products. First was the Velociti Elite 3, UA’s most technical running shoe to date. Of perhaps wider application, though, was Suspension Straps, for backpacks. Like Clone, their fabric expands as it stretches, relieving pressure on the shoulders. UA has added a countermeasure to prevent bouncing. The effect, Blakely said, is perceivable.

Blakely’s most important announcement was no doubt Neolast, a replacement for Spandex that UA has spent the past seven years working up with a company called Celanese. Spandex, Blakely said, is hard to recycle when mixed with polyester, is made with chemicals, is not durable, yellows with age and lacks power. Neolast, by contrast, reflects what he called “performance-driven sustainability.”

Yuron White, Senior Vice President of Product, introduced a number of products, among them a new football boot, a new lowtop basketball shoe and a shoe that plays on nostalgia for the 1990s. He described how the Assert 11, the running category’s new entry in the “good” pyramid layer, was (through the “halo effect”) borrowing the aesthetics of an item in the “best” layer, the Velociti Elite.

White also distinguished the Aura line from the Velociti line – the first dealing in disruptive design, the second in athletic performance.

The big revelation was the Curry 13 signature shoe, a video for which played at the live meeting but is not shown on the online recording.

Brand

Executive Vice President of Brand Strategy Eric Liedtke spent 26 years at Adidas and founded Unless Collective, a brand of streetwear made entirely from plant fibers.

For him UA’s greatest strengths are at home, in the Americas – especially in the US and its East Coast: the I-95 corridor, so named for the interstate highway. EMEA is the rising star among regions, with “green shoots” coming up in “key cities,” like London and Paris, while Asia-Pacific is open country, where UA is relatively unknown and should seize the opportunity to define itself for new customers.

Like many speakers before him, Liedtke spoke of effecting shifts. One is from an organization designed around function (business departments) to one designed around categories and the quest to win over consumers. But another shift is a matter of perception.

The market sees UA, he said, as a brand for “individual athletes, people working for and by themselves,” as a brand for the gym, as a performance-centric brand. UA’s customers skew male and tend to exceed 34 years of age, having grown up with the brand from its early days. UA therefore appears as tough and intense – too aggressive, said Liedtke, for Gen-Z and Gen-A.

Liedtke is proposing to shift the focus:

- from individuals to teams

- from male, aggression and 34-plus to young, fresh and attractive to both sexes

- from tough and intense to determined, passionate, fun and even lighthearted

- from performance-centric to “leveling up an athlete’s cred” on and off the field

“We need to give them [customers] permission to wear us in the streets and hallways,” he said, and UA’s method will be to focus on “the right consumers” – that is, on “the influencers.”

The main character in UA’s “story” is the underdog. UA itself is the underdog sports house, and it hopes to spend more than it has ever spent before (Plank spoke of a half-billion dollars) on a marketing campaign to go after the underdogs, aged 16 to 24, in the public. These are the customers it wants – the undiscovered, unknown and underestimated, in Liedtke’s terms, who have a chip on their shoulder and something to prove: walk-on athletes and undrafted free agents. UA will be building a multi-year brand platform as of 2025.

To generate sales it will offer “reasons to love us” and “reasons to buy us.” The first has to do with brand awareness, brand advocacy, upper-funnel activity and matters of the heart; the second, with the mind, reason and the wallet.

The obstacle, said Liedtke, is the reality that the sportswear industry makes too much stuff. “No one needs a new hoodie.” UA’s job is therefore the create “objects of desire,” and the formula for this is “product x story x distribution.” Product begins with a “performance or cultural insight,” story expresses innovation, material and collaborations, and distribution is the sales plan. Any factor of zero wipes out the rest.

Regions

Asia-Pacific

Jason Archer, Managing Director for Asia-Pacific, is bullish on the long term and seeks to keep the focus on full-price, premium sales.

By UA’s reckoning, Asia-Pacific is a €93 billion market with mid-single-digit growth projected for the next five years. UA’s share of it stands at a mere 2 percent overall. The company has less than 2 percent in China or South Korea, about 3 percent in Japan and about 4 percent in Australia. China nonetheless accounts for half of UA’s revenue in the region. South Korea functions as a fashion trend setter. In Japan UA will continue to work with its licensee, while in Australia it will continue to seek out partnerships with wholesalers and distributors.

UA has adopted a “DTC-first model” in Asia-Pacific, with branded retail and e-commerce together accounting for 80 percent of its regional revenues there. In fact, 1,400 of the brand’s total 2,000 own-stores are operating in 15 Asia-Pacific countries. In addition, UA is selling through regional marketplaces, like Tmall, WeChat and JD.

Unaided brand awareness in the region ranges as a percentage from the mid-teens to the high twenties, and consideration for purchase from 36 to 53 percent.

The sportswear category in particular, Archer said, seems primed for more off-court, off-pitch products in Asia-Pacific, where UA’s emphasis is already on the “better” and “best” layers of the pyramid.

The brand opened the world’s first Curry store during a recent promotional tour with Steph Curry himself.

Americas

Kara Trent, President for the Americas, ran through a number of ways in which UA has in recent times failed to take care of its brand. Half the product has overlapped across accounts, 70 percent of e-commerce sales in FY 2024 were below full price, 70 percent of the marketing budget has gone to performance marketing, and 92 percent of revenue has been coming from 50 percent of the channels.

The Americas, she said, represent a market worth $200 billion, and North America makes up 93 percent of that. UA’s market share in the US is 4 percent.

The company needs to stop trading on price and clarify its offer and segmentation. It needs to shift from retail seasons, like Christmastime, to “sports moments” that match the brand story. The focus needs to shift from product to customers.

In DTC UA has been overly promotional and will now be seeking to make premium sales.

The good news, she said, is that “no one is mad at us,” although some might be “slightly confused or slightly indifferent” as what UA represents.

In the Americas the brand will be making Team Sports, Run and Train its near-term priorities and investing for the future in Sportswear. The flagship store that it has set up at its new headquarters, in Baltimore, Maryland, will serve as the model for all other stores.

EMEA

Unlike in the Americas, UA enjoys premium positioning already in the EMEA, according to Kevin Ross, the region’s Managing Director, and the brand is close to doubling its revenue there since 2020. Ross ascribes this to a focus on team sports, a disciplined go-to-market strategy, constrained growth with a view toward protecting the brand.

EMEA, spread over 71 countries, is worth about $80 billion as market, said Ross. UA owns and operates its distribution in most of Western Europe, Italy and Scandinavia excepted. It is absent in the Baltics and Belarus but present in Kazakhstan. The main country markets are the UK, Germany, France and Spain, which together account for 40 percent of EMEA revenues. Its main partners there are Zalando, El Corte Inglés, Sports Direct and InterSport. Of these four markets the UK is the most important. There UA’s market share reaches 5 percent, while it is at or below 2 percent in the others.

As Ross explained, the UK is where UA has doubled down on brand investment and been disciplined “about where we will and won’t do business.” UA has been careful in its channel marketing, been acquiring local sports-marketing assets and emphasizing “unique athlete experiences.” These are now the formula for scaling up operations in the rest of the region.

Like other speakers, Ross mentioned the shift from Training to Team Sports, but also observed that UA was now in a position to “cover an athlete’s full day” – meaning dress him for life in- and outside of sport.

He also mentioned footwear as UA’s “most significant long-term growth opportunity,” especially as the company share of it is less than 1 percent in every market. “Athletes on and off the field typically start their curation from foot to head.”