VF Corporation reports solid progress in its turnaround in the second quarter of fiscal year 2026, driven by strong core brands and disciplined cost control.

The company exceeded expectations according to its own statements. Sales rose 2 percent to $2.80 billion, which corresponds to a slight decline of 1 percent on a currency-adjusted basis. Operating profit increased to $313 million, while adjusted earnings reached $330 million, significantly exceeding the forecast of $260 million to $290 million. The operating margin improved to 11.2 percent, while the adjusted margin improved to 11.8 percent.

Adjusted earnings per share of $0.52 also exceeded the company’s own expectations but remained below the previous year’s figure of $0.60. The balance sheet also showed positive development: net debt fell by $1.5 billion to $5.7 billion within a year, corresponding to a reduction of 21 percent.

| VF Corp. - Income | |||

|---|---|---|---|

| Q2 2025 ($ thousand) | |||

| GAAP | Constant currency | ||

| Revenues | |||

| Outdoor | 1,663,479 | 1,626,149 | |

| Active | 760,750 | 744,508 | |

| Other | 378,477 | 370,305 | |

| Total | 2,802,706 | 2,740,962 | |

| Segment profit | |||

| Outdoor | 300,740 | 293,016 | |

| Active | 65,748 | 62,691 | |

| Total | 366,488 | 355,707 | |

| Corporate and other expenses | 95,672 | 95,407 | |

| Interest expense, net | 46,209 | 46,789 | |

| “All Other” profit | 43,674 | 42,067 | |

| Pre-tax from continuing operations | 268,281 | 255,578 | |

| Source: VF Corp. | |||

Core brands drive growth, Vans slowly stabilizes

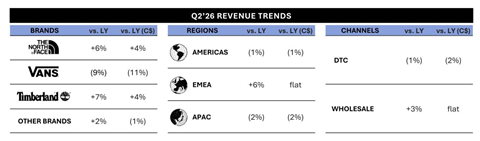

The recovery of the US apparel giant is taking shape: The North Face and Timberland remain the pillars of the group, growing by 6 and 7 percent respectively in Q2 FY26. On a constant currency basis, this corresponds to an increase of 4 percent. Vans, on the other hand, continues to weaken, albeit less sharply: revenues fell by 9 percent (-11% C$).

“We delivered broad-based growth for The North Face and Timberland, while continuing to moderate declines in Vans. We also announced the pending sale of Dickies for $600 million, enhancing our capacity to invest in the portfolio and drive shareholder returns,” said CEO Bracken Darrell. The planned sale of Dickies (to be completed in Q3 FY26) will give the group financial leeway and enable it to focus on higher-margin brands.

The strongest growth in the Other Brands segment once again came from Altra, whose sales rose by over 35 percent year-on-year – the third consecutive quarter with double-digit growth. Smartwool also achieved double-digit growth in direct-to-consumer business, while Icebreaker continued to grow with its MerinoFine products and Eastpak gained momentum through collaborations and marketplace business.

Regions show mixed picture

Geographically, the trend is uneven. In EMEA, sales rose by 6 percent – a ray of hope in international business. The Americas remained slightly down (-1%), while Asia-Pacific declined by 2 percent, mainly because of weakened demand in China and Japan. Sales also presented a mixed picture: the wholesale segment benefited from a solid back-to-school season (+3%), while direct-to-consumer (DTC) business declined slightly (-1%). This was due to lower customer traffic and the closure of non-strategic stores.

| VF Corp. - Revenues | |||||

|---|---|---|---|---|---|

| 2025 | 2024 | Change | Change (constant currency) | ||

| Q2, ended September ($ million) | |||||

| Brands | |||||

| The North Face | 1,157.1 | 1,091.4 | 6% | 4% | |

| Vans | 606.9 | 667.4 | -9% | -11% | |

| Timberland | 506.4 | 475.3 | 7% | 4% | |

| Other | 532.3 | 523.8 | 2% | -1% | |

| VF revenue | 2,802.7 | 2,757.9 | 2% | -1% | |

| Regions | |||||

| Americas | 1,343.5 | 1,355.9 | -1% | -1% | |

| EMEA | 1,072.7 | 1,009.6 | 6% | 0% | |

| Asia-Pacific | 386.6 | 392.5 | -2% | -2% | |

| VF revenue | 2,802.7 | 2,757.9 | 2% | -1% | |

| International | 1,640.3 | 1,572.5 | 4% | 0% | |

| Channels | |||||

| DTC | 909.9 | 914.9 | -1% | -2% | |

| Wholesale | 1,892.8 | 1,843.0 | 3% | 0% | |

| VF revenue | 2,802.7 | 2,757.9 | 2% | -1% | |

| H1, ended September ($ million) | |||||

| Brands | |||||

| The North Face | 1,714.5 | 1,615.6 | 6% | 4% | |

| Vans | 1,104.9 | 1,249.3 | -12% | -13% | |

| Timberland | 761.4 | 704.8 | 8% | 6% | |

| Other | 982.5 | 957.4 | 3% | 0% | |

| VF revenue | 4,563.4 | 4,527.0 | 1% | -1% | |

| Regions | |||||

| Americas | 2,281.1 | 2,331.6 | -2% | -2% | |

| EMEA | 1,623.9 | 1,541.9 | 5% | 0% | |

| Asia-Pacific | 658.4 | 653.6 | 1% | 0% | |

| VF revenue | 4,563.4 | 4,527.0 | 1% | -1% | |

| International | 2,566.4 | 2,482.2 | 3% | 0% | |

| Channels | |||||

| DTC | 1,630.5 | 1,655.9 | -2% | -3% | |

| Wholesale | 2,932.8 | 2,871.1 | 2% | 0% | |

| VF revenue | 4,563.4 | 4,527.0 | 1% | -1% | |

| Source: VF Corp. | |||||

New segment structure ensures greater transparency

The group has been reorganizing its brands since the reporting quarter. The Outdoor division now comprises The North Face and Timberland, while the Active division bundles the Vans, Kipling, Eastpak and JanSport brands. With this restructuring, management aims to simplify operational control and provide a clearer picture of the performance of the individual brand groups.

Turnaround gains momentum thanks to core brands and declining debt

“In Q2, we made further progress on our turnaround plan,” said CEO Darrell. After a difficult start to the year, the group’s restructuring is now showing results: The North Face and Timberland are driving business, while Vans is gradually stabilizing after restructuring measures. The planned sale of Dickies provides additional financial leeway to invest in higher-growth brands. As a result, the turnaround is gaining momentum – even though the environment remains challenging, with price pressure and subdued consumption. “Looking ahead, we will continue to focus on generating value across our brands and returning the company to sustainable and profitable growth,” added Darrell.

Tariff burdens weigh on margins

Higher import tariffs had a particularly negative effect in Q2 FY26. VF expects this effect to total $250 to $270 million for the current fiscal year, with about half of that amount attributable to the current fiscal year. Management intends to offset the burden through savings in procurement and moderate price adjustments. The effects are expected to be fully offset by fiscal year 2027.

Cautious optimism for H2

For the current third quarter, the company expects a decline in sales of 1 to 3 percent in constant currency and adjusted operating income of $275 to $305 million. For the year, the group is aiming for higher free cash flow and an improvement in operating income and cash flow from the previous year. Despite a continuing challenging market environment, VF Corporation is confident that it will hit its targets for fiscal year 2026.