With its outdoor brands Arc’teryx, Salomon and Peak Performance, the Finnish company Amer Sports increased its sales in 2024 and even overtook Adidas in share price. Nevertheless, some analysts show concerns. Here is our financial analysis.

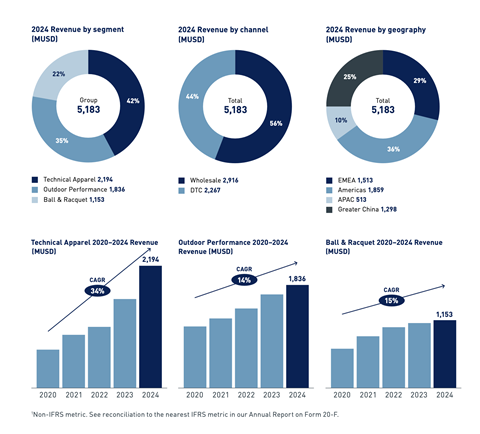

Amer Sports achieved record sales of $5.183 billion in 2024 (+18 percent). Technical Apparel (Arc’teryx, Peak Performance) accounted for 42 percent of sales and grew by 36 percent, while Outdoor Performance (Salomon) reached $1.836 billion. Greater China grew by 50 percent to $1.298 billion, while direct-to-consumer (DTC) sales increased by 44 percent. The Ebitda margin improved to 15.6 percent, and adjusted earnings per share rose to $0.47 (from $-0.27). Net debt fell to 0.7 times Ebitda. Arc’teryx exceeded $2 billion in sales, and Salomon shoes reached $1 billion. In 2025, Amer Sports plans to expand in Greater China, North America, and Europe, focusing on DTC. Salomon is also expanding its sport style sneaker line, while Arc’teryx is increasingly entering the footwear market.

Technical Apparel and Outdoor Performance boost sales

Three strong markets: Americas’ grows, followed by EMEA

Arc’teryx remains the flagship brand

Softgoods segment pushes Salomon sales

Peak Performance – no information about performance

Share price: Amer Sports overtakes Adidas

Amer Sports’ outlook for 2025: Geographic expansion

Analysts: Sales growth for 2025 below expectations

Technical Apparel and Outdoor Performance boost sales

With its outdoor brands Arc’teryx, Salomon and Peak Performance, the Finnish company Amer Sports increased its sales in 2024 by 18 percent compared to the previous year.

Three main segments contributed as follows:

- Technical Apparel (Arc’teryx and Peak Performance): $2.194 million (42 percent of total sales)

- Outdoor Performance (Salomon): $1.836 million (35 percent)

- Ball & Racquet Sports (Wilson): $1.153 million (22 percent)

The Technical Apparel segment, led by Arc’teryx, recorded an impressive sales growth of 36 percent, while Salomon achieved strong results in the Outdoor Performance segment, particularly in footwear.

Three strong markets: Americas’ grows, followed by EMEA

Sales by region show a broad distribution:

- Americas: $1.859 million (36 percent of total sales)

- EMEA: $1.513 million (29 percent)

- Greater China: $1.298 million (25 percent)

- APAC: $513 million (10 percent)

Even though sales in Greater China are currently only in third place, James Zheng, Executive Director and CEO, sees a strong appeal of “our authentic brands” - even if Amer Sports is “still a small player”. Nevertheless, “we once again achieved growth of over 50 percent in Greater China and remain committed to our future in this important consumer market”. The company is also increasingly focusing on a direct customer approach. In 2024, this accounted for 44 percent of sales, an increase from 36 percent in 2023, underlining the strategic shift from a wholesale model to DTC.

Arc’teryx remains the flagship brand

The technical outdoor brand Arc’teryx exceeded the $2 billion sales mark for the first time in 2024, supported by strong growth in North America. Overall, the region generated 33 percent of sales. The brand is particularly well represented in Greater China, while the EMEA and Asian markets (excluding China) account for just 11 percent. Driven by footwear and womenswear, the Technical Apparel segment recorded 36 percent sales growth.

Softgoods segment pushes Salomon sales

Salomon generated sales of over $1 billion in the footwear business in 2024 (68 percent). The Greater China and Asia-Pacific markets performed particularly well – compared to 54 percent in 2022. There were also initial positive signs of growth in Europe and North America.

Peak Performance – no information about performance

In its financial report, Amer Sports focuses on its bestsellers, Arc’teryx and Salomon. CEO Zheng does not give any figures for Peak Performance, saying only: “Peak Performance improves our scale, our competitive position and our diversification across all sports categories.” Due to its Nordic roots, the brand has a strong fan base in the EMEA region; however, there is an opportunity to expand it globally in North and South America, Greater China and the Asia-Pacific region.

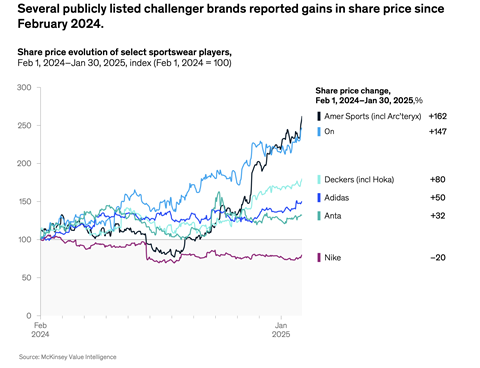

Share price: Amer Sports overtakes Adidas

The adjusted Ebitda margin rose to 15.6 percent, while the adjusted gross margin increased by almost 300 basis points. The adjusted operating margin improved by 130 basis points, reflecting the focus on qualitative growth.

The company achieved adjusted earnings per share of $0.47, compared to a loss of $0.27 in 2023. According to the financial report, this improvement was made possible by an optimized capital structure and lower interest expenses. Amer Sports’ share price thus overtook Adidas and On, among others, with a 162 percent increase in the period from February 1, 2024, to January 30, 2025 (source: Sporting Goods 2025, McKinsey & Company). According to Amer Sports’ latest financial reports, the company’s total liabilities amount to $3.32 billion. In 2023, these still amounted to around $8.5 billion. Nevertheless, analysts recommend that potential investors keep an eye on the company’s balance sheet.

Amer Sports’ outlook for 2025: Geographic expansion

According to the company, Arc’teryx will continue its growth path by expanding its expertise in technical apparel and entering new product categories, particularly by investing in the women’s segment and footwear. The expansion in China and North America will be complemented by new European retail stores, such as in Paris and Chamonix. The company also focuses on sustainability with its ReBIRD™ program, which promotes repair services and upcycling.

Salomon will focus on innovation and geographic expansion in 2025, particularly in the USA and China. Another aim is the further development of its Sportstyle footwear line and winter sports technologies.

Peak Performance will strengthen its position in premium apparel through product optimization and an increased presence in Europe and Asia, with e-commerce and flagship stores serving as key channels. Sustainability remains a central component of the strategy.

Analysts: Sales growth for 2025 below expectations

In the future, Amer Sports plans further growth through expansion in underrepresented markets such as Greater China and through the expansion of its DTC channels. The Arc’teryx and Salomon brands remain key drivers of sales and profitability. However, some analysts expressed concerns about the forecast for 2025, as the expected sales growth of 13-15 percent is below expectations. This more cautious assessment led to a slight decline in the share price of 3 percent in pre-market trading in February 2025. Overall, however, Amer Sports remains attractive to analysts, with its strong brand presence and Asian expansion being positively highlighted.