The appearance of Adidas, Puma and other major brands’ products on Shein (pronounced as two syllables: “She” + “In”), the internationally operating online retailer of fashion and sporting goods based in Singapore, raises concerns about the environmental and ethical impact of fast fashion in specialty retail.

Shein’s business model

Shein’s business model, based on the rapid production of high volumes of low-cost fashion items, poses significant environmental and ethical concerns. The company’s ability to churn out thousands of new items daily – using ultra-fast production cycles – has been linked to major environmental consequences. One key issue is Shein’s reliance on non-recycled synthetic materials like polyester derived from fossil fuels. Studies suggest that polyester production accounts for up to 40 percent of the fashion industry’s total greenhouse gas emissions due to its high carbon footprint during manufacturing.

Moreover, Shein’s rapid production contributes to a culture of disposable fashion, where garments are worn a few times before being discarded. The average consumer throws away 60 percent more clothing today compared to 15 years ago, and much of this waste is linked to fast fashion brands. Shein’s impact on textile waste is particularly concerning, as the brand’s low-cost, short-lifecycle products end up in landfills faster than higher-quality goods.

In terms of carbon footprint, Shein’s logistics have a significant impact. With warehouses and suppliers spread across Asia, Europe and North America, the company relies on a global shipping network, which adds to the carbon footprint due to long-haul transportation. Some estimates suggest that fast fashion companies like Shein contribute around 10 percent of global carbon emissions, and their ultra-fast production and delivery cycles can worsen this figure.

Ethically, Shein has faced scrutiny over labor practices in its supply chain. There have been reports of poor working conditions in Shein-associated factories, with workers subjected to excessive hours, low wages, and inadequate safety measures. According to a 2021 investigative report by Public Eye, factory workers in China were found to be working up to 75 hours per week, with few labor protections in place. Like many fast-fashion brands, Shein benefits from lax regulations in these manufacturing hubs, which allows it to keep costs low at the expense of workers’ rights.

Adidas responds to Shein listings

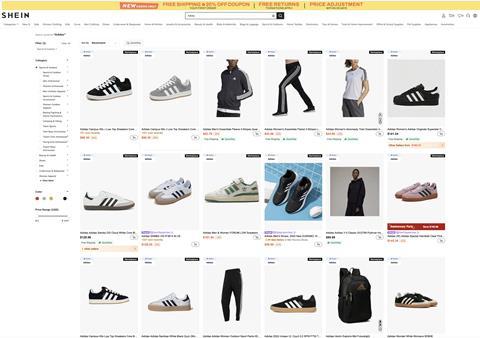

Adidas products have recently appeared on Shein, sparking concerns about environmental and ethical impacts. While only two sandals and one variation of the Samba are offered on the German Shein website, several dozen Adidas products are available on the international site. However, Adidas denies any involvement. Stefan Pursche, spokesperson for Adidas Media Relations, stated, “The information is inaccurate. Adidas does not sell any products and does not allow the re-sale of any products on the platform.” Despite this clear stance, questions remain about how Adidas products ended up on Shein’s platform – and what actions the company plans to take to address the situation. Adidas had not provided further clarification regarding these concerns at the time of publication.

Adding to this complexity, it was found that on Shein’s US site, a seller called “Sports Pavilion,” a Shein-certified marketplace brand, offers numerous Nike products and a smaller selection of Adidas and Asics shoes and apparel. The seller is trending and has reportedly sold over 38,000 products. Interestingly, customer reviews for Nike products vary, with some buyers expressing doubts about the authenticity of the shoes. In contrast, others affirm they must be real, with some noting that their items arrived in official Nike shoe boxes. One dissatisfied customer mentioned receiving a mismatched order with one high heel and one sneaker instead of a pair of Nikes. The products are typically sold at discounts of between 10 and 20 percent, adding to the allure for potential buyers.

On Shein’s German platform, no specific seller is mentioned for Adidas products. Instead, the shoes appear to be sold directly by Shein and shipped from the company’s European warehouse, further complicating questions about how these branded items end up on Shein’s marketplace.

Puma’s position about Shein and the marketplace model

Puma, like Adidas, has also seen its products appear on Shein’s platform in various countries. In response to an inquiry from SGI Europe, the company acknowledged that it became aware of the situation a few weeks ago and is closely monitoring it. Puma’s press department provided the following statements, though no specific spokesperson was named. As with other platforms and marketplaces, Puma emphasized that it is taking action against unauthorized distribution and brand infringements on Shein. The company noted that legal action would be pursued to stop unauthorized activities.

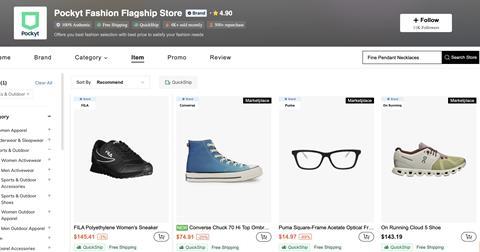

Additionally, when searching for Puma shoes on Shein’s US site, a large number of products were listed. These were being sold by the “Pockyt Fashion Flagship Store,” another Shein-certified seller. Unlike Sports Pavilion, Pockyt Fashion offers a broader range of brands, including On Running, Converse and Fila, as well as non-sporting items like sunglasses and jewelry. This further underscores the wide-reaching nature of Shein’s marketplace and the potential for unauthorized brand representation across multiple product categories.

Puma has clarified that it has no plans to collaborate with Shein’s marketplace model, stating that its distribution strategy does not include any partnerships with the fast-fashion platform. Even if Shein were to adopt a wholesale approach in the future, Puma confirmed it has no intention of using the platform as a distribution channel for its products. Puma also highlighted its commitment to transparency and sustainability, citing its Environmental Social and Governance (ESG) standards as a key reason for not considering collaborations with platforms that do not meet these criteria. This stance reinforces Puma’s dedication to maintaining its values, particularly regarding sustainability and ethical business practices. However, similar to Adidas, how its products ended up on Shein’s platform remains unclear.

Do the products originate from the gray market?

Wholesalers may play a significant role in facilitating the unauthorized distribution of branded products on platforms like Shein. Gray market goods – legitimate products sold outside authorized distribution channels – can end up on these platforms through wholesalers who purchase excess inventory from manufacturers or other distributors and resell them at a discount. This practice, while not inherently illegal, can undermine brands’ control over their pricing and distribution strategies.

To address this issue, brands can implement legal and regulatory measures to curb unauthorized distribution. For example, they could enforce stricter distribution agreements with their wholesale partners, ensuring that products are only sold through authorized channels. Additionally, monitoring tools can be used to track the movement of products and identify where unauthorized sales are occurring. Another potential solution lies in legislation aimed at online marketplaces. Recent efforts, such as the US INFORM Consumers Act, seek to impose stricter requirements on online platforms to verify the identity of high-volume sellers. This kind of regulation could force platforms like Shein to take greater responsibility for the products sold through their marketplace, ensuring that only authorized sellers can list branded goods.

In cases where counterfeit products are involved, brands can also turn to customs enforcement measures to block the importation of these goods. The brands could work with customs agencies to identify and seize counterfeit shipments before they reach the marketplace.

Other brands and significant concerns

Adidas and Puma are not the only well-known brands that have been spotted on Shein’s platform. Nike is represented with a significant number of products, while Asics’ Onitsuka Tiger brand is also available. However, SGI Europe has not yet received statements from these brands regarding the issue.

One could assume that their appearance on Shein might be a strategic move by brands to increase visibility or clear inventory. Still, the responses from Adidas and Puma contradict this assumption. Nike and Asics would likely take similar official stances. Nonetheless, the presence of these brands’ products raises significant concerns for both retailers and the environment. Shein’s business model is based on the mass production of cheap, disposable fashion, with thousands of new items coming to market daily, prioritizing speed and low prices over sustainability.

Why is this problematic? Mainly because brands like Adidas have made significant commitments to sustainability in recent years. Shein’s global logistics and ultra-fast production cycles are notorious for high carbon emissions, excessive waste, and using non-recycled materials, particularly polyester. Moreover, Shein’s business model threatens the survival of specialized, eco-conscious retailers as the sheer volume of cheap products poses a severe challenge to brands with sustainable missions.

For Adidas, which aims to become more sustainable, aligning with a platform like Shein would indeed be considered contradictory. Shein has faced harsh criticism for its environmental impact and labor practices. This situation raises questions about whether Adidas and other major brands are undermining their sustainability goals by associating with a platform that promotes disposable fashion and exacerbates environmental degradation. If these products are sold via wholesalers and not directly from the brands, manufacturers should intervene and stop such practices as soon as possible.

Legal and brand protection measures

Adidas, Puma and any other brand can pursue legal action against unauthorized sales of their products on platforms like Shein through several avenues. Trademark infringement is a primary concern, as the appearance of counterfeit or unauthorized products using their logos can dilute the value of their brand. Under international intellectual property law, brands can file lawsuits or seek cease-and-desist orders to prevent the unauthorized use of their trademarks.

In the US, the Lanham Act provides a legal basis for brands to take action against entities that misrepresent the origin of their goods, which could be the case with unauthorized resellers on platforms like Shein. Brands can argue that these sales constitute trademark infringement or passing off, where customers might mistakenly believe that these products are authorized by the brand when, in fact, they are not.

In Europe, similar protections are available under the European Union Trademark (EUTM) system. Adidas and Puma could leverage the EUTM to file for injunctions against Shein or individual sellers found to be distributing their products without permission. These injunctions could prevent further unauthorized sales and require Shein to remove the infringing listings from its platform.

Precedents for tackling these issues have been set by other brands. For instance, Nike filed lawsuits in 2020 against multiple platforms that sold counterfeit versions of their products, leading to legal victories that required platforms to take down infringing products and compensate the company for damages. The outcomes of such cases could influence how Adidas, Puma and others approach Shein and similar platforms, potentially pushing for stricter regulations around unauthorized sales.

What’s next?

The presence of major brands like Adidas, Puma and Nike on Shein’s platform, whether authorized or not, raises serious questions about the future of sustainable fashion. The environmental damage caused by fast fashion’s relentless production cycles, coupled with the ethical concerns around Shein’s labor practices, makes it crucial for these global companies to take decisive action. By allowing their products to appear on platforms that prioritize speed and low costs over sustainability, these brands risk undermining their own environmental commitments and further marginalizing specialized, eco-conscious retailers.

For the sake of the environment and the survival of responsible fashion, these companies must enforce stricter controls over their distribution channels and withdraw their products from platforms like Shein. Doing so would uphold their values and send a powerful message about the importance of sustainable practices in the fashion industry.

SGI Europe will continue to follow this issue closely.