Michael Nendwich is one of Europe’s most prominent insiders in the sporting goods industry. The Austrian is a Vice President at the Federation of the European Sporting Goods Industry (FESI) and Executive President of the European Federation of Sporting Goods Retailers (FEDAS). In this SGI Europe interview, he not only highlights one trend impacting the entire industry, but also reveals which AI tool is set to disrupt brands and retailers alike in the coming months.

SGI Europe: What trends are you currently observing in sports participation and consumer behavior across the European market?

Nendwich: That’s a tricky question, because trends are incredibly diverse. In sports, with only a few exceptions, there’s rarely one universal trend that applies across all countries. They’re shaped by many external factors. That’s why we see it as the responsibility of our retailers to identify these trends and draw the right conclusions for their business. Our role is to raise awareness of overarching developments.

Are you seeing any such overarching developments?

Yes. Particularly in Central and Southern Europe, we’re seeing a clear upward trend in tourism, which is directly impacting both sports and specialty retail. We’re living through a time of great uncertainty and consumer restraint – and that’s something we’re seeing across all markets. But there’s one major exception: tourism. People are still investing in their holidays, and they’re spending money in tourist regions. This area has become a key growth driver for the sporting goods sector in Europe.

So tourism is becoming a growth engine for sports retail. Could this shift your focus within the associations? Speaking of which – how do you see the future role of FEDAS and FESI?

For FEDAS, two key topics are front and center. First, “Young Talents” – our efforts to proactively support the next generation in retail. And, second, the harmonization of product category codes. Essentially, improving data exchange between industry and retailers.

FESI, on the other hand, is more focused on political advocacy. Right now, we’re dealing with product labeling in France, which is being introduced as a standalone national initiative, as well as with upcoming EU product regulations set to take effect in 2026. These are areas where we can contribute our perspective and help shape the conversation.

Are there any disruptive trends on the horizon that could significantly change the sporting goods industry and retail?

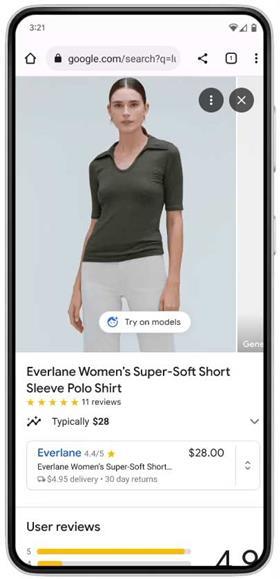

A huge trend – in fact, a real paradigm shift – is happening through artificial intelligence. Just take a look at the rapidly evolving Google Shopping platform. Their latest feature harnesses the power of the visual Gemini AI, allowing users to virtually try on any listed piece of clothing in seconds. All it takes is a full-body photo. AI handles body measurements and automatically fits the clothes to the image. It’s currently being beta-tested in the US, but insiders are already talking about “billions of garments” users will be able to try on.

Tools like this are going to completely change how people shop for apparel. And they’re set to give e-commerce in our industry a whole new dynamic, with new opportunities for engagement. It allows easier access to high-quality product information, makes sport-specific technologies more tangible for consumers, and improves product comparability. I see this as a major opportunity for the entire industry, not just for end consumers.

What other opportunities and challenges do you see for the European sporting goods market?

The biggest challenge – and this is true in all countries – is uncertainty. The so-called “polycrises” we’ve been navigating in recent years have caused significant instability, which in turn has led to notable drops in consumer spending. It would be helpful if things calmed down a bit, but that’s not really in our hands.

One opportunity lies in retail specialization. It’s becoming increasingly important for retailers to define a clear profile, build a strong team and work with the right products to drive strong sales. That said, full-range retailers like Decathlon are doing an excellent job in many countries. Their model provides low-barrier access to a wide variety of sports, and it works extremely well.

Correction

Our original article mistakenly identified Michael Nendwich as President of both FESI and FEDAS. He is in fact a Vice President at FESI and Executive President of FEDAS. We apologize for the error.

→ Discover why retail success in sports today means more than just selling products

And from the industry side, while the challenges are similar, where do you see the opportunities?

Alongside the well-established brands that continue to perform strongly, we’re seeing some exciting newcomers gaining traction. One example I’d highlight is Gymshark. The fitness-focused brand has carved out a clear identity and found success through a sharp marketing strategy and targeted communication. Gymshark is a best-practice example when it comes to outstanding community branding.

→ Read how Gymshark built a global fitness brand through community, content and omnichannel growth