Germany runs, on city pavements, forest trails, and the quiet roads in between. But the country’s millions of runners are more than athletes; they’re consumers whose daily routines are rewriting the rules of a major sporting-goods market. Who are they, what drives their buying decisions, and how are their habits reshaping the performance running market?

SGI Europe’s Performance Running Market Germany 2025 Report, developed in partnership with Priceagent, explores these questions through a nationwide consumer survey, mapping how runners think, train, and buy, and what that means for brands and retailers in the performance segment.

This article highlights key insights from the report’s general findings. The full version, available exclusively to SGI Europe Premium subscribers, includes deeper segmentation by age, gender, and income as well as extended pricing and trend analysis.

Who are Germany’s runners?

The typical German runner is an experienced, disciplined individual. The average age across respondents is 43, placing the majority in a demographic that balances sport, work, and family life. Sixty percent identify as male, forty percent as female.

Consistency stands out as a defining trait. Over half of all respondents (52 %) run at least three times a week. Nearly eight in ten (79 %) prefer to train alone rather than with a group, which fits the individual nature of running as both exercise and personal ritual.

And yet, few runners are loyal to just one sport. A remarkable 95 % say they also participate in other athletic activities. For brands, this reinforces an important point: today’s runner is not a single-sport consumer, but part of a broader performance lifestyle.

A multisport lifestyle shapes the market

Runners aren’t training in isolation. They cross-train and compete across various sports categories. The most popular complementary sports are cycling (45%) and strength training or gym work (43%), followed by swimming (34%) and hiking (28%).

As a result, the running market is shaped by a hybrid consumer base that demands versatility from products and apparel. A runner might buy cycling shorts for cross-training or choose a trail shoe for both trail running and hiking. In short, performance categories are blending, and the lines between them are fading.

For retailers and manufacturers, the opportunity lies in building ecosystems that meet this multisport reality: connected gear, adaptable apparel, and (digital) platforms that integrate data across activities.

Tracking habits: fragmented and far from universal

About three in four runners track their activity with an app, but the market is highly fragmented. Samsung Health leads with 18%, followed by Adidas Running (15%) and Nike Run Club (10%).

That fragmentation speaks volumes about user behavior. Many runners simply use whatever app comes pre-installed on their device. Others seem to prefer being part of their running brand’s larger connected system, such as Nike or Adidas.

For digital players, that fragmentation is both a challenge and an opening. No single platform dominates, meaning loyalty is up for grabs and integration, usability, and user experience may determine who captures the next wave of connected runners.

Brand loyalty is softer than expected

When it comes to footwear, runners are pragmatic. Only 27% insist on buying from the same brand repeatedly, while 40 % say they are open to trying new brands “occasionally.” A further 24% actively seek novelty.

This data points to a fluid market where other key factors outweigh long-term brand allegiance which gives challenger brands a window of opportunity. For established players, that’s a reminder to defend market share through innovation and engagement.

Still, big brands are leading the German running market – for now. Nike is at the top with 33% of most-recent shoe purchases, followed closely by Adidas at 29% and Asics at 17%. Together, the three account for roughly 80% of current purchases. Smaller specialist brands, Brooks, Hoka, and Saucony among them, make up much of the rest.

Interestingly, the premium price band shows higher relative demand for these niche brands. At those levels, consumers seem more willing to experiment or invest in performance differentiation.

Spending and shopping: the store still matters

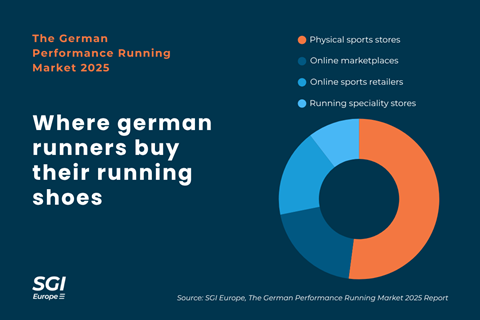

Despite years of digital acceleration, the physical sports store remains the cornerstone of Germany’s running market. Half of all runners buy their shoes in-store, far outpacing online sports retailers (17%) and marketplaces (19%). Specialty running stores attract around one in ten buyers. Brand websites and social media barely register as purchase channels.

That dominance of brick-and-mortar retail is not simply habit. Runners seem to value the expertise of store staff, especially in a category where comfort and injury prevention depend on the right model.

Annual spending levels confirm a mature, value-conscious market. Forty percent of respondents spend between €200 and €499 on running gear each year, while another 34% spend under €200. About one in five invest between €500 and €999, and only a small minority (6%) exceed the €1,000 mark.

Indicating repeat purchasing rather than big-ticket spending, the purchases seem to be consistent with the analyzed runner’s profile as a disciplined, routine-driven person. In general, the bulk of the market appears to be driven by routine replacement.

Trust is built face to face

Physical stores aren’t just where runners buy; they’re also where they learn. Thirty percent cite in-store advice as their main source of product information, ahead of online reviews (19%) and brand websites (14%). Another trend reflects the global shift toward social trust: runners rely on advice from friends, fellow runners and social media influencers.

For brands, this underscores the importance of knowledgeable retail staff and consistent product communication across channels. Messaging may start online, but final reassurance often happens in person.

Sustainability matters, but doesn’t decide

Sustainability in running mirrors a wider industry pattern: it matters, but it rarely decides. Across all respondents, 61% consider sustainability “very” or “somewhat important” when choosing running shoes.

However, when it comes to primary buying drivers, sustainability is only first for about 5%, whereas the other 95% prefer performance, comfort, design and price.

The challenge for brands is to make high-performance footwear inherently sustainable without compromising quality.

Looking ahead: a broader definition of performance

Germany’s running market shows all signs of an evolving performance era. Runners are consistent, data-aware, and open to experimentation. However, they also expect sustainability, reliability, comfort, and a fair price. That combination is steering the next product cycle toward broader versatility, and more transparent value.

Innovation will remain central, yet the definition of “performance” is shifting. Consumers increasingly judge a shoe not only by speed or cushioning, but by how it fits their wider lifestyle. The boundaries between performance, purpose, and personal expression continue to blur.

These dynamics will shape how brands position themselves and how retailers connect with their audiences.

A closer look in the full report

The Performance Running Market Germany 2025 is a 52-page analysis of Germany’s running consumer base. It is part of SGI Europe’s Predictive Consumer Demand Report Series for the global active lifestyle and sporting goods industry. It provides segmented insights by age, gender, and income, plus detailed data on purchase drivers and frequency, psychological pricing thresholds, consumer demand patterns and brand perception.

Developed in partnership with Priceagent, a leading pricing intelligence platform specializing in willingness-to-pay modeling, the report combines SGI Europe’s market insight with Priceagent’s analytical data on price perception, revenue potential, and consumer behavior.

Methodology

The study was conducted online from June 25–26, 2025, among 1,001 qualified respondents in Germany aged 18–80 who run at least once per week. Data were analyzed by running frequency, purchase habits, brand preferences, and mindset toward performance footwear.

Every question was modeled for willingness to pay (WTP), producing demand and potential revenue curves to identify key price walls and optimal price points.

Scope

The 52-page report explores:

- Consumer profiles and running habits

- Buying, research, and pricing behavior

- Brand perception and sustainability attitudes

- Future product and market trends

For brands and retailers, the report delivers a detailed, data-driven view of Germany’s performance running market.

Available exclusively to SGI Europe Premium subscribers. See our subscription options here.