A rise of 9 percent in retail sales of bicycles and accessories drove the growth of the global sporting goods market in 2019, according to the NPD Group. The consumption of sports shoes slowed down to 6 percent, compared with an estimated increase of 9 percent in 2018. Both apparel and equipment went up by 4 percent.

The end result was growth of 5 percent on a constant-currency basis to $498 billion for the total market, down from the 7 percent increase registered in 2018, a year in which apparel and equipment had also risen at higher rates of 8 and 5 percent, respectively. Bikes and accessories were up by only 6 percent in 2018.

Apparently, the recent stronger growth in this segment was due largely to rising demand for more expensive (and less sporty) e-bikes. The momentum in cycling has continued in 2020 for several reasons, but the Covid-19 pandemic will evidently prevent the total market from breaking the $500 billion barrier. It will certainly cause it to record its first decline since 2008, when it fell by 2 percent.

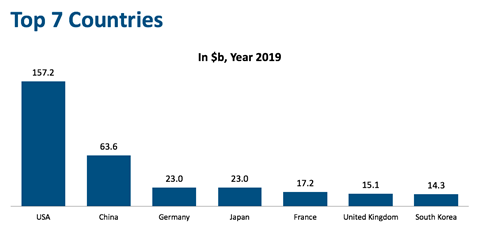

In geographical terms, China continued to drive the growth of the global market in 2019, but its contribution to the overall growth declined to 20 percent from 35 percent in the previous year. With sales of $63.6 billion, it remained the second-largest sporting goods market after the U.S., accounting for 13 percent of global retail turnover in the sector. However, the Chinese market’s growth slowed down to 9 percent from 22 percent in the previous year on a constant-currency basis, according to NPD.

The market research company estimates that the German market too went up by 9 percent in 2019, matching Japan in size as the third-largest market in the world, with a retail turnover estimated at $23.0 billion. Sales grew in the U.S. by 4 percent to $157.2 million. They rose by only 2 percent in Japan. Germany and Japan were followed by France (+5%), the U.K. (+2%) and South Korea (+3%).

Source: © NPD Group