Puma has entered a reset phase as part of its turnaround plan, reporting a 10.4 percent currency-adjusted sales decline to €1.96 billion in the third quarter. CEO Arthur Hoeld, who took over in July, announced an expanded cost-efficiency program and a sharpened focus on four product pillars – Running, Football, Training and Sportstyle – with an ambition to restore Puma’s place amid the top three global sports brands.

Financial performance: reset year and operational clean-up

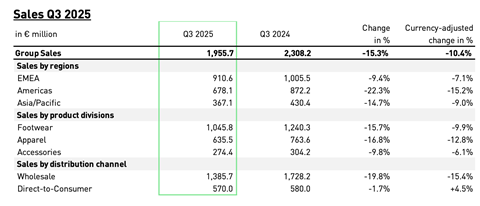

Puma reported a 10.4 percent currency-adjusted decline in Q3 sales (-15.3% reported) to €1,955.7 million, reflecting deliberate measures to clean up distribution, lower wholesale exposure and reduce discounting.

Wholesale revenue dropped 15.4 percent, while direct-to-consumer (DTC) sales rose 4.5 percent, driven by e-commerce growth and stronger full-price sell-through.

The gross margin fell by 260 basis points to 45.2 percent, impacted by promotional activity and inventory adjustments. Adjusted EBIT declined to €39.5 million (Q3 2024: €237m), while reported EBIT stood at €29.4 million, including €10.1 million in one-off restructuring costs related to the efficiency program.

Puma will eliminate approximately 900 white-collar positions globally by the end of 2026, following 500 cuts earlier this year, to streamline operations. Inventory rose 17.3 percent year-on-year to €2.1 billion, which the company aims to normalize by 2026.

Despite the weak quarter, Puma reaffirmed its full-year outlook for 2025, expecting a low double-digit sales decline (currency-adjusted) and a reported EBIT loss, defining 2025 as a “year of reset” and 2026 as a “year of transition.”

“In our industry, it takes 18 months to create new products and bring them to market. We will gain ground again and grow above industry standards from 2027 onwards,” said Arthur Hoeld, CEO of Puma. “Our medium-term goal is to return to the top three global sports brands.”

→ Read: The biggest sports companies in the world

On capital markets, Puma’s share price has dropped nearly 50 percent in 12 months, increasing speculation about its ownership. Major shareholder Artemis (Kering) (29%) stated in September that its stake is “no longer considered strategic.”

Siginificant leadership reorganization at Puma

Hoeld – who spent more than 25 years at Adidas – became CEO in July, but this hasn’t been the only change to Puma’s leadership team.

In October, Maria Valdes was promoted to Chief Brand Officer, to oversee Brand Marketing, Product, Creative Direction, Innovation and Go-to-Market. Earlier, Andreas Hubert became Chief Operating Officer (COO) for Sourcing, Logistics, Digital and Technology, while Matthias Bäumer assumed the role of Chief Commercial Officer (CCO) for Markets, Retail, E-commerce and Stichd.

“The logo will shine again in the future,” Hoeld said, emphasizing a renewed focus on brand clarity, integration and operational discipline. For the way back into the top three sports brands worldwide, Hoeld has set his strategy on three pillars:

Strategic priorities: DTC strength, integrated storytelling and core focus

1. Strengthening DTC channels

Puma plans to adjust its sales mix, currently at 70 percent wholesale, toward the industry average of 60 percent, without abandoning key partnerships. “This is not a DTC-first or exclusive strategy, but the balance has to change,” said Hoeld, who hopes for significant growth in both channels. As an example, he mentioned that a new flagship store on London’s Oxford Street will be opening in the coming weeks.

2. Storytelling and the integration of product, marketing and go-to-market

“Our brand heat is low,” said Hoeld, noting that Puma ranked ninth among consumers in internal brand tracking during Q1.

He emphasized that Puma will move away from “disconnected brand campaigns”. As a result he stopped the biggest brand campaign of the past years, simply because he was not convinced of a thought-through storyline and integration between product, storytelling and go-to-market-strategy: „We need more integrated and more nimble campaigns.“

Running will be central to this effort, especially around the Nitro technology. ”Currently, Nitro is the best-kept secret in the industry,” he added.

3. Focus on four key sports categories

Puma will streamline operations to focus on Running, Football, Training and Sportstyle.

- Running: The “Nitro Technology in Running will be successful and gain ground,” the CEO said confidently. Hoeld was “very positively surprised” with Nitro’s performance. “We have to do a better job in the communication of that technology.” “It’s a fierce competition with ten to 12 brands. We have to be present in running clubs and communities – we have to fight everywhere.” Puma will focus on running. Rather than trail running, the move will be toward fitness running – also with the help of Hyrox. In February 2026, Puma will be launching a branded Hyrox shoe – a hybrid of running and fitness shoe.

- Football: Puma hopes for high visibility through partnerships with, among others, Manchester City, Borussia Dortmund and the Portuguese national team, as well as its official match-ball deals with the Premier League, Serie A and LaLiga.

- Training: Called “the hidden champion” by Hoeld, Training is to gain visibility also through Puma’s exclusive Hyrox partnership, extended until 2030, under which Puma remains the only brand developing Hyrox-specific products.

- Sportstyle: Expected to deliver the most absolute growth, Sportstyle will capitalize on heritage franchises. Hoeld: “From a desirability perspective, it is very important to look at the archive.” Performance comes first at Puma, ”but at the same time we have a massive opportunity to inspire consumers to wear products in a stylish way off the pitch.” Hoeld didn’t reveal the product strategy for the near future here but did indicate that the great history with Palermo, Suede, GV Special and Clyde will guide the way: ”Which elements we will get into the market in 2027 is still in development.”

Puma will also continue to invest selectively in basketball (especially in the US), golf, team sports and motorsport and is expecting cross-category halo effects in the kids and accessories categories.

Puma outlook

Puma’s transformation program marks a decisive shift toward operational discipline and brand coherence. With this the leadership team hopes to face continued pressure from slowing wholesale demand and intensified competition, especially in running and lifestyle segments.

“We will provide healthy and sustainable profits to our shareholders. The potential is unmatched – it just requires a different mindset,” said Hoeld.

While 2025 is shaping up as a reset year and 2026 as a transition period, Puma expects growth to resume in 2027, supported by a leaner structure, clearer product focus and improved storytelling. Among the lingering questions are whether investors trust the industry veteran and his (long) three-year program for growth, whether consumers will be attracted again by the brand’s legacy and whether Puma isn’t too late to the running-boom party.